303x Filetype DOCX File size 0.22 MB Source: admin.ks.gov

Standard Mileage Rate

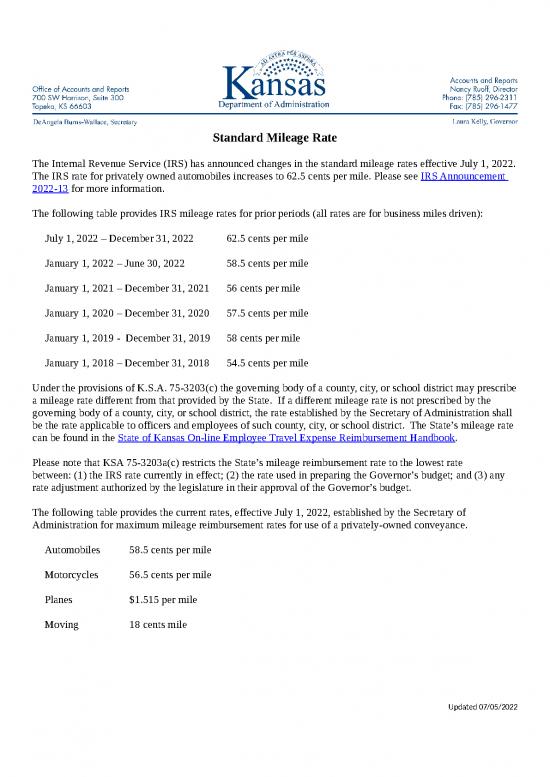

The Internal Revenue Service (IRS) has announced changes in the standard mileage rates effective July 1, 2022.

The IRS rate for privately owned automobiles increases to 62.5 cents per mile. Please see IRS Announcement

2022-13 for more information.

The following table provides IRS mileage rates for prior periods (all rates are for business miles driven):

July 1, 2022 – December 31, 2022 62.5 cents per mile

January 1, 2022 – June 30, 2022 58.5 cents per mile

January 1, 2021 – December 31, 2021 56 cents per mile

January 1, 2020 – December 31, 2020 57.5 cents per mile

January 1, 2019 - December 31, 2019 58 cents per mile

January 1, 2018 – December 31, 2018 54.5 cents per mile

Under the provisions of K.S.A. 75-3203(c) the governing body of a county, city, or school district may prescribe

a mileage rate different from that provided by the State. If a different mileage rate is not prescribed by the

governing body of a county, city, or school district, the rate established by the Secretary of Administration shall

be the rate applicable to officers and employees of such county, city, or school district. The State’s mileage rate

can be found in the State of Kansas On-line Employee Travel Expense Reimbursement Handbook.

Please note that KSA 75-3203a(c) restricts the State’s mileage reimbursement rate to the lowest rate

between: (1) the IRS rate currently in effect; (2) the rate used in preparing the Governor’s budget; and (3) any

rate adjustment authorized by the legislature in their approval of the Governor’s budget.

The following table provides the current rates, effective July 1, 2022, established by the Secretary of

Administration for maximum mileage reimbursement rates for use of a privately-owned conveyance.

Automobiles 58.5 cents per mile

Motorcycles 56.5 cents per mile

Planes $1.515 per mile

Moving 18 cents mile

Updated 07/05/2022

no reviews yet

Please Login to review.