365x Filetype XLSX File size 0.03 MB Source: www.ato.gov.au

Sheet 1: Data

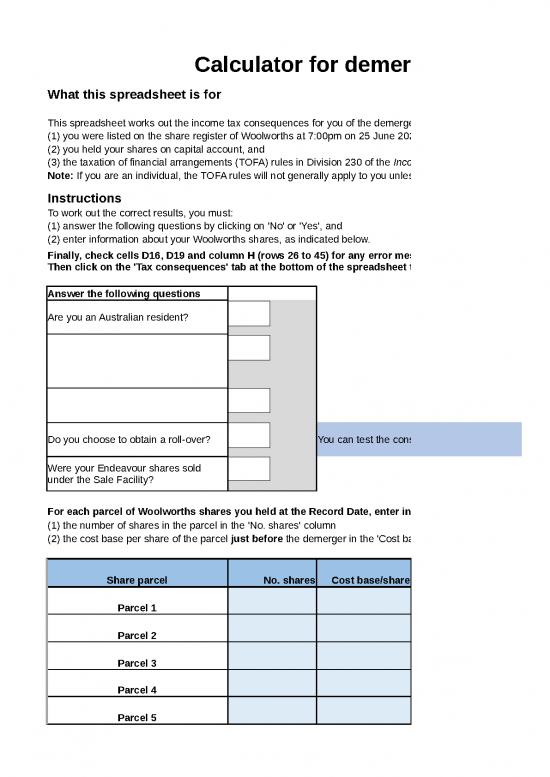

| Calculator for demerger of Endeavour from Woolworths | ||||||

| What this spreadsheet is for | ||||||

| This spreadsheet works out the income tax consequences for you of the demerger of Endeavour Group Limited (Endeavour) from Woolworths Group Limited (Woolworths) on 1 July 2021 if: | ||||||

| (1) you were listed on the share register of Woolworths at 7:00pm on 25 June 2021 (the Record Date) | ||||||

| (2) you held your shares on capital account, and | ||||||

| (3) the taxation of financial arrangements (TOFA) rules in Division 230 of the Income Tax Assessment Act 1997 don't apply to you in relation to the demerger. | ||||||

| Note: If you are an individual, the TOFA rules will not generally apply to you unless you have made an election for them to apply. | ||||||

| Instructions | ||||||

| To work out the correct results, you must: | ||||||

| (1) answer the following questions by clicking on 'No' or 'Yes', and | ||||||

| (2) enter information about your Woolworths shares, as indicated below. | ||||||

| Finally, check cells D16, D19 and column H (rows 26 to 45) for any error messages (in red) and make the necessary corrections. Then click on the 'Tax consequences' tab at the bottom of the spreadsheet to view the income tax consequences of the demerger. |

||||||

| Answer the following questions | ||||||

| Are you an Australian resident? | ||||||

| Do you choose to obtain a roll-over? | You can test the consequences of your choice by choosing 'Yes' or 'No' alternately. | |||||

| Were your Endeavour shares sold under the Sale Facility? | ||||||

| For each parcel of Woolworths shares you held at the Record Date, enter in the table below: | ||||||

| (1) the number of shares in the parcel in the 'No. shares' column | ||||||

| (2) the cost base per share of the parcel just before the demerger in the 'Cost base/share' column. | ||||||

| Share parcel | No. shares | Cost base/share | Cost base of parcel | Cap. Gain/share* | Cap. Gain/parcel* | Input error messages |

| Parcel 1 | ||||||

| Parcel 2 | ||||||

| Parcel 3 | ||||||

| Parcel 4 | ||||||

| Parcel 5 | ||||||

| Parcel 6 | ||||||

| Parcel 7 | ||||||

| Parcel 8 | ||||||

| Parcel 9 | ||||||

| Parcel 10 | ||||||

| Parcel 11 | ||||||

| Parcel 12 | ||||||

| Parcel 13 | ||||||

| Parcel 14 | ||||||

| Parcel 15 | ||||||

| Parcel 16 | ||||||

| Parcel 17 | ||||||

| Parcel 18 | ||||||

| Parcel 19 | ||||||

| Parcel 20 | ||||||

| *Depending on your circumstances, some or all capital gains shown in this table may be disregarded. See the 'Tax Consequences' sheet. | ||||||

| Total post-CGT shares | 0 | Total cost base of post-CGT shares | $0.00 | |||

| Data about the demerger* | ||||||

| Full name of head entity of demerger group | Woolworths Group Limited | |||||

| Full name of demerged entity | Endeavour Group Limited | |||||

| Short name of head entity of demerger group | Woolworths | |||||

| Short name of demerged entity | Endeavour | |||||

| Endeavour shares you received per Woolworths share you held | 1 | |||||

| Capital return per Woolworths share | $0.71 | |||||

| Proportion of total pre-demerger cost base of Woolworths shares allocated to Woolworths shares | 85.81% | |||||

| Proportion of total pre-demerger cost base of Woolworths shares allocated to Endeavour shares | 14.19% | |||||

| Market value of Endeavour share at time of demerger | $6.2068 | |||||

| Market value of Woolworths share at time of demerger | $37.5475 | |||||

| Small Shareholder threshold (no. Woolworths shares held) | 800 | |||||

| Average proceeds per share from sale of Endeavour shares under Sale Facility | $6.2050 | |||||

| Record time | 7:00pm | |||||

| Record date | 25/06/2021 | |||||

| Date of demerger | 7/1/2021 | |||||

| *This is pre-filled data | ||||||

no reviews yet

Please Login to review.