296x Filetype PDF File size 0.40 MB Source: data.bloomberglp.com

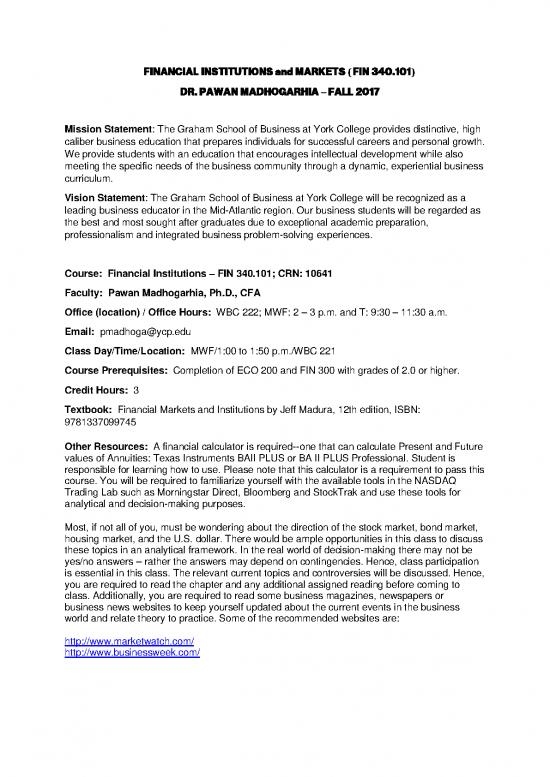

FINANCIAL INSTITUTIONS and MARKETS (FIN 340.101)

DR. PAWAN MADHOGARHIA – FALL 2017

Mission Statement: The Graham School of Business at York College provides distinctive, high

caliber business education that prepares individuals for successful careers and personal growth.

We provide students with an education that encourages intellectual development while also

meeting the specific needs of the business community through a dynamic, experiential business

curriculum.

Vision Statement: The Graham School of Business at York College will be recognized as a

leading business educator in the Mid-Atlantic region. Our business students will be regarded as

the best and most sought after graduates due to exceptional academic preparation,

professionalism and integrated business problem-solving experiences.

Course: Financial Institutions – FIN 340.101; CRN: 10641

Faculty: Pawan Madhogarhia, Ph.D., CFA

Office (location) / Office Hours: WBC 222; MWF: 2 – 3 p.m. and T: 9:30 – 11:30 a.m.

Email: pmadhoga@ycp.edu

Class Day/Time/Location: MWF/1:00 to 1:50 p.m./WBC 221

Course Prerequisites: Completion of ECO 200 and FIN 300 with grades of 2.0 or higher.

Credit Hours: 3

Textbook: Financial Markets and Institutions by Jeff Madura, 12th edition, ISBN:

9781337099745

Other Resources: A financial calculator is required--one that can calculate Present and Future

values of Annuities: Texas Instruments BAII PLUS or BA II PLUS Professional. Student is

responsible for learning how to use. Please note that this calculator is a requirement to pass this

course. You will be required to familiarize yourself with the available tools in the NASDAQ

Trading Lab such as Morningstar Direct, Bloomberg and StockTrak and use these tools for

analytical and decision-making purposes.

Most, if not all of you, must be wondering about the direction of the stock market, bond market,

housing market, and the U.S. dollar. There would be ample opportunities in this class to discuss

these topics in an analytical framework. In the real world of decision-making there may not be

yes/no answers – rather the answers may depend on contingencies. Hence, class participation

is essential in this class. The relevant current topics and controversies will be discussed. Hence,

you are required to read the chapter and any additional assigned reading before coming to

class. Additionally, you are required to read some business magazines, newspapers or

business news websites to keep yourself updated about the current events in the business

world and relate theory to practice. Some of the recommended websites are:

http://www.marketwatch.com/

http://www.businessweek.com/

FINANCIAL INSTITUTIONS and MARKETS (FIN 340.101)

DR. PAWAN MADHOGARHIA – FALL 2017

http://online.wsj.com/home-page

http://finance.yahoo.com/

You will need to subscribe to the ProBanker Simulation. The details will be provided in the class.

There may be additional fees to subscribe to this simulation

Course Description (from the catalog): This course provides a study of the major financial

institutions and the role that major institutional investors serve in the current financial system.

Topics include commercial banks, mutual funds, securities firms, insurance companies, and

pension funds.

Instructor’s Educational Philosophy: The primary goal of this course is to provide you with a

basic understanding and framework of how financial institutions acquire, allocate, and control

their financial resources to maximize shareholder value. This course should help you to

integrate a series of finance and economics principles that explore the connection between

financial markets, financial institutions and the economy. My goal is to provide you with an

understanding of important concepts through experiential learning. There will be lot of online

quizzes, in-class assignments, simulations, and an extensive project. You will be expected to

build on the concepts that you have already learned in your prerequisite courses. There will be

extensive use of trading lab software such as Morningstar, Bloomberg etc.

Course Core Learning Objectives: Upon successful completion of this course you should be

able to:

Discuss the term structure of interest rates

Evaluate the relationship between interest rates and security valuation

Discuss the efficient market hypothesis as it relates to stock valuation

Discuss the functions of the Federal Reserve and the tools that they apply to affect the

economy

Discuss the different aspects of Money Markets, Bond Markets, Mortgage Markets,

Stock Markets, Foreign Exchange Markets, and Derivatives Markets

Evaluate the performance of commercial banks and other financial institutions and how

commercial banks manage different types of risks

Explain the basic features of financial derivatives and how financial institutions apply

them for risk management

Discuss how currency values are determined in the short run and in the long run

FINANCIAL INSTITUTIONS and MARKETS (FIN 340.101)

DR. PAWAN MADHOGARHIA – FALL 2017

Discuss how financial regulations affect the operations of financial institutions particularly

commercial banks

Managing risk off the balance sheet with derivative securities and securitization

Core Learning Outcomes:

1. Analyze the role of financial institutions; discuss the types of financial markets, and risks

faced by financial institutions and how they manage those risks

2. Evaluate Federal Reserve Bank’s primary functions, and monetary policy tools that they

apply to affect the economy

3. Evaluate how the Federal Reserve affects the money supply, the level of interest rates,

the rate of inflation, and the level of economic activity

4. Discuss the term structure of interest rates. Evaluate how interest rates are determined,

effect of inflation rates on the interest rates, and evaluate the relationship between

interest rates affect security valuation

5. Analyze how interest rate changes affect changes in bond prices. Discuss how interest

rate risk can be measured and how interest rate risk can be managed by financial

institutions and investors. Discuss the factors that could affect a security’s yield

6. Analyze the characteristics of money market instruments

7. Evaluate the different instruments traded in different capital markets. Discuss

securitization of debt

8. Analyze the role of different financial institutions: commercial banks, insurance

companies, mutual funds and hedge funds, and pension funds

9. Analyze the role of mortgages, mortgage-backed securities and the role of mortgage

insurers

10. Discuss the characteristics of different financial markets – debt security markets, stock

markets, derivatives markets, and foreign exchange markets

Class Assessment (what/how): There will be three mid-term exams and one comprehensive

final exam. The exams will consist of multiple choices, true/false short answers type questions,

and/or problems. All exams will be closed book and closed notes. Please note that no make-up

exam will be administered unless the student presents a legitimate (college approved) reason

prior to the scheduled exam date. If you miss an exam and you do not have a documented

excuse, you must take the final exam and the score for the final exam may be counted towards

the missed exam. In such circumstances, please discuss possibilities to make-up the missed

assignment/exams with your instructor. Exam dates are available in the schedule and are

subject to change as the class progresses.

Late Submission of Course Materials: Late submission of assignments is allowed. However,

there would be a 1% per day and 7% per week penalty for late submissions. You are strongly

encouraged to submit your assignments on time to keep pace with the course.

Grading: Grades will be available on the course page on Moodle. The following represents the

tentative distribution of values applied to course requirements:

FINANCIAL INSTITUTIONS and MARKETS (FIN 340.101)

DR. PAWAN MADHOGARHIA – FALL 2017

Exams 50% of grade

Project 20% of grade

Probanker Simulation 10% of grade

Quizzes/Assignments 10% of grade

BMC Certification 10% of grade

Grading Scale:

90-100 4.0 (A)

85-89 3.5 (B+)

80-84 3.0 (B)

75-79 2.5 (C+)

70-74 2.0 (C)

60-69 1.0 (D)

<60 0 (F)

Grading Policy:

4 (Excellent): This grade denotes accomplishment that is truly distinctive and decidedly

outstanding. It represents a high degree of attainment and is a grade that demands evidence of

originality, independent work, an open and discriminating mind, and completeness and accuracy

of knowledge, as well as an effective use of the knowledge.

3.5 (Very Good): This grade denotes mastery of the subject matter. It represents very good

achievement in many aspects of the work, such as initiative, serious and determined industry,

the ability to organize work, and the ability to comprehend and retain subject matter and to apply

it to new problems and contexts.

3 (Good): This grade denotes considerable understanding of the subject matter. It represents a

strong grasp and clear understanding of the subject matter and the ability to comprehend and

retain course content.

2.5 (Above Average): This grade denotes above average understanding of the subject matter. It

represents a good grasp of the subject matter and the ability to comprehend and retain course

content.

2 (Average): This grade denotes average understanding of the subject matter. It represents the

grade that may be expected of a student of normal ability who gives the work a reasonable

amount of time and effort.

1 (Below Average): This grade denotes below average understanding of the subject matter. It

represents work that falls below the acceptable standard.

0 (Failure): This grade denotes inadequate understanding of the subject matter. It signifies an

absence of meaningful engagement with the subject matter and that the student is not capable

of doing or understanding the work or has made little or no effort to do so.

I (Incomplete): The student may request permission from the instructor to receive an incomplete

prior to the final examination and must present extraordinary reasons for the petition. The

Instructor should indicate on the Attendance/Final Grade Record the required work the student

must do to complete the course. Any grades of “I” not removed within two calendar months after

the end of the semester will automatically be changed to “0” in the Records Office. Grades of

no reviews yet

Please Login to review.