283x Filetype XLSX File size 0.04 MB Source: www.justice.gov.uk

Sheet 1: Precedent T (front sheet)

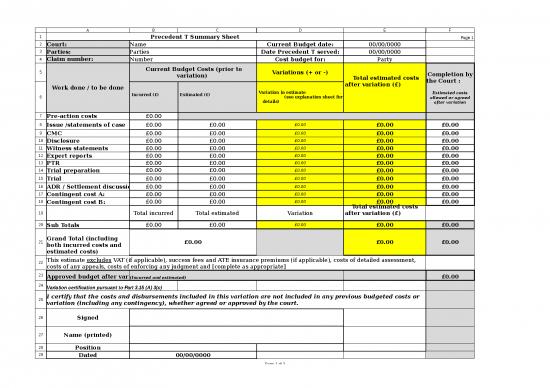

| Precedent T Summary Sheet | Page 1 | ||||

| Court: | Name | Current Budget date: | 00/00/0000 | ||

| Parties: | Parties | Date Precedent T served: | 00/00/0000 | ||

| Claim number: | Number | Cost budget for: | Party | ||

| Work done / to be done | Current Budget Costs (prior to variation) | Variations (+ or -) | Total estimated costs after variation (£) | Completion by the Court : Estimated costs allowed or agreed after variation | |

| Incurred (£) | Estimated (£) | Variation in estimate (see explanation sheet for details) | |||

| Pre-action costs | £0.00 | ||||

| Issue /statements of case | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| CMC | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Disclosure | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Witness statements | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Expert reports | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| PTR | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Trial preparation | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Trial | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| ADR / Settlement discussions | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Contingent cost A: | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Contingent cost B: | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Total incurred | Total estimated | Variation | Total estimated costs after variation (£) | ||

| Sub Totals | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Grand Total (including both incurred costs and estimated costs) | £0.00 | £0.00 | £0.00 | ||

| This estimate excludes VAT (if applicable), success fees and ATE insurance premiums (if applicable), costs of detailed assessment, costs of any appeals, costs of enforcing any judgment and [complete as appropriate] | |||||

| Approved budget after variation | (Incurred and estimated) | £0.00 | |||

| Variation certification pursuant to Part 3.15 (A) 3(c) | |||||

| I certify that the costs and disbursements included in this variation are not included in any previous budgeted costs or variation (including any contingency), whether agreed or approved by the court. | |||||

| Signed | |||||

| Name (printed) | |||||

| Position | |||||

| Dated | 00/00/0000 | ||||

| version 15/04/2020 | |||||

| Notes for completion of Precedent T in Excel | |||||

| Precedent T can be completed in Excel or Word format. If an Excel version of the form is used the following are some guidance notes on the Excel format BUT practitioners are responsible for checking the formula and any formatting issues. | |||||

| Point | Excel Tab | Guidance | |||

| 1 | Variation particulars | The budgeting party should complete the variation particulars tab first: | |||

| 2 | Variation particulars | A brief narrative as to the significant development (cell E7) is required: | |||

| 3 | Variation particulars | A brief explanation by phase is required (cells E9 to E19): | |||

| 4 | Variation particulars | Time and disbursement values in columns B and C should be completed: this is the additional cost or reduction in costs by value: | |||

| 5 | Variation particulars | The Total at cell D20 will self complete: | |||

| 6 | Variation particulars | Experts disbursements: complete the table with the new expert fees figure by expert type. The total expert disbursement (cell E38) is then entered at cell C13 on the variation particulars tab. The previous budgeted total by expert type should then be inserted in Row F. | |||

| 7 | Front sheet | The variation tab figures will populate the Precedent T Front Sheet in column D | |||

| 8 | Front sheet | The budgeting party must then complete columns B and C with the previous budget figures by phase at rows 7 to 18 | |||

| 9 | Front sheet | The sub totals at row 20 and 21 will self complete | |||

| 10 | Front sheet | The Judge should complete the agreed or allowed figures (estimated costs only) by phase in column F: the subtotals F20 and F21 will self complete | |||

no reviews yet

Please Login to review.