275x Filetype XLSX File size 0.09 MB Source: www.aia.com.au

Version 3.2

Updated 17 May 2022

Should you require assistance with

Lump Sum Income Replacement Calculator this calculator email tece@aia.com

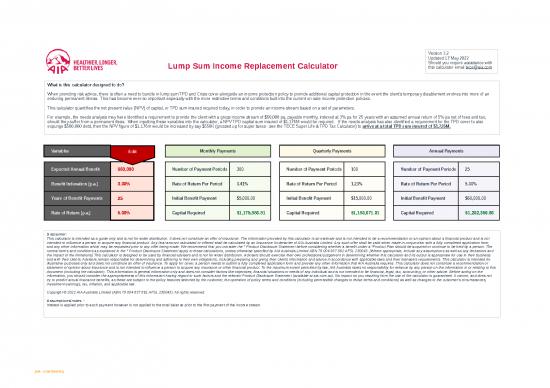

What is this calculator designed to do?

When providing risk advice, there is often a need to bundle in lump sum TPD and Crisis cover alongside an income protection policy to provide additional capital protection in the event the client’s temporary disablement evolves into more of an

enduring permanent illness. This has become ever-so important especially with the more restrictive terms and conditions built into the current on-sale income protection policies.

This calculator quantifies the net present value (NPV) of capital, or TPD sum insured required today, in order to provide an income stream based on a set of parameters.

For example, the needs analysis may have identified a requirement to provide the client with a gross income stream of $60,000 pa, payable monthly, indexed at 3% pa for 25 years with an assumed annual return of 5% pa net of fees and tax,

should they suffer from a permanent illess. When inputting these variables into the calculator, a NPV TPD capital sum insured of $1.176M would be required. If the needs analysis has also identified a requirement for the TPD cover to also

expunge $500,000 debt, then the NPV figure of $1.176m would be increased by say $550K (grossed up for super taxes - see the TECE Super Life & TPD Tax Calculator) to arrive at a total TPD sum insured of $1,726M.

Variables Edit Monthly Payments Quarterly Payments Annual Payments

Expected Annual Benefit $60,000 Number of Payment Periods 300 Number of Payment Periods 100 Number of Payment Periods 25

Benefit Indexation (p.a.) 3.00% Rate of Return Per Period 0.41% Rate of Return Per Period 1.23% Rate of Return Per Period 5.00%

Years of Benefit Payments 25 Initial Benefit Payment $5,000.00 Initial Benefit Payment $15,000.00 Initial Benefit Payment $60,000.00

Rate of Return (p.a.) 5.00% Capital Required $1,175,886.81 Capital Required $1,180,671.01 Capital Required $1,202,359.96

Disclaimer:

This calculator is intended as a guide only and is not for wider distribution. It does not constitute an offer of insurance. The information provided by this calculator is an estimate and is not intended to be a recommendation or an opinion about a financial product and is not

intended to influence a person to acquire any financial product. Any final amount calculated or offered shall be calculated by an Insurance Underwriter of AIA Australia Limited. Any such offer shall be valid when made in conjunction with a fully completed application form,

and any other information which may be requested prior to any offer being made. We recommend that you consider the * Product Disclosure Statement before considering whether a benefit under a *Product Plan should be acquired or continue to be held by a person. The

normal terms and conditions as explained in the * Product Disclosure Statement apply to these calculations, unless otherwise specified by AIA Australia Limited ABN 79 004 837 861 AFSL 230043. [Where appropriate, include any assumptions as well as any limitations and

the impact of the limitations] This calculator is designed to be used by financial advisers and is not for wider distribution. Advisers should exercise their own professional judgement in determining whether this calculator and its output is appropriate for use in their business

and with their clients. Advisers remain responsible for determining and adhering to their own obligations, including preparing and giving their clients information and advice in accordance with applicable laws and their licensee's requirements. This calculator is intended for

illustrative purposes only and does not constitute an offer of insurance. To apply for cover, a person needs to submit a fully completed application form and provide any other information that AIA Australia requires. This calculator does not constitute a recommendation or

statement of opinion about insurance and is not intended to influence a person to acquire any insurance or other financial product. To the maximum extent permitted by law, AIA Australia takes no responsibility for reliance by any person on the information in or relating to this

document (including the calculator). This information is general information only and does not consider factors like objectives, financial situations or needs of any individual and is not intended to be financial, legal, tax, accounting, or other advice. Before acting on the

information, you should consider the appropriateness of this information having regard to such factors and the relevant Product Disclosure Statement (available at aia.com.au). No impact on you resulting from the use of the calculator is guaranteed. It cannot, and does not

try to predict actual insurance benefits, as these are subject to the policy features selected by the customer, the operation of policy terms and conditions (including permissible changes to those terms and conditions) as well as changes to the customer's circumstances,

investment earnings, tax, inflation, and applicable law.

Copyright © 2022 AIA Australia Limited (ABN 79 004 837 861 AFSL 230043). All rights reserved.

Assumptions/notes -

Interest is applied prior to each payment however is not applied to the total balance prior to the first payment of the income stream.

#[AIA - CONFIDENTIAL]

no reviews yet

Please Login to review.