Authentication

293x Filetype PPT File size 0.77 MB

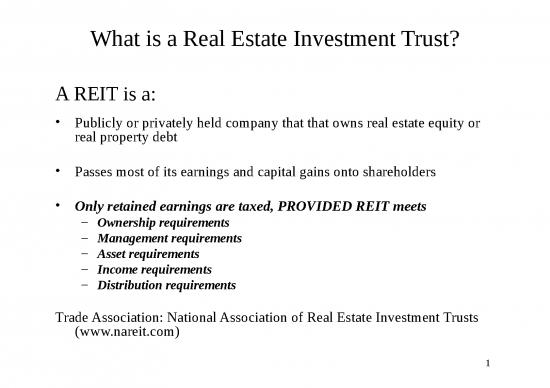

REITs

2

REITs

3

Requirements

Ownership

– 5 or fewer entities may not own 50% or more of the

outstanding shares (the “5/50 Test”)

– No one shareholder owns more than 9.9% (pension funds

excluded)

– REIT shares must be transferable and held by at least 100

persons

– Must be managed by a board of directors or trustees

– Must be incorporated in one of the 50 states or DC as a

taxable entity

4

Requirements

Management

– REIT managers must be passive

• REIT trustees, directors or employees may not actively engage

in managing or operating REIT properties (includes providing

service and collecting rents from tenants).

• Managers may set policy: rental terms, choose tenants, sign

leases, make decisions about properties.

– REITs allowed to own 100% of a Taxable REIT Subsidiary (TRS).

• REIT Modernization Act of 1999 (effective 2001)

• TRS can provide services to REIT tenants and others (previously, this

was not allowed).

• Debt and rental payments from TRS to REIT are limited to ensure

that the TRS actually pays income taxes.

5

Requirements

Assets

– 75% of assets must be real estate, cash, and govt. securities

• other REIT shares are considered real estate assets, but

not more than 20% of its assets can be stocks in taxable

REIT subsidiaries

– not more than 5% of assets can be stock in non-real estate

corporations

– may not have more than 10% of voting securities of any

corporation other than another REIT, Taxable REIT

Subsidiary (TRS) or subsidiary whose assets and income

are owned by the REIT for federal income tax purposes

6

no reviews yet

Please Login to review.