307x Filetype XLSX File size 0.06 MB Source: cdn2.hubspot.net

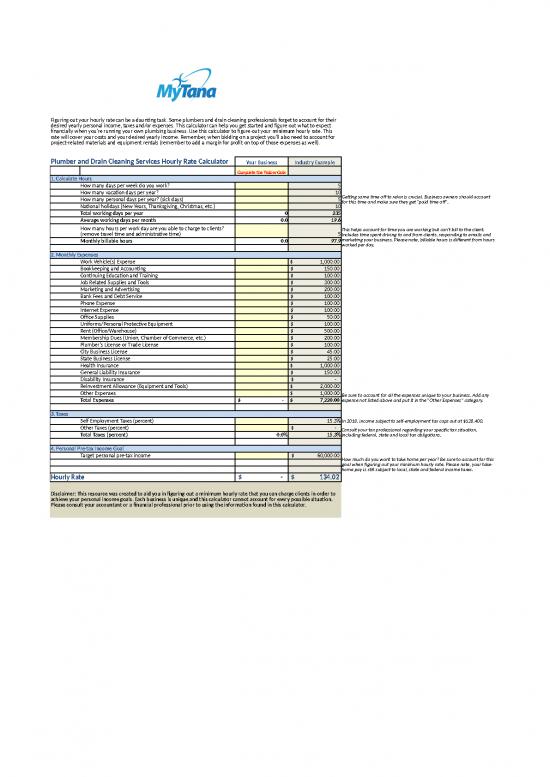

Figuring out your hourly rate can be a daunting task. Some plumbers and drain cleaning professionals forget to account for their

desired yearly personal income, taxes and/or expenses. This calculator can help you get started and figure out what to expect

financially when you're running your own plumbing business. Use this calculator to figure out your minimum hourly rate. This

rate will cover your costs and your desired yearly income. Remember, when bidding on a project you'll also need to account for

project-related materials and equipment rentals (remember to add a margin for profit on top of those expenses as well).

Plumber and Drain Cleaning Services Hourly Rate Calculator Your Business Industry Example

Complete the Yellow Cells

1. Calculate Hours

How many days per week do you work? 5

How many vacation days per year? 10

How many personal days per year? (sick days) 5Getting some time off to relax is crucial. Business owners should account

for this time and make sure they get "paid time off".

National holidays (New Years, Thanksgiving, Christmas, etc.) 10

Total working days per year 0 235

Average working days per month 0.0 19.6

How many hours per work day are you able to charge to clients? This helps account for time you are working but can't bill to the client.

(remove travel time and administrative time) 5Includes time spent driving to and from clients, responding to emails and

Monthly billable hours 0.0 97.9marketing your business. Please note, billable hours is different from hours

worked per day.

2. Monthly Expenses

Work Vehicle(s) Expense $ 1,000.00

Bookkeeping and Accounting $ 150.00

Continuing Education and Training $ 100.00

Job Related Supplies and Tools $ 300.00

Marketing and Advertising $ 200.00

Bank Fees and Debt Service $ 100.00

Phone Expense $ 100.00

Internet Expense $ 100.00

Office Supplies $ 50.00

Uniforms/Personal Protective Equipment $ 100.00

Rent (Office/Warehouse) $ 500.00

Membership Dues (Union, Chamber of Commerce, etc.) $ 200.00

Plumber's License or Trade License $ 100.00

City Business License $ 45.00

State Business License $ 25.00

Health Insurance $ 1,000.00

General Liability Insurance $ 150.00

Disability Insurance $ -

Reinvestment Allowance (Equipment and Tools) $ 2,000.00

Other Expenses $ 1,000.00 Be sure to account for all the expenses unique to your business. Add any

Total Expenses $ - $ 7,220.00 expense not listed above and put it in the "Other Expenses" category.

3. Taxes

Self Employment Taxes (percent) 15.3%In 2018, income subject to self-employment tax caps out at $128,400.

Other Taxes (percent) $ - Consult your tax professional regarding your specific tax situation,

Total Taxes (percent) 0.0% 15.3%including federal, state and local tax obligations.

4. Personal Pre-tax Income Goal

Target personal pre-tax income $ 60,000.00

How much do you want to take home per year? Be sure to account for this

goal when figuring out your minimum hourly rate. Please note, your take-

home pay is still subject to local, state and federal income taxes.

Hourly Rate $ - $ 134.02

Disclaimer: This resource was created to aid you in figuring out a minimum hourly rate that you can charge clients in order to

achieve your personal income goals. Each business is unique and this calculator cannot account for every possible situation.

Please consult your accountant or a financial professional prior to using the information found in this calculator.

no reviews yet

Please Login to review.