339x Filetype PDF File size 0.21 MB Source: www.nh.gov

Hugh J. Gallen

State of New Hampshire State Office Park

Spaulding Building

95 Pleasant Street

Concord, NH 03301

Department of Labor 603/271-3176

TDD Access: Relay NH

Ken Merrifield 1-800-735-2964 FAX:

Commissioner 603/271-6149

Rudolph W. Ogden, III http://www.nh.gov/labor

Deputy Commissioner

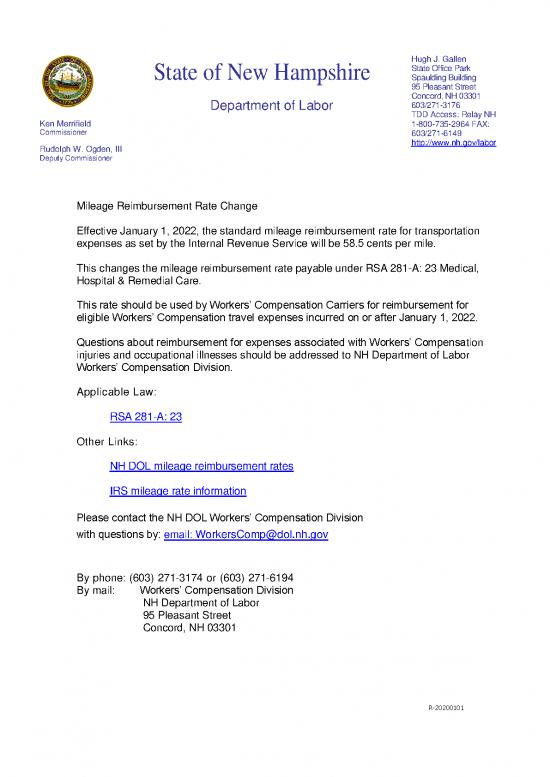

Mileage Reimbursement Rate Change

Effective January 1, 2022, the standard mileage reimbursement rate for transportation

expenses as set by the Internal Revenue Service will be 58.5 cents per mile.

This changes the mileage reimbursement rate payable under RSA 281-A: 23 Medical,

Hospital & Remedial Care.

This rate should be used by Workers’ Compensation Carriers for reimbursement for

eligible Workers’ Compensation travel expenses incurred on or after January 1, 2022.

Questions about reimbursement for expenses associated with Workers’ Compensation

injuries and occupational illnesses should be addressed to NH Department of Labor

Workers’ Compensation Division.

Applicable Law:

RSA 281-A: 23

Other Links:

NH DOL mileage reimbursement rates

IRS mileage rate information

Please contact the NH DOL Workers’ Compensation Division

with questions by: email: WorkersComp@dol.nh.gov

By phone: (603) 271-3174 or (603) 271-6194

By mail: Workers’ Compensation Division

NH Department of Labor

95 Pleasant Street

Concord, NH 03301

R-20200101

no reviews yet

Please Login to review.