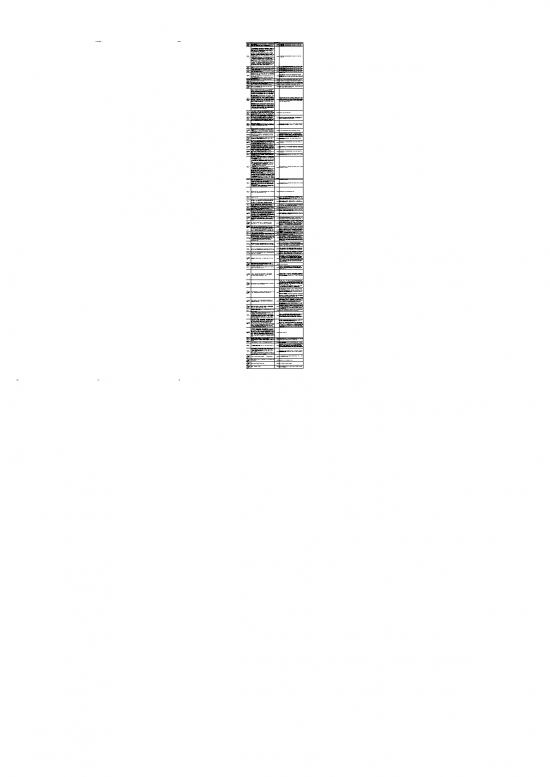

269x Filetype XLSX File size 0.08 MB Source: www.michigan.gov

Sheet 1: SCA Q&A

| State of Michigan, Department of Health and Human Services | ||||

| Standard Cost Allocation Methodology | ||||

| SCA Q&A Tracking | ||||

| No. | Agenda Topic | Issue/Question | Q&A Release Date | Response and/or Proposed Changes |

| 1 | Allocation Clarifications | May require not to change things, so requires 'actuals' based on FTE. Will need to be consistent across the organization. | 4/23/2021 | This has been addressed in the methodology report released in April 2021. SCA Workgroup discussed on 1/29/21 |

| 2 | Allocation Clarifications | So you would have to go back and adjust what you had allocated based upon FTE? It may require you to not go back and change things – so it would have to be based on actuals |

4/23/2021 | This has been addressed in the methodology report released in April 2021. SCA Workgroup discussed on 1/29/21 |

| 3 | Allocation Clarifications | I want to share my concerns with the workgroup about allocating employee insurance expense by FTE as proposed by the draft version of the PIHP and CMHSP Standard Cost Allocation Methodology. Paragraph 6.6.1 of the GF contract states “The CMHSP will comply with generally accepted accounting principles (GAAP) for governmental units when preparing financial statements. The CMHSP will use the principles and standards of 2 CFR 200 Subpart E Cost Principles for determining all costs reported on the financial status report…” 2 CFR 200.431 (d) specifically defines 2 methods of allocating fringe benefits. 2 CFR 200.431 (d) states “Fringe benefits may be assigned to cost objectives by identifying specific benefits to specific individual employees or by allocating on the basis of entity-wide salaries and wages of the employees receiving the benefits. When the allocation method is used, separate allocations must be made to selective groupings of employees, unless the non-Federal entity demonstrates that costs in relationship to salaries and wages do not differ significantly for different groups of employees.” As shown above, either 1) specific benefits to specific employees or 2) allocating on the salaries and wages of the employees receiving the benefits is considered allowable by 2 CFR 200. Using FTE to allocate employee insurance expense would be inconsistent with the fringe benefit allocation methods prescribed by 200.431 (d). Option 2) is a viable method of allocating fringes benefits and does not require allocating at the individual level. In fact, option 2) already appears to be used into the Standard Cost Allocation Methodology to allocate pension and retirement expenses. It is my understanding that the Standard Cost Allocation Methodology will be used to produce to the Financial Status Report (FSR) and per the Contract paragraph 6.6.1, the FSR needs to follow 2 CFR 200 Subpart E. Furthermore, federal grant expenditures need to be allocated in accordance with 2 CFR 200 and deviations from the cost principles described in 2 CFR 200 may result in questioned costs during a single audit. I would encourage the workgroup to consider Option 2 noted above as an viable alternative to allocating fringe benefits by FTE. |

4/23/2021 | This has been addressed in the methodology report released in April 2021. SCA Workgroup discussed on 1/29/21 |

| 4 | Allocation Clarifications | Can specific Other Expenses be allocated on some basis to multiple cost centers rather directly assigned? | 4/23/2021 | Items such as Room and Board, cannot be allocated, which is why it is set as directly assigned. Other items (e.g. mailroom expenses) identified as Other Expenses can be directly assigned to General Administration or IT. |

| 5 | Allocation Clarifications | Need to discuss whether Other Expense should be allocated and we need either a specified Room & Board expense category OR we have two Other Expense categories (one that is directly assigned and another that is allocated). | 4/23/2021 | Items such as Room and Board, cannot be allocated, which is why it is set as directly assigned. Other items (e.g. mailroom expenses) identified as Other Expenses can be directly assigned to General Administration or IT. |

| 6 | Allocation Clarifications | Can specific other expenses be allocated on some basis to multiple cost centers rather directly assigned (such as telephone office supplies)? | 4/23/2021 | Items such as Room and Board, cannot be allocated, which is why it is set as directly assigned. Other items (e.g. mailroom expenses) identified as Other Expenses can be directly assigned to General Administration or IT. |

| 7 | Allocation Clarifications | I have a question specific to our CMHSP. We are still a department of our County, and therefore we are charged as part of our County Cost Allocation Plan for things such as space, maintenance, most of the IT costs, HR, payroll, etc. This typically is recorded in one expense account and then we are spreading this across all cost centers based on the FTE count. Could you please take into consideration how we should handle this as it pertains to the new allocation template and logic? |

4/23/2021 | This expense can be identified as an Other Expense and can be directly assigned to General Administration or IT. Ideally, amounts allocated from the county could be separately identified as facility related, IT related, and all other functions. There will be some cases where the SCA Workgroup will need to provide TA to certain CMHSPs. |

| 8 | Managed Care Administration | Need to review the IT costs to determine if there is a more appropriate way to get claims processing separate from other IT | 4/23/2021 | Claims processing is being included within Other Managed Care Administration and is separate from IT |

| 9 | Expense category strategy | Where would compensated absences liability be reported? | 4/23/2021 | This is a balance sheet item, but the expense is likely part of salaries/wages for the employee. |

| 10 | Allocation Clarifications | This will impact grants/contracts that will not allow us to go back to the beginning of the year to adjust the insurance/pension allocations that have been billed to them. | 4/23/2021 | Estimate as best possible and at year end do cost adjustments, but this is not applicable for this year. |

| 11 | Allocation Clarifications | MH courts contracts require actual not estimate, no allocation, based on employee and required documentation. In that case, it would be direct allocation and create a mixed approach. | 4/23/2021 | This has been addressed in the methodology report. SCA Workgroup discussed on 1/29/21 |

| 12 | Non-Encounterable cost center clarifications / changes | Recipient Rights - Are Recipient Rights Trainings considered trainings from the Training Department or part of the Recipient Rights cost? | 4/23/2021 | Recipient rights costs include the cost of the trainers. The 2 hours for individuals attending training should still be charged to their direct service cost center. |

| 13 | Non-fee for service contracts/Reporting network provider costs | In the Cost Allocation training #1, the comment was made that CMH/PIHP should be able to pull the encounter data to report cost. In our current processes, we do add up the total from encounters but always need to do some adjustment to match the amount we have actually paid to providers because of some of the non-Fee for Service contracts that we have with Providers. In those contracts we have estimated the number of encounters and costs. Examples of non-Fee for Service contracts would be Daily or Monthly case rates, Net Cost Contracts, and Value Based Purchasing arrangements. Below are examples of those types of contracts and how we establish the encounter rate. How would these examples would play out in the Cost Allocation process? Daily/Monthly Case Rate: For ACT services, we pay the outside provider a per day amount for each enrolled ACT Consumer provided they have documented contact with that Consumer during the month. We use a CPT code for the actual billing that does not get submitted to the PIHP and also require the Provider to submit encounters with the actual CPT code. The Actual CPT code does submitted to the CMH does not include a charge amount. At the CMH level, we have calculated the cost per encounter based on expected billable (productivity) amounts. Let’s say the rate was based on providing an average of 12 ACT units per month per consumer. However the actual average units per month per person are 6. Thus the actual cost to provide that service is double the amount that we have calculated and reported throughout the year. In order to report the appropriate costs for ACT services , would we need to pull all those encounters back at the end of the year, re-price them and then resubmit them or is there another option? Net Cost contracts We have several net cost contracts with Providers where we cover the entire cost of the program based on an annual budget they submitted. They do submit encounters for billable services that have a zero charge. As in the example of daily/monthly case rate, we have calculated the charge amount that gets applied to the encounter before it is sent to the PIHP. So, lets say the encounter rate based on previous year encounters and total program cost is $100.00 per unit. However during the current year, they do not incur the same amount of costs and they provide more billable units than anticipated. In order to report appropriate costs, would those encounters need to be pulled back at the end of the year, re-priced , and then resubmit with a changed charge amount that would more closely reflect the total amount paid to the provider. |

4/23/2021 | For non-FFS contracts with network providers, the Service UNC tab should reflect what is included within the encounter data (i.e. so that entities can summarize their data warehouse to populate). A separate tab in the EQI template will be created to capture all adjustments to expenditures for non-FFS contract arrangements, including documentation of the contract type, the information included in encounters, and the actual expenditures incurred. There will be a separate row for each provider and procedure code. CMHSPs will need to begin collecting start/stop times for contracted services to support this reporting beginning 10/1/2022. |

| 14 | Non-fee for service contracts/Reporting network provider costs | –“ Note that there will be instances where services are provided through contractual arrangements with network providers that “bundle” services together, or are provided under sub-capitated contractual arrangements. In these instances, network provider contracts will require modification to require that network providers can report actual services and related payments for the services at the individual service level.”, Page 18 item 6 Does this suggest that all Provider Contracts need to be Fee for Services based? If not, how would a Net cost type contract comply with this requirement? | 4/23/2021 | See above. FFS contracting is not a requirement. |

| 15 | Non-fee for service contracts/Reporting network provider costs | Medical Loss Ratio - Incurred claims: direct claims paid to providers (including under capitated contracts) for services covered under the contract, unpaid claims liabilities, provider withholds and incentive/bonus payments, and claim payments recovered from fraud reduction efforts (not to exceed the amount of fraud reduction expenses which must not include fraud B29prevention activities). Non-claims costs must be excluded with the exception of administrative costs attributable to direct provision of Medicaid covered services by CMSHP provider employees, which may be included with incurred claims.23 I believe the statement was also made that the Network Provider claims should be able to be pulled directly from the encounters. How would unpaid claims liabilities and incentive/bonus payments be included in Provider Network payments? | 4/23/2021 | Unpaid claim liabilities, incentives, and bonuses paid to providers should not be included in the encounter data and can be reported on the Other Expense tab of the EQI template. These expenditures should be included in incurred claims of the MLR. |

| 16 | Non-fee for service contracts/Reporting network provider costs | Value Based Contract (incentive pay) If we have a contract with a provider to give a performance bonus amount if certain measures are met, do those costs need to be reflected in the encounters or would those performance payment amounts not be included in the MLR calculation? If not in the MLR (or incorporated into the cost of providing the unit) would they be Managed Care Administration costs? |

4/23/2021 | Incentives and bonuses paid to providers should not be included in the encounter data and can be reported on the Other Expense tab of the EQI template (row 13). These expenditures should be included in incurred claims of the MLR. |

| 17 | Assignment of Salaries and Wages | a. We contract with Psychiatrists by the hour and they provide services in person at our office or via telepsych, We provide MA staff, space, receptionist and IT. How do we split this between contractual and cover the support costs that we provide? We use their NPI number to bill. Yes as billing provider. b. Psychiatrist is contractual staff (03 category), compensation directly assigned to cost center (or multiple) based on the work. Support staff goes to the cost center and IT is allocated based on methodology. Workgroup further discussion. |

4/23/2021 | James followed up and indicated they do use the CMHSP billing provider NPI in this example. |

| 18 | Managed Care Administration | Earlier you showed Access including benefit eligibility activity and MPM shows targeted case management assisting the beneficiary to access programs that provide financial assistance. Discuss the difference please. | 4/23/2021 | Allocation to encounterable/clinical services should occur first in alignment with the Michigan Medicaid Provider Manual and Mental Health Code Sets documentation. Access activities as documented in MDHHS' policy "Access Standards" should be assigned to the non-encounterable cost center "Access Center" which is then allocated to the administrative cost category "Shared managed care administration." Provider front office activities to verify eligibility at the point of care are not considered access and instead should be reported as "General Administration." |

| 19 | Non-Encounterable cost center clarifications / changes | CMHSP must get into a contractual relationship with the FI. What am I supposed to do with this in the cost allocation; Incurred claims will be what is paid to the provider; The administration associated with the Self-Determination – where does it go? |

4/23/2021 | We have added Self-Determination Administration as a non-encounterable cost center so this is separately identifiable |

| 20 | Assignment of Salaries and Wages | I am struggling just a bit on collection of costs of certain areas. Example would be behavior treatment. That is a team of different credentialed staff and supervisors collected under different cost centers. H2000 is a team based services with staff under different clinical cost centers. Those staff would need to be allocated across appropriate costs centers. Also true of administrative costs. Key task to get salaries and wages where services are being provided. Will have additional discussion on the best way to allocate across cost centers. | 4/23/2021 | Additional training will be provided detailing approaches for assigning salaries and wages across multiple cost centers |

| 21 | Assignment of Salaries and Wages | Hi – the response provided to the concern of how to allocate minutes to the H2000 was to be sure to have payroll costs in the appropriate cost centers for the members of the team, however this code is entered by one staff participating in the treatment team meeting. How would we allocate the complete cost of the team to the service if the service will come in with the modifier of the staff that enter the service. Currently our Behavior Treatment Committee chair enters the service for each of the cases that are reviewed during the monthly meeting. A cost per meeting is calculated by summing the cost of the team members. The total annual cost is spread to the number of units for the year. Can you explain how this could then be put into the template? | 4/23/2021 | Salaries and wages for all staff involved in the behavior treatment plan should be allocated to the behavior treatment cost center. This is a team-based service and would not include a provider group modifier. |

| 22 | Assignment of Salaries and Wages | Our psychiatrists will provide ABA assessment or identification as well as medication Administration. What is the thought on assigning a cost center? Option 1 - encounter would show minutes on each activity and directly allocate based on service provided. Option 2 - documentation of time on each activity and then allocate to the cost centers. |

4/23/2021 | Additional training will be provided detailing approaches for assigning salaries and wages across multiple cost centers |

| 23 | Service Cost Centers | My understanding is that treatment planning is one of the activities included in case management services, meaning that T1016 or T1017 would be coded. If so, why would H0032 be included as a case management service? Wouldn't it be more appropriate to include H0032 under outpatient? Workgroup agreed to look at again. | 4/23/2021 | We have updated the cost centers for each procedure code to include variation for different provider groups performing the same service. |

| 24 | Service Cost Centers | Would the workgroup re-visit the placement of H0032 (treatment planning) in the Case Management cost center (as indicated in Appendix 2)? There is language in the PIHP/CMHSP Encounter Reporting HIPCS and Revenue codes document that would seem to conflict with this placement. The language excerpts below would seem to indicate that H0032 should be in many cost centers, but not in case management as Case managers and/or supports coordinators do not report treatment planning. i. H0032 - When/how to report encounter: 1. -Count independent facilitator and all professional staff, where the consumer has chosen them to attend, participating in a person-centered planning or plan review session with the consumer 2. -Case manager or supports coordinator do not report treatment planning as this is part of TCM and SC 3. -Report monitoring the implementation of part(s) of the plan by clinician, such as OT, PT or dietitian. 4. -Assessments and evaluations by clinicians should not be coded as Treatment Planning but rather as the appropriate discipline (e.g., OT, PT, speech and language) 5. -Use Modifier TS when clinician performs monitoring of plan face-to-face with consumer 6. Allocating and reporting costs 7. -Major implications for indirect contribution to other activities 8. -Indirect activity 9. -The cost of a clinician’s monitoring the implementation of plan that does not involve a face-to-face contact with the consumer is an indirect cost of treatment planning ii. Other ambulatory/outpatient services that can be reported at same time iii. Treatment Planning (H0032) can be reported by an independent facilitator and all professional staff for the same session. In addition, it can be reported by multiple staff at same time that the case manager/supports coordinator also reports that time using their own code: T1016, T1017, H0039, H0036, H2022, or H2021. It should be noted that only one staff person can attend an IPOS in the behavioral health case management role. In their role providing services and supports planning, Adult Peer Specialists and Recovery Coaches will report H0032 with their appropriate, respective modifiers. Youth Peer Support Specialists will report H0038 with the TJ modifier and Parent Support Partners S5111 with the HM modifier. iv. 11. Face-to-face interactive Case Management monitoring (T1016/T1017) can be reported at the same time as in-home service such as community living support and personal care, and certain day-time activity services (clubhouse, supported employment, prevocational service, skill building, community activities). Professionals and specialty providers will report treatment plan monitoring (H0032-TS) at the same time that the consumer is receiving the service for which they are being monitored in the above settings. v. 12. Face-to Face monitoring by home-based staff (H0036) and ACT (H0039) team members can be reported at the same time as day-time activity services. The consumer must be present and have at least 15 minutes of interaction with the home-based staff or ACT team member for the monitoring activity and the service being monitored to be reported at same time. |

4/23/2021 | We have updated the cost centers for each procedure code to include variation for different provider groups performing the same service. |

| 25 | Service Cost Centers | Additionally, would the workgroup include treatment planning monitoring (H0032:TS) to determine which costs centers that code could be used in? | 4/23/2021 | We have updated the cost centers for each procedure code to include variation for different provider groups performing the same service. |

| 26 | Service Cost Centers | The chart seems to imply that codes with modifiers would follow in the same cost centers as the primary code (without the modifier) . However, there are a few codes where the modifier may need to be placed differently from the main CPT code. Below are two examples: 1. Behavior Treatment – The Behavior treatment monitoring code does not seem to be included in the codes (H2000:TS) for any of the programs listed. I am not sure it belongs in BT. For our organization, this code is reported in the IDDA Supports Coordination/case management and provided by the Psychologist. Several of our Residential contracts also allow for BT monitoring. Where would this code belong? 2. Case Management – The code for Treatment Planning (H0032) is included in the Case Management cost center. It does not appear that the Treatment Plan Monitoring code (H0032:TS) is identified in any of the cost centers. Where does this code belong? |

4/23/2021 | We have updated the cost centers for each procedure code to include variation for different provider groups performing the same service. |

| 27 | Service Cost Centers | Health homes need cost centers. Does there need to be separate cost centers for the health home service costs separate from the health home administrative costs? | 4/23/2021 | We have added a cost center for the health home procedure codes. |

| 28 | Service Cost Centers | Where do CCBHC costs go? | 4/23/2021 | CCBHC costs will not be treated differently than any other costs incurred by CMHSPs. These additional costs should be identified in the most appropriate cost center. We will make adjustments to be explicit about excluding all of the non-allowable costs shown in the CMS CCBHC cost report from the clinical and non-encounterable cost centers. |

| 29 | Service Cost Centers | In Appendix 2, the S9484 code is the only code listed for the Crisis/mobile Crisis cost center, see below: 109 Crisis/Mobile Crisis S9484 It is our understanding that an Intensive Crisis Response team can also use the following: Intensive Crisis Stabilization S9484, H2011 TJ, H2011 HB, H2011 HC, H2011: Below are excerpts from the guidance: Crisis intervention mental health services, per hour. Use for the - MDHHS-approved program only. PLEASE NOTE EFFECTIVE 10/1/18: S9484 TJ – will no longer be used for ICSS for children, because the 1-hour time requirement does not accurately reflect the services being provided. MUST USE H2011 TJ for Children. PLEASE NOTE EFFECTIVE 10/1/18: ICSS for Adults CAN use the H2011 HB or H2011 HC to report if they do not meet the one hour minimum OR use the S9484 if meets the one hour requirement for this code. CAN USE H2011 or S9484 for Adults. Hour DT=24/day H2011 - this service must be initially reported at 30 minutes and in 15-minute increments thereafter. DT: H2011=96/day Line Professional State Plan, Healthy Michigan, EPSDT When/how to report encounter: Face-to-face contacts only, other contacts (phone, travel) are incorporated in as an indirect activity Allocating and reporting costs -Costs of the team -Bundled activity -Cost and contact/productivity model assumptions used -Account for contacts where more than one staff are involved Please review and determine if the codes for Cost Center 109 should be updated. |

4/23/2021 | We have discussed this issue with MDHHS and will be utilizing H2011 HT to identify Mobile Crisis services for children and adults. MDHHS will be developing guidance regarding the requirements to be considered a qualifying Mobile Crisis team. |

| 30 | Service Cost Centers | Definition of Care Coordination includes Person-centered planning process and self-determination. Does the Person centered planning process include the non -encounterable time of a Independent Facilitator when working on the development of the Person Centered Plan (this is separate from the IPOS) ? | 4/23/2021 | The independent facilitator is by rule a contracted network provider and should be included within the direct-run cost centers. The non-encounterable time of the independent facilitator should be added to the cost of the service (H0032) a CMHSP pays a network provider to deliver. |

| 31 | Service Cost Centers | Outpatient – includes 90792, which is a psych eval with Med Monitoring. No other Psych codes are included in the Outpatient program. It would seem that Psychiatric Services – Med clinic would be a better fit for that code. Can this code be moved to Psychiatric Services? | 4/23/2021 | We have updated the cost centers for each procedure code to include variation for different provider groups performing the same service. |

| 32 | Managed Care Administration | The costs within 05 are a mix of provider administration and subcontractor/managed care administration costs. They need to be separated. | 4/23/2021 | The group has discussed the separating these items would require significantly more detail in time tracking for staff and have opted to move forward with what is currently proposed for the initial SCA methodology. If needed, this could be updated in future years. |

| 33 | Assignment of Salaries and Wages | In the Rate Setting workgroup, there were some salary and wages that were directly included in the cost of the service. For example, 90792 Psych assessment included 90 minutes of Nursing time. Since these individuals provide direct support for this services, It is appropriate to include Nursing/ MA costs (directly as part of the rate) into the services provided in a Psychiatric Med clinic. Would the salaries and benefits of RN/ MA’s be considered Salary and Wages – Clinical direct service staff for all the Evaluation and Management codes? Should the salary and wages of individuals who are included in the rate development template (s) as being directly involved in the encounter, be included in the Salaries and Wages -clinical direct service staff line? | 4/23/2021 | We agree that these clinical staff should be included within the expense category line Salaries and Wages - Clinical direct service staff. Individuals included within the independent rate model would be included in this expense category for those services. |

| 34 | Assignment of Salaries and Wages | Our Psych Med clinic program includes support staff that check in/out Consumers and nursing triage services that are mostly non-billable phone contacts. Currently these costs are included in the cost of the services provided by the Doctors and Nurses in that clinic. If I understand the new model, those salary dollars would be included in an admin cost center and spread across all programs even though those individual support staff only provide services to the Psych clinic. Is that accurate? | 4/23/2021 | We have added a separate expense category for service support staff salaries and wages so that their costs can be identifiable and directly assignable into direct-run cost centers. This would still be considered provider administration for purposes of the independent rate model comparison. |

| 35 | Non-Encounterable cost center clarifications / changes | What is the definition of second-line supervision? If I remember correctly, the rate setting templates only include the first line supervisor. Should these structures be in alignment? | 4/23/2021 | Supervision Definition: Time and expenses for first- and second- line supervisors in the oversight and management of directly reporting clinical staff. As with clinical staff, first- and second-line supervisors are also on-site and client facing, although their supervisory time does not result in a billable service. In addition to providing direct oversight of clinical staff, supervisory staff are those primarily responsible for supervising, hiring, and training the clinical staff that actually provide the billable services. Supervisor responsibilities may also include program planning and evaluation, advocacy, working with families, performance management and discipline, and working with community members. |

| 36 | Assignment of Salaries and Wages | I had a question in regards to the attached Appendix 3 spreadsheet. Will we be required to separate salaries based on education level in our payroll system and cost allocation worksheet? | 4/23/2021 | No, that detail is not required in payroll systems or cost allocation; it is only required in the encounter data |

| 37 | General | Is there a plan to require the SCA workbook to be submitted as part of the annual required reports? Will we be expected to use the tool to actually allocate our various expenses such as support staff, supervisors, building expense, IS, auto & etc.? Or will it be ok to allocate these expenses in our accounting software as long as we use the required method such as square feet or FTEs? | 4/23/2021 | The intent is to require components of the SCA Model as part of annually required reporting (e.g., Final DRClinical CC Summ tab). There will be some flexibility in model use so long as the allocation methodology is followed (e.g., facilities allocated by square footage in the general ledger would be allowable and the model can accommodate that). There may be some expenses deemed to be immaterial that would not be required to have a consistent allocation methodology (e.g., workers compensation). |

| 38 | General | When will the final SCA model/workbook be complete? | 4/23/2021 | A Revised Draft model will be provided following the April training. Additional models will be provided as needed in the future based on additional feedback from the field. |

| 39 | General | Will there be another training after we’ve had additional time to work through the new cost centers, standard expense categories and etc. to review how costs are allocated using the model? And to answer additional questions that I’m sure will arise? | 4/23/2021 | The intent is to have bi-weekly FAQ sessions during which CMHSPs can ask additional questions that will arise during implementation of the new SCA model |

| 40 | Managed Care Administration | Managed care or delegated administration: my view is that all of the CMH for Central Michigan’s administration is related to direct or contracted services and other non-encounterable costs. All of the agency’s administration expense would be incurred if we were a standalone provider of service – if we didn’t have a PIHP all of our administration costs would be incurred. Because of this it is difficult to determine what percent of admin time is managed care/delegated. Will Milliman/MDHHS be specifically indicating what exactly is considered to be managed care/delegated administration? | 4/23/2021 | The SCA report documents functions that are considered managed care administration based on federal guidance and the MDHHS-PIHP and MDHHS-CMSHP contracts. Additionally, other administration (e.g., General Administration) will be allocated to both managed care administration and provider administration based on certain allocation methods outlined in the report that were determined to be appropriate by the SCA Workgroup. CMHSPs should also review their delegation agreement with their PIHP for additional details on what managed care activities they are responsible to provide. MDHHS and Milliman are available to provide guidance on managed care administration definition and allocation. |

| 41 | Managed Care Administration | For managed care/delegated admin, will Milliman be specifically listing what admin expenses are to be tracked under this? Or will Milliman be changing the direction for CMHSPs on this and allowing CMHSPs to allocate all admin as a provider of service? When will that decision be made? | 4/23/2021 | Please see the table in the Standard Cost Allocation Methodology Report mapping the non-encounterable cost centers to the administrative cost categories, particularly “Shared managed care administration – all other managed care administration” and “Shared managed care administration – healthcare quality improvement activities.” The functions in non-encounterable cost centers that map to these administrative cost categories are considered managed care/delegated admin. |

| 42 | Allocation Clarifications | On the EQI UNC tab, are we mandated to use a grant fund source in our EMR and track units of service? We currently track grant revenue and offset expense, but we do not track units of service. | 4/23/2021 | The grant fund source was included within the EQI template to allow for CMHSPs to capture units that are fully covered by grant funding. To the extent that a CMHSP does not provide any services fully covered by a grant fund source, then there would be no units reported under this source. Future COB reporting requirements will necessitate tracking grant funding offsets at the individual claim level. |

| 43 | Managed Care Administration | Under the cost center ‘Other Managed Care Administration’, what is meant by provider directory? How does that differ from Provider Network? | 4/23/2021 | Provider Directory is intended to represent the costs of compiling and presenting the details of your provider network in either electronic web-based or paper manual format for beneficiaries to find providers in your service area. We agree that this aligns with the activities under the Provider Network non-encounterable cost center and have moved it from “Other Managed Care” to “Provider Network.” |

| 44 | Assignment of Salaries and Wages | We have a Medical Director, would that position fall under General Administration or Clinical Supervisor? | 4/23/2021 | Medical Director costs fall under the Standard Expense Category “Salaries and Wages, Administration” which is next directly assigned to the non-encounterable cost centers. In general, Medical Director activities would fall under “General Administration.” However, depending on the activities of your Medicaid Director, some may be dedicated to one administrative function and all their salaries and wages will be directly assigned to the corresponding non-encounterable cost center. Other employees may support multiple administrative functions (or even have a mix of clinical and administrative responsibilities), which will require their salaries and wages to be assigned to the appropriate cost centers as a percentage of time spent performing the different activities. Activities that account for five percent or less of an employee’s total time are not required to be tracked or assigned to non-encounterable cost centers to focus efforts on splitting time associated with significant roles and responsibilities. |

| 45 | Non-Encounterable cost center clarifications / changes | In the 12/9/20 Standard Cost Allocation Methodology Draft document, under the non-encounterable cost center descriptions, there is an item called ‘Supervision’. The definition is between ‘Trainers Net Expense’ and ‘Medical Records’, however we didn’t see a cost center for this in the 200 series of numbers, would it be 218? | 4/23/2021 | Clinical supervision is cost center 301 |

| 46 | Service Cost Centers | Would a Program Director, a clinical position supervising 1st and 2nd line supervisors of direct run programs be assigned to the cost center ‘Supervision’? | 4/23/2021 | A Program Director, whose primary responsibility is overseeing program services, including overseeing the 1st and 2nd line supervisors of clinical services, should not be assigned to supervision, and instead should be assigned to the Standard Expense Category “Salaries and Wages, Administration” which would then be directly assigned to a non-encounterable cost center, likely General Administration. |

| 47 | Assignment of Salaries and Wages | If finance staff, such as a claims processing clerk, has a portion of their time allocated to 210/Managed Care Admin and to 204/Finance, would the CFO’s time be split between 204/Finance and 210/Managed Care based on the staff supervised? | 4/23/2021 | Leaders of administrative staff should allocate their time based on the activities they directly perform as individuals, not that of their staff. If a CFO spent 15% of their time reviewing/monitoring claims payment activities and 85% of their time on financial reporting and expense management, they would allocate their time to those non-encounterable cost centers as such, regardless of the percentage of their staff’s actual time allocation. |

| 48 | Non-Encounterable cost center clarifications / changes | For cost center 214/Quality, 208/IT and 210/Managed Care, where do you draw the line for quality data collection? When is it quality, vs IT or managed care? | 4/23/2021 | Activities that support ensuring 1) standards for staff, program and management performance exist; 2) compliance with them is assessed and 3) ongoing improvements are introduced, monitored, and assessed with respect to their outcomes should be assigned to the non-encounterable cost center "Other Healthcare Quality Improvement Activities" which is then assigned to the administrative cost category "Shared managed care administration - healthcare quality improvement activities." While a managed care administrative activity, it is necessary to separate out activities that improve health care quality for inclusion in the medical loss ratio. 45 CFR 158.150 provides additional clarification on what activities can be included in “214/Other Quality Improvement Activities.” Quality data collection will likely be allocated to 214 unless it is supporting one of the excluded activities in the statute, i.e. utilization management. |

| 49 | Non-Encounterable cost center clarifications / changes | Would a person that monitors Hab Supp Waivers, SED Waivers and Children’s waivers, assisting with recerts and etc. be considered to fall under 201 Access or 210 Managed Care? | 4/23/2021 | More information about the described individual's responsibilities may be necessary to determine their expense allocation. Activities assigned to the non-encounterable cost center "Access" should align to MDHHS' policy "Access Standards" as documented in the MDHHS-PIHP and MDHHS-CMHSP contracts. Clinical screening as part of determining coverage eligibility is a requirement of the Access policy and therefore those activities would be allocated to "Access." When not included in an encounter, monitoring waivers would be allocated to the non-encounterable cost center "Care Coordination." Both "Access" and "Care Coordination" are assigned to the administrative cost category "Shared managed care administration;" however, "Care Coordination" counts as activities that improve health care quality and can be included in the numerator of the medical loss ratio. |

| 50 | Assignment of Salaries and Wages | Would all of a medical assistant or nurse’s non-encounterable time be coded to 202 Care Coordination? Or would their time spent related to a psychiatric dr visit be coded to the 118 Psychiatric Services cost center? | 4/23/2021 | If the indirect, or non-billable time of a medical assistant or nurse is incurred to support the provision of a clinical service, it should be assigned to the clinical service or cost center being supported by the employee. If a medical assistant or nurse is supporting services that meet the definition for Psychiatric Services – Med Clinic, their time should be coded to that cost center whether or not their time results in a billable service. The direct and indirect time for these individuals is included within the independent rate model for this service and would be included in the Salaries and Wages - Clinical direct service staff expense category and included in the Med Clinic cost center. The non-encounterable cost centers should be used only when an employee’s time is not intended to be supporting the direct provision of a clinical service. Please refer to the definitions for the non-encounterable cost centers. |

| 51 | Non-Encounterable cost center clarifications / changes | It appears that cost center 208 IT is 100% allocated as general business operations expense, except for the portion attributed to encounter data, is that correct? Currently we allocate about 75% of the IT costs to direct run services based on IT staff time. | 4/23/2021 | The Methodology does separate encounters from general IT and includes encounters in the “other managed care administration” non-encounterable cost center which is mapped to the administrative cost category “Shared managed care administration – all other managed care administration.” Other IT activities in the non-encounterable cost center “IT” are mapped to the administrative cost category “Business operations” which is then further allocated to all cost centers based on the number of FTEs attributed to each cost center. |

| 52 | General | Is it expected that 100% of a CMHSP's expenses, that are also reported on the FSR, will also be in the Standard Cost Allocation Document? If not, what is excluded? |

4/23/2021 | There is an "Other" section in the FSR that may not be captured currently in the SCA methodology. Additional changes to the SCA model may be needed to capture these expenses. |

| 53 | Allocation Clarifications | For Montcalm Care Network employees, PTO earned in a year can equal between 10% and 16% of their annual hours paid of 2080, based upon years of service. Currently when PTO is paid it is charged to their "home" cost center, which is the cost center where the majority of their time worked is charged. At the end of the fiscal year the balance of unused leave is placed in a Leave Reserve fund, with increases or decreases from the previous years balances charged to the employees " home" cost center. These increases or decreases are accrued as wages, employment taxes to the home cost center. This is to assure funds are available should MCN go out of business to pay off employees for their earned PTO balance. What is Milliman's position on this? |

4/23/2021 | Without fully understanding the Montcalm Care Network PTO policy, the salaries and wages to be accounted for in the standard cost allocation should be the same as the salaries and wages expenses that have been accrued by the entity for the reporting period. In other words, if the increases or decreases to the Leave Reserve fund are accrued by the entity as wages in the reporting period, and the entity has determined that such accrual is consistent with GAAP, then those accrued wages should be included in the salaries and wages reported in the SCA worksheet. |

| 54 | Assignment of Salaries and Wages | Montcalm Care Network has 3 team leaders. The first is a Case Manager who spends 50% doing direct case management services, and 50% supervising several Peer Support Staff in the Peer Support Cost Center. The second is a Home Based Specialist who spends 20% supervising five Family Support Assistants who work in the Home Based Cost Center, and spends 80% doing direct home based services in the Home Based Cost Center ( all are billed for the same CPT code). The third works in the Access department where she supervises the front desk staff (Support Staff cost center) consumer registration ( Consumer Registration cost center) and coordinates the clinical staff who work in the Access Department (Access cost center). My question is how should these 3 staff be classified as far as which salaries and wages expense account to use? Should they split time between direct services and supervision or just choose one or the other? The third team leader is problematic because most of her "supervision" is of staff whose wages would be in the 05 salaries and wages expense and should the portion of her supervision time for the non-clinical go to 05 (do not provide direct services), portion of supervision time for clinical go to 02, and the balance of her time go to 01? Also is all Access staff time considered salaries and wages expense code 01? |

4/23/2021 | All salaries and wages for clinical employees, i.e., those that meet the definitions for Clinical Direct Service Staff or Clinical First- and Second-Line Supervision, should be classified as Expense Category 01 or 03, respectively. For clinical employees, time should be apportioned between 01 and 03 based on the time spent by employees. All salaries and wages for administrative employees, including Access, should be classified as Expense Category 06. For employees that have a mix of clinical and administrative responsibilities, it will be necessary to apportion their salaries and wages between clinical (01 and/or 03) and administrative (06). Apportionment should be based on time spent by these employees. For clinical staff, in addition to assigning salaries and wages to the appropriate Standard Expense Category (01 or 03), it is also critical to assign their wages and FTE statistics to the appropriate Standard Cost Center. Clinical staff wages (01) and FTE statistics should be assigned to Direct-run Clinical cost centers 101 - 139 (or to Excluded Services 401-403) based on the employee time spent. All first- or second-line supervision wages (03) and FTE statistics should be assigned to cost center 301, Clinical Supervision, (or to Excluded Services 401-403) based on the employee time spent. Administrative staff wages for employees who support multiple administrative functions should be assigned to non-encounterable cost centers 201-218 (or to Excluded Services 401-403) based on the employee time spent. For purposes of assigning wages and time, activities that account for five percent or less of an employee’s total time are not required to be tracked or assigned to non-encounterable cost centers to focus efforts on splitting time associated with significant roles and responsibilities. |

| 55 | Assignment of Salaries and Wages | Currently Montcalm Care Network allocates supervisors based upon the FTE's of the staff they supervise based upon the budget for the fiscal year. There are currently 12 such staff. Given MCN's 25% staff turnover and an average of vacant position per month, it would be very time consuming to update supervised actual staff FTE's every month before allocation each supervisor. Each supervisor has their own cost center where their costs are accumulated before allocation each month. Each supervisor has their own allocation expense account that posts their allocation amounts to the cost centers where their staff charge their salaries and wages. At that point you cannot tell the breakout of the supervisor's allocation by the proposed 19 proposed SCA expense accounts. I am not going to post these allocations by the up to 19 proposed SCA expense accounts. This means that the 02 expense account will for the most part only appear in these individual supervisor's cost centers and not in the cost centers where direct services are provided. Which of the 19 expense accounts would these allocations of first and second line supervisors be included? |

4/23/2021 | See response to above question. |

| 56 | Service Cost Centers | Service codes 96130 & 96131 are cross walked to cost center 113 on Appendix 2. How should service codes 96130 & 96131 be coded to Autism, which is cost center 102? | 4/23/2021 | These services are not specific to Autism and therefore are not being included in the Autism cost center. |

| 57 | Service Cost Centers | Service code H0032 is cross walked to cost center 105, case management. If T1016 & T1017 are inclusive of treatment planning (H0032), why is H0032 only listed under cost center 105 case management? | 4/23/2021 | The SCA Workgroup has updated the cost centers for this and other services. |

| 58 | Service Cost Centers | Why doesn’t cost center 109, Crisis/Mobile Crisis, include service codes H2011 & T1023? | 4/23/2021 | We have discussed this issue with MDHHS and will be utilizing H2011 HT to identify Mobile Crisis services for children and adults. All other crisis services will be included in the Crisis cost center, which is separate from Mobile Crisis. |

| 59 | Allocation Clarifications | Will the new education modifiers be required for FY22? How will these education modifiers be used for reporting and cost allocation? | 4/23/2021 | The provider group modifiers will be required for all non-team based services beginning in SFY 2022. These provider groups, however, are not required to be tracked in the CMHSP general ledger. Service costs are accumulated in the clinical cost centers and the model creates establishes a composite cost per minute for each cost center. The weighted average cost per minute method (which is described in the SCA Methodology report in detail) utilizes the provider group modifiers and standard weighting to allocate costs to each procedure code/provider group modifier combination. |

| 60 | Allocation Clarifications | Do CMHSPs only do direct-run services for third parties? Need to think about administration allocated to third-party expenditures. What happens to the administrative costs for the GF or Third Party claims? The CMH manages the provider network for all benefits regardless of payer. i. There will be administrative costs for GF ii. Effectively, the admin will never be allocated to third-party payers and will fall on GF or Medicaid. Is this allowable? Can you say more about the 3rd party payor comment you made please. Will need to talk through as a work group and whether acting as an entity subcontracting to other providers or only serving third party payer as a provider to further refine the methodology. |

4/23/2021 | Managed care administration will be allocated to all payers; it was noted that this will be minimal for non-Medicaid payers during SCA Workgroup discussion on 2/12. Further discussion needed for Commercial/Medicaid payers. |

| 61 | Non-Encounterable cost center clarifications / changes | What about insurance buyout payments (healthcare opt out)? Is this considered compensation? | 5/26/2021 | If CMH is accounting for this as an insurance expense (by GAAP), the way it is classified, is how to include the expense in the SCA model. |

| 62 | Non-Encounterable cost center clarifications / changes | What about employer contributions to Health Savings Accounts? Should this be treated the same as healthcare expense? | 5/26/2021 | Employer contributions to HSAs are treated like insurance. |

| 63 | Non-Encounterable cost center clarifications / changes | How about employee EAP and wellness program expenses? | 5/26/2021 | EAP is considered an HR function, which is allocated by FTE. |

| 64 | Non-Encounterable cost center clarifications / changes | How PTO is handled when it is deferred? | 5/26/2021 | Federal guidance 200.431 section B includes leave, including PTO, as allowable if all criteria met, and costs equitably allocated. |

| 65 | Service Cost Centers | Is 108 just for Youth Mobile Crisis and 106 for both State Certified Intensive crisis and other crisis? Is the intent to keep Youth crisis separate from other crisis or to keep a State Certified Intensive Crisis program (that can serve both youth and adult) as a cost center? | 5/26/2021 | Cost center 108 is for mobile crisis only, while all other forms of crisis should fall under cost center 106. Based on the new SFY 2022 code sets, any crisis codes with an HT modifier will fall under 108 Mobile Crisis, while all non-HT crisis codes will fall under 106 Crisis. The following are notes from the 5/26/2021 bi-weekly meeting: Feedback was provided that State Certified Intensive Crisis program (which was described as mobile crisis for adults) includes MD time, which is billed under S9484. S9484 code is in 106, but should be within 108 along with mobile crisis. MD is called in as needed and is also paid for on-call even if they do not provide services. Other qualifying providers use the S9484 code as well, e.g. social workers, and this is also corresponding to mobile crisis. Youth mobile crisis (24/7) will also use HT, but an MD is not required on call for this team. CMHSP also has a crisis team separate from mobile crisis (Emergency Crisis Response Team). This team does things such as a preadmission screening, but does not follow-up after the initial contact like the mobile crisis teams are required to do. There will be follow-up discussions with MDHHS and the SCA Workgroup confirming the proposed change to include S9484 in the mobile crisis cost center. |

| 66 | General | Is it expected that the SCA will show an allocation of expenses by funding source, or is that not determined until the information is entered into the EQI? The current cost allocation plan I use takes costs from the GL by cost center after various allocations have been made in the GL ( fringe benefits, vehicles, IT, space, fringe benefits, IT, supervision). Then I run a service activity log data report for the period which breaks out services by cost center by funding source. From this report I calculate funding source percentages by cost center and apply them to the accumulated costs in the cost center. From this I determine the overall cumulative funding source revenue earned (Medicaid, HSW, SEDW, Healthy Michigan and General Funds). I do not do this by individual HCPCS code. The resulting revenue breakdown is then booked to the General Ledger for the period. As a result, I can run revenue and expenditure reports from the General Ledger for each cost center. I would plan on continuing to do this starting 10/1/21. I would still use the cost allocation plan I currently use. I would be internalizing as many of the SCA allocations in my General Ledger, just entering the resulting allocations by cost center for each in the SCA. Those costs that are allocated only in the SCA would then be booked to the General Ledger. At this point the costs in each would be distributed the same. I would then run the same service activity log reports that I have used before to determine the break down by funding source. |

5/26/2021 | The SCA Workgroup discussed that many CMHSPs are internalizing the standard allocation methodologies. To accommodate this, the SCA model allows CMHSPs to directly allocate all expense categories if allocation methods are internalized. It is unclear whether the methodology you have implemented using the service activity logs follows to weighted average cost per minute method. If it does not, then your internal expenditure reporting would not be consistent with the results of the SCA model. The following are notes from the 5/26/2021 bi-weekly meeting: CMHSPs should track both the direct and indirect time attributable to the service and assign the service related time to the appropriate cost center. Indirect time not attributable to services should be allocated based on the sum of direct and indirect service related time. There was clarification that direct minutes were utilized from the encounters on the Service UNC tab in the SCA methodology. Services that do not include enough time to result in an encounter would not be included in the Service UNC tab, but should be included in the cost center. |

| 67 | Service Cost Centers | On the updated Appendix 2, we’re not seeing the following: T1016, and hospital codes such as 0100,0124, 0912, 0913. What cost center would these fall under? | 5/26/2021 | T1017 is the only service code used for case management and supports coordination beginning in SFY 2022. An update to Appendix 2 will list out all services that are understood to be always contracted out to network providers and thus not necessary for the direct-run cost allocation. Appendix 2 updates will include services assumed to be contracted only. |

| 68 | Non-Encounterable cost center clarifications / changes | Should we split out prevention and advocacy from other mental health code functions? | 5/26/2021 | Prevention and advocacy will be included as separate lines in future EQI reporting for the Mental Health Code expenditures that are captured within the Mental Health Code/CMHSP Only Activities non-encounterable cost center. |

| 69 | General | Is the costing process expected to update the EQI only on the annual report or each time the EQI report is submitted during the fiscal year? | 5/26/2021 | It would be updated each time the EQI report is submitted, every four months. It is anticipated that inputting the trial balance should not be a significant time commitment. |

| 70 | Assignment of Salaries and Wages | What do you use for Team Leader wage expense account? 1 or 3? | 5/26/2021 | Reference Slide 24 from the April 2021 training. Team leads might have overlap in these expense categories used. For example, a home based worker leading peer support (different cost center); part of their time in expense category 01 attributable to home-based services and of their time in expense category 03 attributable to supervision of peer support. |

| 71 | Managed Care Administration | I'm still trying to make sure we handle Managed care admin correctly, we are a CMH that direct runs over 90% of our services- not all our Admin should be Managed care admin - right ? For example, how much of total Accounting Admin cost is attributed to service provision and how much is managed care admin ? | 5/26/2021 | That is correct, not all admin should be managed care. Certain non-encounterable cost centers (e.g., Finance) will be allocated to both managed care admin and provider admin. Slide 16 (April training) and SCA methodology report provides more information on allocation methods. CMHSPs with mostly direct-run services will have more of their business operations attributable to provider administration than a CMHSP who contracts out most of their services. |

| 72 | Service Cost Centers | Would it be possible to have a complete list of cost centers with definitions, the standard expense categories and their definitions and the HCPC/CPT code crosswalk to the cost centers all in one document? We are having difficulty switching from document to document as we work through this new methodology. Thank you! | 5/26/2021 | Thank you for the suggestion. The next version of the report will include an Appendix with all of the cost centers and definitions in Appendix 2. |

| 73 | Service Cost Centers | An issue we stumbled on as we work through the new methodology and are having difficulty solving is for the service codes that can be coded to two different cost centers such as 112/117. To be able to select the cost center based on the new education level modifier in our EHR, the modifier will need to be added on the backside at an earlier stage in the process. Currently backside added modifiers are added at the time a service becomes and is reported as encounter. To use this modifier in a GL mapping in a PCE system, the assignment will need to occur before the adjudication of claims. We don’t know if this is possible, but wanted you to consider this issue to see if there are any other solutions you may be able to come up with. | 5/26/2021 | We would request at least one CMHSP work with their EHR vendor regarding this issue and share the resulting solution or further defined issue. MDHHS would be happy to facilitate a meeting to reach a solution on this topic if discussions between CMHSPs and EHR vendors cannot create a solution that can be shared with all CMHSPs. |

| 74 | General | Has Milliman/MDHHS been working with the various CMHSP/PIHP software vendors such as PCE to see how they can assist with implementing this new methodology? | 5/26/2021 | SCA workgroup members made best effort to consider system changes needs in the design of the SCA methodology; however, EHR vendors have not been involved in the discussions to date. Please also see the response to the question above. |

| 75 | Service Cost Centers | We are beginning the process of aligning our EHR to the proposed standard cost allocation cost centers. I found some issues with the current version of appendix 2. • Autism – Should include H0031U5 • Supports Coordination (T1016) is not listed in any of the cost centers • 90792 is not listed in the Psychiatric Services – Med Clinic & Outpatient for MH (it is included in SUD) • H0031 is only listed in SIS Assessment with WY modifier. This code is used for services other than the SIS Assessment Please let us know if these changes will be implemented. |

5/26/2021 | There are several updates related to the identified codes. 1. Appendix 2 released in April 2021 included 90792 for both mental health and SUD cost centers. 2. H0031 will have a redefinition of qualified providers. The WY modifier is appended to H0031 to indicate SIS, but nonprofessional assessment for the reduced list of qualified providers is still included. Crosswalk has been developed. Provider qualifications will need updated. Noted that ADOS will use 96112/113. 3. U5 modifier has been removed from the SFY 2022 code sets 4. T1016 has been removed from the SFY 2022 code sets. All case management will be coded under T1017. |

| 76 | Service Cost Centers | Discussion of consolidation of SUD and Non SUD Cost centers. Proposal is to remove SUD-specific cost centers and to blend them with MH cost centers. |

5/26/2021 | CMHSPs can have more detail than the SCA cost centers if they choose, but discussion was that we don’t want to require the additional detail in the SCA framework. There was a question about whether encounters would be impacted. SCA Workgroup did not believe encounter reporting would be impacted by this change. SCA Workgroup to work with select CMHSPs who suggested the change to determine what cost centers should be utilized/retained for SUD service codes that do not have a corresponding MH service code (e.g., H0015, H0019) Please let the SCA workgroup know if you are aware of any reporting requirements that may not mesh well with this change |

| 77 | General | Discussed use of H2015 by peers who are not yet certified. | 5/26/2021 | The state will be reviewing what is included in the reporting and costing considerations and determine if peers should continue use of H2015 before certification. |

| 78 | General | Any idea when the "Draft" will be considered final? We want to begin cross walking our current account strings but there are over 15,000 of them so we don't want to have to do it several different times. |

5/26/2021 | There should not be significant changes from the version shared at the April training. The goal is for no more major changes to the expense categories and cost centers, except for the consolidation of SUD cost centers. CMHs should be able to start without too much burden coming later from other changes. It is expected that there will be ongoing changes as needed, e.g. when codes are updated. |

| 79 | Allocation Clarifications | Currently each manager has their own cost center. Their wages and benefits, allocation of IT, space and other directly charged costs related to them are accumulated in their personal cost center. At the end of the month the costs in their cost center are allocated to other cost centers based upon the budgeted FTE's of the staff they supervise. The SCA is now requiring that they be allocated based upon where they actually spend their time by cost center. For allocated Health insurance the SCA requires that this be based upon the FTE's of all staff eligible and participating in the insurance plan. This can be determined at the beginning of the year and applied throughout the full year. I have absolutely no basis to allocate mangers time by activity for various cost centers, other than the FTE's of the staff they supervise. Using the Case Management cost center as an example. As the FY 2021 begins, if managers are now charging their time to various cost centers every day, there will be three managers using the 03 Standard expense category code charging to case management. Each of these also supervise staff in other cost centers. I can no longer keep track of each individual manager. |

6/10/2021 | The SCA methodology does represent a different approach than the method described in this question. The SCA workgroup has established a method that assumes it is reasonable for CMHSPs to assign direct service staff wages to Standard Direct-Run Clinical Cost Centers based on the types of services they provide, and to assign administrative staff salaries to Standard Non-encounterable Cost Centers based on the nature of the administrative functions they provide. Facility-related costs should be allocated based on the square footage use of space for each standard cost center. Other directly charged costs should also be assigned to standard cost centers based on their purpose. If managers meet the definition of first or second line clinical supervision, their salaries and wages should be accumulated and assigned to the single Clinical Supervision cost center (301), where they are further allocated to clinical cost centers based on the relative salaries and wages of clinical staff. If managers fulfill an administrative function (i.e., they do not meet the supervision definition, nor do they provide billable clinical services), their salaries should be allocated to one of the standard Non-encounterable cost centers. The employer portion of employee health and other insurance-related expenses, pension expenses, and other fringe benefits should be allocated to all cost centers based on allocated employee salaries and wages. Payroll taxes and fees should be directly assigned to each cost center based on the assigned employees (i.e., payroll taxes and fees should follow the employee). |

| 80 | Assignment of Salaries and Wages | Do you expect each of the 6 expense categories for wages to remain specifically identifiable throughout the allocation process? First example. First and second line supervisors. Supervisor A costs are accumulated in a separate cost center for Supervisor A. Supervisor A wages are charged to expense 03. On a monthly basis, all of the costs are accumulated related to Supervisor A in the Supervisor A cost center, including fringes (expense accounts 07, 08 and 09), space (expense code 17) and other such as IT (expense account 20). On a monthly basis all of the costs in the cost center for Supervisor A are allocated to the staff that are supervised. Supervisor A supervises Case Managers who split their effort between case management services in costs center 104 (Case Management) and family training in cost center 113 (Outpatient). For example, this might be 90% to 104 and 10% to 113. Currently when this allocation is booked to the General Ledger, there is an expense account entitled allocation of Supervisor A. The entry to book this zeroes out the amount in the Supervisor A cost center and shows amounts in cost center 104 and 113 for one amount allocated to each of the cost centers. All of the distinctions of expense accounts disappear and are consolidated in the allocation of Supervisor A expense account. If we continue to follow this process in the SCA it will not reflect any 03 expenses. The same would be the case for all of the administration costs in the 200 cost center series. If all of the expense accounts must keep their detailed expense code this will be a big problem. It will be nearly impossible to put the genie back in the bottle, that is translate back to the General ledger what was done in the SCA. |

6/10/2021 | The expense categories are not specifically identifiable throughout the allocation process, but they are identifiable within the summarized trial balance. Expense category 03 is for staff supervisors and 05 is for contractual staff as supervisors. Both get allocated solely to cost center 301 regardless of the cost center included within the trial balance. Cost center 301 is then allocated proportionately across all clinical cost centers. There is not a need to track individual clinical cost centers that supervisors are supervising, but that can be done in the CMHSP general ledger if the CMHSP opts to do so. |

| 81 | Service Cost Centers | From the current list of cost centers, I fail to find what cost center(s) to use for Contracted Clinical Services. The cost centers listed with matching HCPCS codes in Appendix 2 are identified in the Draft Standard Cost Allocation Model as of 5-11-21 in the CMHSP Cost Center Group column as " Direct-Run Clinical". Would these be reported under 211 Provider Network? The only place I see a "Contracted" designation is on the Service UNC tab in the Draft Standard Cost Allocation Model received 5-11-21 in column O "Standard Cost Center". But all of those so designated in Column O only pull costs from other worksheet tabs in the model to Column X "CMHSP Direct-Run Expenditures". The column where I would expect to see contracted expenses, which would be column Y "Network Provider Expenditures", has no formula and is blank. I believe "Direct-Run Clinical" costs need to kept separate from "Contracted" due to separate types of allocations. |

6/10/2021 | The SCA methodology is primarily intended to allocate costs incurred by CMHSPs to either direct run clinical services or to administrative functions. Contracted network provider services do not have any cost center requirements, but can utilize the existing cost centers if a CMHSP opts to do so. The contracted network provider service costs and units should be directly assigned based on the service codes actually billed for and paid by the CMHSP. Amounts paid by CMHSPs to contractors that provide administrative services should be directly assigned to the appropriate non-encounterable cost center. The Service UNC tab and recent SFY 2022 code set documents have included a SCA Cost Center column. In some cases, this is listed as "Contracted". This indicates that the SCA Workgroup does not believe this service is ever delivered directly by CMHSP staff and therefore is not included in one of the standard cost centers. |

| 82 | Service Cost Centers | For contracted clinical encounterable services, what cost centers should be used? Are you planning to add additional numbers that correspond with the 101-138 that contracted services will be coded to or can we make up our own, maybe the 600 series? The 4/26/21, page 6, SCA Methodology – April Training says that under std exp cat 10, it does list cost centers 101-139 – does that mean we can use those even though other documents say direct-run only? | 6/10/2021 | See above response. |

| 83 | General | Will CCBHC be added into the model? | 6/10/2021 | SCA Workgroup is working with MDHHS to review and understand the CCBHC reimbursement methodology and reporting requirements as they intersect and relate to the SCA methodology. MDHHS is currently working with CMS on the reporting requirements and further discussion will be shared in the future. CCBHC services are a subset of CMH services, so no additional cost centers or expense categories should be necessary. Other reporting needs are being considered. Changes to the SCA structure/cost centers are not anticipated. |

| 84 | Non-Encounterable cost center clarifications / changes | Clarify IT allocation | 6/10/2021 | IT costs follow the non-encounterable cost centers allocation process. Staff allocated to 208 are then allocated to business operations and spread to all other cost centers based on FTE count. This allocates hardware, software, and technical support services across all employees with the assumption that every employee has some level of technical infrastructure support. Timesheets or other time mechanism is critical to assigning time to the appropriate cost centers. |

| 85 | Expense category strategy | Can you define what you include in first and second tier supervision again? | 6/10/2021 | Some organizations create two tiers of supervision. Whether organizations have one or two tiers of supervision, the assumption is that it is generally a 1:10 ratio (except for EBPs). Some may have 8 first line supervisory with 2 second-line supervisors (i.e., this is not a program director). This language was intended to provide flexibility in the staffing model that some CMHSPs were known to have. |

| 86 | Non-Encounterable cost center clarifications / changes | What cost center should consumer registration go in? Access or Customer service? What cost center would reimbursement/billing staff go in? They deal with direct run services as well contracted services. Where would recipient rights go now that Milliman knows it is not all Mental Health Code/CMHSP Only Activities Unique non-encounterable CMHSP only activities (e.g., MHC) that are assignable to Medicaid, Healthy Michigan and GF? What cost center would the executive director go in? |

6/10/2021 | Please refer to the MDHHS Access Policy and MDHHS-PIHP contract and review the consumer registration activities to determine if they are "Access" or "Customer Service" or "General Administration." Reimbursement/billing staff would be assigned to "Finance" which requires further allocation to all other cost centers as a percentage of the total expenses directly assigned or allocated to each cost center. This presumes the greater the size of the functional area, the greater the consumption of financial services. Recipient rights and other mental health code/CMHSP only activities that are not captured by a service code should be allocated to this cost center. These expenditures will be allocated to Medicaid, Healthy Michigan, and/or General Fund based on total allocated expenses. Executive Director would be assigned to "General Administration" which requires further allocation to all other cost centers as a percentage of the total expenses directly assigned or allocated to each cost center. |

| 87 | Service Cost Centers | In the SCA Q&A 20210527.xlsx file on line Row 73, it says: “CMHSPs should track both the direct and indirect time attributable to the service and assign the service related time to the appropriate cost center. Indirect time not attributable to services should be allocated based on the sum of direct and indirect service related time.” Does this mean it should be tracked in payroll? Or through Service Activity logs? There was clarification that direct minutes were utilized from the encounters on the Service UNC tab in the SCA methodology. Services that do not include enough time to result in an encounter would not be included.” Is this second statement the clarification? | 6/10/2021 | How to track direct and indirect time will be a CMHSP decision based on a number of different factors. The SCA Workgroup requests that any CMHSP needing training and/or technical assistance reach out to SCA.Feedback@Milliman.com. Once there is an understanding of the number of CMHSPs requesting assistance, a plan will be put together to provide that assistance. We've clarified a sentence in row 73: Services that do not include enough time to result in an encounter would not be included in the Service UNC tab, but should be included in the cost center. |

| 88 | Allocation Clarifications | Am I understanding that health insurance would be allocated based on wages where higher paid staff would be charged with a higher percent of the health insurance cost? | 6/10/2021 | Higher paid staff are paid with higher percent of costs, but the goal is consistency. We will evaluate after one year, and this may change in the future. While a higher portion of insurance costs are covered by higher paid staff, the same percentage should be applied to all salaries and wages. Individual costs are higher, but the percentage should be the same. |

| 89 | Allocation Clarifications | Am I understanding correctly that health insurance would be allocated to wages of staff who do not receive health insurance because it based on wages and not based on wages of staff actually receiving health insurance benefits, for example relief staff, temporary staff or staff that do not qualify for insurance benefits? | 6/10/2021 | Yes. There has been some discussion with the SCA workgroup. Originally we looked at basing the allocation on qualifying FTE to attribute expenses to those employees eligible to receive the benefits. After audit concerns were raised with the qualifying FTE approach, the SCA workgroup determined that attributing based on all employee salaries and wages was the most viable option for consistency, understanding that not all will take insurance. |

| 90 | General | At what frequency would the percent of wages be able to be calculated? | 6/10/2021 | Some CMHs may recalculate monthly to match grant monthly cycles. Some CMHs may recalculate every 4 months with EQI cycle. One suggestion is to consider doing monthly. |

| 91 | Expense category strategy | How to input if we currently directly assign benefits? | 6/10/2021 | The SCA methodology was revised to allocate insurance benefits based on all employee salary and wages. CMHSPs may have to make changes to comply with the SCA methodology. Each CMH will need to evaluate what they need operationally. Some CMHs may want to directly assign benefits into the cost center, e.g. due to Board reporting, but for purposes of Medicaid reporting they will have to comply with the SCA allocation methodology. This is an area of CMH choice based on other reporting requirements. Expenses can be input in the standard summarized trial balance in the SCA model as direct assigned to cost centers or without allocation to cost centers. If the assignment to cost centers used in the CMHSPs General Ledger for this expense category is not consistent with the SCA methodology, these expenses will need to be allocated within the SCA model (i.e. by changing the input in E11 on the Expense Category Summary tab). If the assignment in the CMHSP General Ledger is consistent with the SCA Methodology, they can "directly assign" the expense category (this option is only applicable for 08 Insurance, 09 Retirement, and 17 Facilities). The CMH should make sure the allocation used in the model aligns with the SCA methodology and flows through to unit costs, which will then be used for EQI reporting. |