353x Filetype XLSX File size 0.13 MB Source: www.davispolk.com

Sheet 1: Introduction

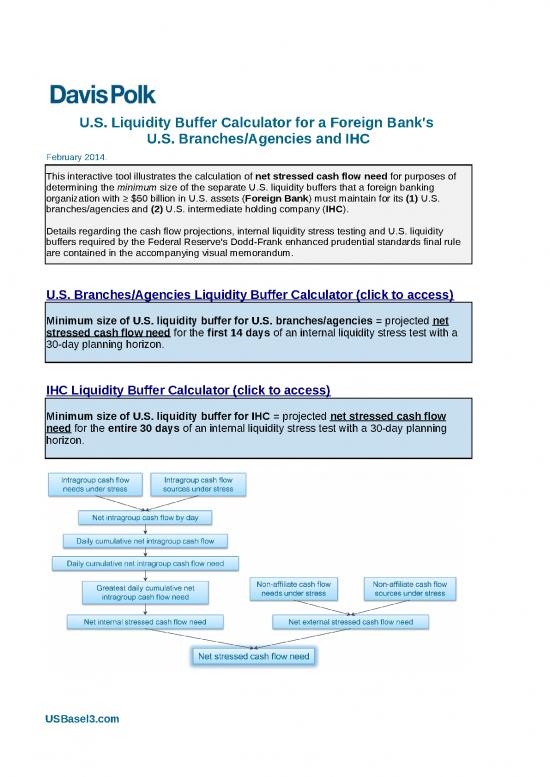

| U.S. Liquidity Buffer Calculator for a Foreign Bank's U.S. Branches/Agencies and IHC |

||||||

| February 2014. | ||||||

| This interactive tool illustrates the calculation of net stressed cash flow need for purposes of determining the minimum size of the separate U.S. liquidity buffers that a foreign banking organization with ≥ $50 billion in U.S. assets (Foreign Bank) must maintain for its (1) U.S. branches/agencies and (2) U.S. intermediate holding company (IHC). Details regarding the cash flow projections, internal liquidity stress testing and U.S. liquidity buffers required by the Federal Reserve's Dodd-Frank enhanced prudential standards final rule are contained in the accompanying visual memorandum. |

||||||

| U.S. Branches/Agencies Liquidity Buffer Calculator (click to access) | ||||||

| Minimum size of U.S. liquidity buffer for U.S. branches/agencies = projected net stressed cash flow need for the first 14 days of an internal liquidity stress test with a 30-day planning horizon. | ||||||

| IHC Liquidity Buffer Calculator (click to access) | ||||||

| Minimum size of U.S. liquidity buffer for IHC = projected net stressed cash flow need for the entire 30 days of an internal liquidity stress test with a 30-day planning horizon. | ||||||

| U.S. Liquidity Buffer Calculator for U.S. Branches/Agencies | |||||||||||||||||||||||||||||||

| February 2014. | |||||||||||||||||||||||||||||||

| Instructions: ■ Enter intragroup and non-affiliate cash flow sources and needs into the blue shaded cells. We have included, as placeholders, amounts that match the calculation example in our visual memo. These can be replaced with other amounts. ■ Empty rows have been left to allow you to add other categories of cash flow sources and needs. ■ Cash flow sources should be positive numbers. ■ Cash flow needs should be negative numbers. ■ All other cells will be automatically updated, including the final determination of the minimum size of the U.S. liquidity buffer. |

|||||||||||||||||||||||||||||||

| NET EXTERNAL STRESSED CASH FLOW NEED | |||||||||||||||||||||||||||||||

| Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 | Day 7 | Day 8 | Day 9 | Day 10 | Day 11 | Day 12 | Day 13 | Day 14 | Day 15 | Day 16 | Day 17 | Day 18 | Day 19 | Day 20 | Day 21 | Day 22 | Day 23 | Day 24 | Day 25 | Day 26 | Day 27 | Day 28 | Day 29 | Day 30 | Period Total | |

| Non-affiliate cash flow sources | |||||||||||||||||||||||||||||||

| Maturing loans/placements with other firms | 5 | 5 | 6 | 6 | 6 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 28 |

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| Total non-affiliate cash flow sources | 5 | 5 | 6 | 6 | 6 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 28 |

| Non-affiliate cash flow needs | |||||||||||||||||||||||||||||||

| Maturing wholesale funding /deposits | (12) | (8) | (8) | (7) | (7) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (42) |

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| Total non-affiliate cash flow needs | (12) | (8) | (8) | (7) | (7) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (42) |

| For Stress Testing Purposes (Not Liquidity Buffer Purposes) | 30-Day Period Total | ||||||||||||||||||||||||||||||

| Net external stressed cash flow need | (7) | (3) | (2) | (1) | (1) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (14) |

| For Liquidity Buffer Purposes | 14-Day Period Total | ||||||||||||||||||||||||||||||

| Net external stressed cash flow need | (7) | (3) | (2) | (1) | (1) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (14) | ||||||||||||||||

| NET INTERNAL STRESSED CASH FLOW NEED | |||||||||||||||||||||||||||||||

| Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 | Day 7 | Day 8 | Day 9 | Day 10 | Day 11 | Day 12 | Day 13 | Day 14 | Day 15 | Day 16 | Day 17 | Day 18 | Day 19 | Day 20 | Day 21 | Day 22 | Day 23 | Day 24 | Day 25 | Day 26 | Day 27 | Day 28 | Day 29 | Day 30 | Period Total | |

| Intragroup cash flow sources | |||||||||||||||||||||||||||||||

| Maturing loans to parent | 2 | 2 | 3 | 2 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 10 |

| Maturing loans to non-U.S. entities | 0 | 0 | 1 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 |

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| Total intragroup cash flow sources | 2 | 2 | 4 | 3 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 14 |

| Intragroup cash flow needs | |||||||||||||||||||||||||||||||

| Maturing funding from parent | 0 | (4) | (10) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (14) |

| Maturing deposit from non-U.S. entities | (1) | (1) | (1) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (3) |

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| [insert additional category] | 0 | ||||||||||||||||||||||||||||||

| Total intragroup cash flow needs | (1) | (5) | (11) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (17) |

| Net intragroup cash flows | 1 | (3) | (7) | 3 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (3) |

| For Stress Testing Purposes (Not Liquidity Buffer Purposes) | 30-Day Period Total | ||||||||||||||||||||||||||||||

| Daily cumulative net intragroup cash flow | 1 | (2) | (9) | (6) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | |

| Daily cumulative net intragroup cash flow need | 0 | (2) | (9) | (6) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | |

| Greatest daily cumulative net intragroup cash flow need | 0 | 0 | (9) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Net internal stressed cash flow need | 0 | 0 | (9) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (9) |

| For Liquidity Buffer Purposes | 14-Day Period Total | ||||||||||||||||||||||||||||||

| Daily cumulative net intragroup cash flow | 1 | (2) | (9) | (6) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | |||||||||||||||||

| Daily cumulative net intragroup cash flow need | 0 | (2) | (9) | (6) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | (3) | |||||||||||||||||

| Greatest daily cumulative net intragroup cash flow need | 0 | 0 | (9) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||

| Net internal stressed cash flow need | 0 | 0 | (9) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (9) | ||||||||||||||||

| NET STRESSED CASH FLOW NEED | |||||||||||||||||||||||||||||||

| Amounts below relate to the first 14 days | |||||||||||||||||||||||||||||||

| Net external stressed cash flow need | (14) | ||||||||||||||||||||||||||||||

| Net internal stressed cash flow need | (9) | ||||||||||||||||||||||||||||||

| Net stressed cash flow need | (23) | ||||||||||||||||||||||||||||||

| Minimum size of U.S. liquidity buffer for U.S. branches/agencies | 23 | ||||||||||||||||||||||||||||||

no reviews yet

Please Login to review.