275x Filetype XLSX File size 0.04 MB Source: benefits.hr.ufl.edu

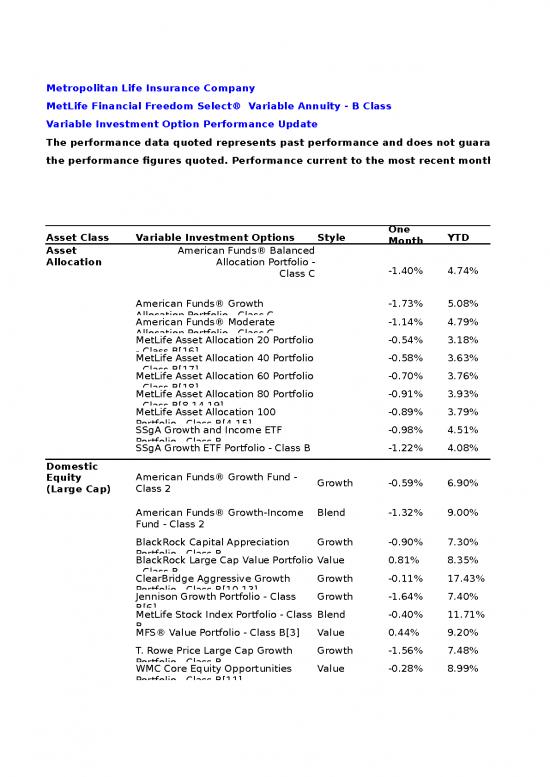

Metropolitan Life Insurance Company

MetLife Financial Freedom Select® Variable Annuity - B Class

Variable Investment Option Performance Update

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than

the performance figures quoted. Performance current to the most recent month-end may be viewed at www.metlife.com. The investment return and principal value of an investment will fluctuate and an investor's shares, when redeemed, may be worth more or less than their original cost. For Investment Divisions that invest in Portfolios of the underlying Trust that were in existence prior to the Investment Division inception date, these returns have been adjusted to reflect the charges and expenses of the MetLife Financial Freedom Select B Class Variable Annuity, as if the contract had existed during the stated period(s), including all Portfolio-level expenses, the Separate Account Charge of 1.15% (the Separate Account Charge includes an additional charge of 0.25% as a percentage of your average Account Balance in the American Funds Bond, American Funds Growth, American Funds Growth-Income and American Funds Global Small Capitalization Investment Divisions), and the annual Account Fee of $30†. These results do not reflect the withdrawal charges which begin at 9% and decrease over 12 years (for returns reflecting these charges, see the Standardized report pages in this document that follows this Nonstandardized report). These figures represent past performance and are not an indication of future performance.

B Class

Non-Standardized Performance: Without surrender charges applied

as of 12/31/2014

One

Asset Class Variable Investment Options Style Month YTD

Asset American Funds® Balanced

Allocation Allocation Portfolio -

Class C -1.40% 4.74%

American Funds® Growth -1.73% 5.08%

Allocation Portfolio - Class C

American Funds® Moderate -1.14% 4.79%

Allocation Portfolio - Class C

MetLife Asset Allocation 20 Portfolio -0.54% 3.18%

- Class B[16]

MetLife Asset Allocation 40 Portfolio -0.58% 3.63%

- Class B[17]

MetLife Asset Allocation 60 Portfolio -0.70% 3.76%

- Class B[18]

MetLife Asset Allocation 80 Portfolio -0.91% 3.93%

- Class B[8,14,19]

MetLife Asset Allocation 100 -0.89% 3.79%

Portfolio - Class B[4,15]

SSgA Growth and Income ETF -0.98% 4.51%

Portfolio - Class B

SSgA Growth ETF Portfolio - Class B -1.22% 4.08%

Domestic

Equity American Funds® Growth Fund - Growth -0.59% 6.90%

(Large Cap) Class 2

American Funds® Growth-Income Blend -1.32% 9.00%

Fund - Class 2

BlackRock Capital Appreciation Growth -0.90% 7.30%

Portfolio - Class B

BlackRock Large Cap Value Portfolio Value 0.81% 8.35%

- Class B

ClearBridge Aggressive Growth Growth -0.11% 17.43%

Portfolio - Class B[10,13]

Jennison Growth Portfolio - Class Growth -1.64% 7.40%

B[6]

MetLife Stock Index Portfolio - Class Blend -0.40% 11.71%

B

MFS® Value Portfolio - Class B[3] Value 0.44% 9.20%

T. Rowe Price Large Cap Growth Growth -1.56% 7.48%

Portfolio - Class B

WMC Core Equity Opportunities Value -0.28% 8.99%

Portfolio - Class B[11]

WMC Large Cap Research Portfolio - Blend -0.11% 12.11%

Domestic Class B[2,12]

Equity Invesco Mid Cap Value Portfolio - Value 0.14% 8.29%

(Mid Cap) Class B[5,9]

Met/Artisan Mid Cap Value Portfolio Value -0.37% 0.42%

- Class B

MetLife Mid Cap Stock Index Blend 0.69% 7.88%

Portfolio - Class B

Morgan Stanley Mid Cap Growth Growth -2.02% -0.23%

Portfolio - Class B[1]

T. Rowe Price Mid Cap Growth Growth 0.48% 11.39%

Domestic Portfolio - Class B

Equity Invesco Small Cap Growth Portfolio Growth 0.10% 6.58%

(Small Cap) - Class B

Loomis Sayles Small Cap Core Blend 1.64% 2.23%

Portfolio - Class B

Loomis Sayles Small Cap Growth Growth 1.25% -0.31%

Portfolio - Class B

Neuberger Berman Genesis Value 0.34% -1.53%

Portfolio - Class B

Russell 2000® Index Portfolio - Blend 2.65% 3.49%

Class B

T. Rowe Price Small Cap Growth Growth 0.98% 5.33%

Portfolio - Class B

MetLife Small Cap Value Portfolio - Value 0.78% 0.46%

Class B[20]

Balanced Calvert VP SRI Balanced Portfolio -0.97% 8.25%

MFS® Total Return Portfolio - Class -0.12% 7.03%

B

International Equity American Funds® Global 0.78% 0.61%

Small Capitalization Fund - Class 2

Harris Oakmark International Portfolio - Class B -2.72% -6.95%

Loomis Sayles Global Markets Portfolio - Class B -1.88% 2.19%

MFS® Research International Portfolio - Class B -4.52% -8.10%

MSCI EAFE® Index Portfolio - Class B -4.20% -7.42%

Oppenheimer Global Equity Portfolio - Class B[7] -2.80% 0.78%

Fixed Income American Interm. -0.23% 3.72%

Funds® Bond Fund - Class 2

Barclays Aggregate Bond Index Portfolio - Class B Interm. -0.02% 4.18%

BlackRock Bond Income Portfolio - Class B Interm. 0.10% 5.49%

Lord Abbett Bond Debenture Portfolio - Class B High Yield -0.96% 3.54%

Met/Franklin Low Duration Total Return Portfolio - Short -0.31% -0.19%

Class B

PIMCO Inflation Protected Bond Portfolio - Class B Infltn Protctd -2.07% 1.63%

PIMCO Total Return Portfolio - Class B Interm. -0.45% 2.91%

Western Asset Management Strategic Bond Opportunities Portfolio - Class

BMultisector -0.78% 3.99%

Western Asset Management U.S. Government Interm. Gov. -0.20% 1.29%

Portfolio - Class B

SpeciClarion Global Real Estate Portfolio - Class B 0.05% 11.87%

alty

- Return Not Available

†Pro-rated based on an average contract size; not applicable for contracts with account values greater than $25,000.

*Annualized for Investment Options/Portfolios in existence for more than one year.

Current performance may be lower or higher than the performance quoted. This is past performance and is no guarantee of future results.

Fees and/or expense reimbursement arrangements are currently in effect or may have been in effect for certain funds. These fee waivers and expense reimbursements

have the effect of increasing performance results. Please see the prospectus for more information.

The performance shown may reflect, for some periods described, the management of previous subadvisers.

A Portfolio may have a name and/or objective that is similar to that of a publicly available mutual fund that is managed by the same money manager. These Portfolios are not

publicly available and will not have the same performance as those publicly available mutual funds. Different performance will result from differences in implementation of investment policies, cash flows, fees and size of the Portfolio.

Each of the Metropolitan Series Fund, Met Investors Series Trust and American Funds has adopted a distribution plan under Rule 12b-1 of the Investment Act of 1940. We

are paid the Rule 12b-1 Fee.

1Prior to the opening of business on May 3, 2004, the FI Mid Cap Opportunities Portfolio was merged into the Janus Mid Cap Portfolio and Fidelity Management & Research Company became sub-investment manager for the Portfolio which changed its name to FI Mid Cap Opportunities Portfolio. The investment division with the name FI Mid Cap Opportunities on April 30, 2004 ceased to exist. Performance history presented here is that of Janus Mid Cap Division. Effective May 3, 2010, the following investment portfolio merged: FI Mid Cap Opportunities Portfolio into Morgan Stanley Mid Cap Growth Portfolio. Performance for the Morgan Stanley Mid Cap Growth Portfolio consists of the performance for the FI Mid Cap Opportunities Portfolio before and on April 30, 2010 and the Morgan Stanley Mid Cap Growth Portfolio after April 30, 2010.

2On or about April 30, 2007, the BlackRock Large Cap Portfolio of the Metropolitan Series Fund, Inc. merged into the BlackRock Large-Cap Core Portfolio of the Met

Investors Series Trust. Values prior to April 30, 2007 reflect the performance of the BlackRock Large Cap Portfolio (formerly the BlackRock Investment Trust Portfolio).

3Effective April 28, 2008, the MFS Value Portfolio of the Met Investors Series Trust (MIST) merged with and into the MFS Value Portfolio of the Metropolitan Series Fund, Inc. (MSF). Values before April 28, 2008 reflect the performance of the MSF MFS Value Portfolio (formerly Harris Oakmark Large Cap Value Portfolio) since its inception on November 9, 1998. (Note that because the MIST MFS Value Portfolio is deemed to be the “accounting” survivor of the merger, the performance history set forth in the Portfolio’s April 28, 2008 prospectus is that of the MIST MFS Value Portfolio.)

4As of May 2, 2011, the following portfolio merger took effect: MetLife Aggressive Allocation Portfolio into MetLife Aggressive Strategy Portfolio (currently known as MetLife Asset Allocation 100 Portfolio). Performance for the MetLife Aggressive Strategy Portfolio (currently known as MetLife Asset Allocation 100 Portfolio) consists of the performance of the MetLife Aggressive Allocation Portfolio before and on April 29, 2011 and the MetLife Aggressive Strategy Portfolio (currently known as MetLife Asset Allocation 100 Portfolio) after April 29, 2011.

5Effective April 30, 2012, the Lord Abbett Mid Cap Value Portfolio of the Metropolitan Series Fund merged into the Lord Abbett Mid Cap Value Portfolio (currently known as Invesco Mid Cap Value Portfolio) of the Met Investors Series Trust. Values before April 30, 2012 reflect the performance of the Lord Abbett Mid Cap Value Portfolio of the Metropolitan Series Fund.

6Effective April 30, 2012, the Oppenheimer Capital Appreciation Portfolio merged into the Jennison Growth Portfolio. Values before April 30, 2012 reflect the performance of the Oppenheimer Capital Appreciation Portfolio.

7Prior to the opening of business on April 29, 2013, the Oppenheimer Global Equity Portfolio of the Metropolitan Series Fund (MSF) merged with and into the Met/Templeton Growth Portfolio of Met Investors Series Trust (MIST) and the Met/Templeton Growth Portfolio was renamed the MIST Oppenheimer Global Equity Portfolio. Values before April 29, 2013 reflect the performance of the Oppenheimer Global Equity Portfolio of the Metropolitan Series Fund.

8Effective April 29, 2013, Met/Franklin Templeton Founding Strategy Portfolio merged into MetLife Growth Strategy Portfolio (now known as MetLife Asset Allocation 80

Portfolio). Values before April 29, 2013 reflect the performance of Met/Franklin Templeton Founding Strategy.

9Effective October 1, 2013, Invesco Advisers, Inc. replaced Lord, Abbett & Co. LLC as the subadviser to the Invesco Mid Cap Value Portfolio, which was previously known as

Lord Abbett Mid Cap Value Portfolio

10Effective November 1, 2013, ClearBridge Investments, LLC replaced Janus Capital Management LLC as the subadviser to the ClearBridge Aggressive Growth Portfolio II, which was previously known as Janus Forty Portfolio.

11Effective February 3, 2014, Wellington Management Company, LLP replaced Davis Selected Advisers, L.P. as the subadviser to the WMC Core Equity Opportunities

Portfolio, which was previously known as the Davis Venture Value Portfolio.

12Effective February 3, 2014, Wellington Management Company, LLP replaced BlackRock Advisors, LLC as the subadviser to the WMC Large Cap Research Portfolio, which was previously known as the BlackRock Large Cap Core Portfolio.

13Effective April 28, 2014, the ClearBridge Aggressive Growth Portfolio II of the Met Investors Series Trust merged with and into the ClearBridge Aggressive Growth Portfolio of the Met Investors Series Trust. Values before April 28, 2014 reflect the performance of the ClearBridge Aggressive Growth Portfolio II.

14Effective April 28, 2014, the MetLife Growth Strategy Portfolio of the Met Investors Series Trust merged with and into the MetLife Asset Allocation 80 Portfolio of the

Metropolitan Series Fund.

15Prior to April 28, 2014, the MetLife Asset Allocation 100 Portfolio was known as the MetLife Aggressive Strategy Portfolio.

16Prior to April 28, 2014, the MetLife Asset Allocation 20 Portfolio was known as the MetLife Conservative Allocation Portfolio.

17Prior to April 28, 2014, the MetLife Asset Allocation 40 Portfolio was known as the MetLife Conservative to Moderate Allocation Portfolio.

18Prior to April 28, 2014, the MetLife Asset Allocation 60 Portfolio was known as the MetLife Moderate Allocation Portfolio.

19Prior to April 28, 2014, the MetLife Asset Allocation 80 Portfolio was known as the MetLife Moderate to Aggressive Allocation Portfolio.

20Effective December 1, 2014, Delaware Investments Fund Advisers and Wells Capital Management Incorporated replaced Third Avenue Management LLC as the subadvisers to the MetLife Small Cap Value Portfolio, which was previously known as the Third Avenue Small Cap Value Portfolio.

While diversification through an asset allocation strategy is a useful technique that can help to manage overall portfolio risk and volatility, there is no certainty or assurance that a diversified portfolio will enhance overall return or outperform one that is not diversified. An investment made according to one of these asset allocation models neither guarantees a profit nor prevents the possibility of loss.

Asset allocation portfolios are "fund of funds" portfolios. Because of this two-tier structure, each asset allocation portfolio bears its own investment management fee and expenses as well as its pro rata share of the management fee and expenses of the underlying portfolios. The Contract Owner may be able to realize lower aggregate expenses by investing directly in the underlying portfolios instead of investing in an asset allocation portfolio. In that case, you would not receive the asset allocation services provided by an investment adviser.

Investment Performance Is Not Guaranteed.

Additional prospectuses for the MetLife Financial Freedom Select variable annuity issued by Metropolitan Life Insurance Company and

for the investment portfolios are available from your financial professional or at www.metlife.com. The contract prospectus contains information about the contract’s features, risks, charges and expenses. Investors should consider the investment objectives, contract features, risks charges and expenses of the investment company carefully before investing. The investment objectives, risks and policies of the investment options, as well as other information about the investment options, are described in their respective prospectuses. Please read the prospectuses and consider this information carefully before investing. Product availability and features may vary by state. Please refer to the contract prospectus for more complete details regarding the living and death benefits.

Variable annuities are long-term investments designed for retirement purposes. Variable annuities have limitations, exclusions, charges,

termination provisions and terms for keeping them in force. There is no guarantee that any of the variable investment options in this product will meet its stated goals or objectives. The account value is subject to market fluctuations and investment risk so that, when withdrawn, it may be worth more or less than its original value. All product guarantees, including optional benefits, are subject to the claims-paying ability and financial strength of the issuing insurance company. Please contact your financial professional for complete details.

Distributions of 401(k), 403(b) or 457(b) salary reduction contributions allocated to your annuity account, and the earnings on such

contributions, are generally not permitted prior to attaining normal retirement age under your retirement plan except under certain situations, such as your severance from employment with the employer sponsoring the plan or your death, disability or hardship as provided under the plan. Distributions of contributions and earnings may also be restricted as defined in the plan documents. Contact your plan administrator to determine when and under what circumstances you may request a distribution from your plan. Where permitted, distributions of taxable amounts are generally subject to ordinary income tax and, if made before age 59½, may be subject to a

10% federal income tax penalty. In the case of 457(b) governmental plans, the 10% federal income tax penalty may apply to amounts rolled over from another type of qualified retirement plan or IRA. Because the purchase of a variable annuity through an employer retirement plan does not provide additional tax-deferral benefits beyond those already provided through the retirement plan, you should consider the variable annuity for its death benefit, annuity options and other non-tax related benefits. Distributions will reduce the living and death benefits and account value and may be subject to withdrawal charges.

The MetLife Financial Freedom Select variable annuity is issued by Metropolitan Life Insurance Company, on Policy Form Series G.FFS (08/02) and is

offered through MetLife Securities, Inc. All products are distributed by MetLife Investors Distribution Company (member FINRA), 1095 Avenue of Americas

New York, NY 10166.

Metropolitan Life Insurance Company • New York, NY 10166 www.metlife.com • 1-800-638-7732

CLVA6586-B

L1214402352[exp1216][All States][DC]

B Class

The performance data quoted represents past performance and does not guarantee future results. Performance current to the most recent month- end may be viewed at www.metlife.com. The investment return and principal value of an investment will fluctuate and an investor's shares, when redeemed, may be worth more or less than their original cost. Each Investment Option consists of an investment division of the separate account supporting the contract (an "Investment Division") that invests solely in shares of a fund portfolio (a "Portfolio"). Standardized Performance for an Investment Option, as defined by the SEC, is the Average Annual Total Return for periods commencing no earlier than the Investment Division inception date and terminating at the end of the most recent calendar quarter. Average Annual Total Returns shown that include periods prior to the Investment Division inception date are Non-Standardized Performance . Charges for Standardized Performance include all Portfolio-level expenses, the Separate Account Charge of 1.25% which includes the Optional Annual Step-Up Death Benefit (the Separate Account Charge includes an additional charge of 0.25% as a percentage of your average Account Balance in the American Funds Bond, American Funds Growth, American Funds Growth-Income and American Funds Global Small Capitalization Investment Divisions), the Lifetime Withdrawal Guarantee Benefit charge of

0.95% of the Total Guaranteed Withdrawal Amount, the maximum applicable withdrawal charge of 9% and the annual Account Fee of $30†. Past performance does not guarantee future results.

B Class

Average Annual Total Return

as of 12/31/2014

Assuming Contract Surrender

Standardized as of 12/31/2014

Assuming Contract Surrender 10 Year or

Variable Investment Since

Asset Class Options 1 Year 5 Year* Portfolio 1 Year

Asset Allocation Inception*

American Funds® -5.69% 5.32% 2.09% -5.69%

Balanced Allocation

American Funds® -5.38% 6.70% 2.09% -5.38%

Growth Allocation

no reviews yet

Please Login to review.