334x Filetype XLSX File size 0.20 MB Source: truthaboutmoney.co.za

Sheet 1: Jan

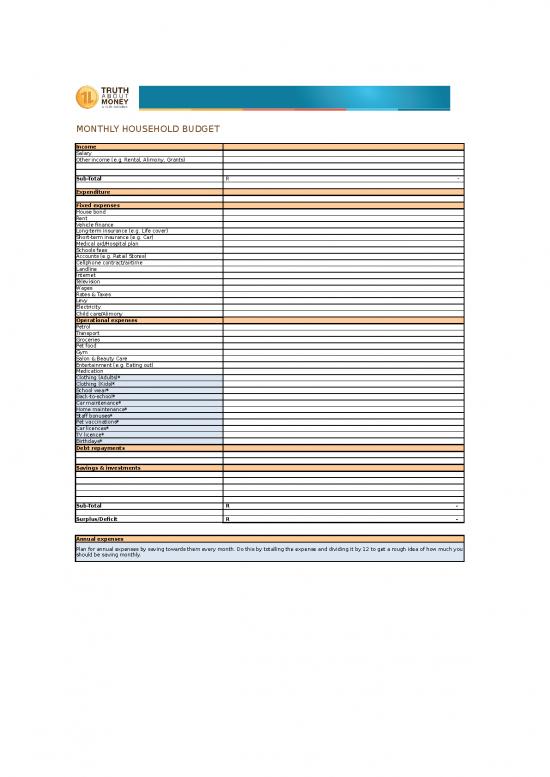

| MONTHLY HOUSEHOLD BUDGET | ||

| Income | ||

| Salary | ||

| Other income (e.g. Rental, Alimony, Grants) | ||

| Sub-Total | R - | |

| Expenditure | ||

| Fixed expenses | ||

| House bond | ||

| Rent | ||

| Vehicle finance | ||

| Long-term insurance (e.g. Life cover) | ||

| Short-term insurance (e.g. Car) | ||

| Medical aid/Hospital plan | ||

| Schools fees | ||

| Accounts (e.g. Retail Stores) | ||

| Cellphone contract/airtime | ||

| Landline | ||

| Internet | ||

| Television | ||

| Wages | ||

| Rates & Taxes | ||

| Levy | ||

| Electricity | ||

| Child care/Alimony | ||

| Operational expenses | ||

| Petrol | ||

| Transport | ||

| Groceries | ||

| Pet food | ||

| Gym | ||

| Salon & Beauty Care | ||

| Entertainment (e.g. Eating out) | ||

| Medication | ||

| Clothing (Adults)* | ||

| Clothing (Kids)* | ||

| School wear* | ||

| Back-to-school* | ||

| Car maintenance* | ||

| Home maintenance* | ||

| Staff bonuses* | ||

| Pet vaccinations* | ||

| Car licences* | ||

| TV licence* | ||

| Birthdays* | ||

| Debt repayments | ||

| Savings & investments | ||

| Sub-Total | R - | |

| Surplus/Deficit | R - | |

| Annual expenses | ||

| Plan for annual expenses by saving towards them every month. Do this by totalling the expense and dividing it by 12 to get a rough idea of how much you should be saving monthly. | ||

| HOUSEHOLD MONTHLY BUDGET | ||

| Income | ||

| Salary | ||

| Other income (e.g. Rental, Alimony, Grants) | ||

| Sub-Total | R - | |

| Expenditure | ||

| Fixed expenses | ||

| House bond | ||

| Rent | ||

| Vehicle finance | ||

| Long-term insurance (e.g. Life cover) | ||

| Short-term insurance (e.g. Car) | ||

| Medical aid/Hospital plan | ||

| Schools fees | ||

| Accounts (e.g. Retail Stores) | ||

| Cellphone contract/airtime | ||

| Landline | ||

| Internet | ||

| Television | ||

| Wages | ||

| Rates & Taxes | ||

| Levy | ||

| Electricity | ||

| Child care/Alimony | ||

| Operational expenses | ||

| Petrol | ||

| Transport | ||

| Groceries | ||

| Pet food | ||

| Gym | ||

| Salon & Beauty Care | ||

| Entertainment (e.g. Eating out) | ||

| Medication | ||

| Clothing (Adults)* | ||

| Clothing (Kids)* | ||

| School wear* | ||

| Back-to-school* | ||

| Car maintenance* | ||

| Home maintenance* | ||

| Staff bonuses* | ||

| Pet vaccinations* | ||

| Car licences* | ||

| TV licence* | ||

| Birthdays* | ||

| Debt repayments | ||

| Savings & investments | ||

| Sub-Total | R - | |

| Surplus/Deficit | R - | |

| Annual expenses | ||

| Plan for annual expenses by saving towards them every month. Do this by totalling the expense and dividing it by 12 to get a rough idea of how much you should be saving monthly. | ||

| HOUSEHOLD MONTHLY BUDGET | ||

| Income | ||

| Salary | ||

| Other income (e.g. Rental, Alimony, Grants) | ||

| Sub-Total | R - | |

| Expenditure | ||

| Fixed expenses | ||

| House bond | ||

| Rent | ||

| Vehicle finance | ||

| Long-term insurance (e.g. Life cover) | ||

| Short-term insurance (e.g. Car) | ||

| Medical aid/Hospital plan | ||

| Schools fees | ||

| Accounts (e.g. Retail Stores) | ||

| Cellphone contract/airtime | ||

| Landline | ||

| Internet | ||

| Television | ||

| Wages | ||

| Rates & Taxes | ||

| Levy | ||

| Electricity | ||

| Child care/Alimony | ||

| Operational expenses | ||

| Petrol | ||

| Transport | ||

| Groceries | ||

| Pet food | ||

| Gym | ||

| Salon & Beauty Care | ||

| Entertainment (e.g. Eating out) | ||

| Medication | ||

| Clothing (Adults)* | ||

| Clothing (Kids)* | ||

| School wear* | ||

| Back-to-school* | ||

| Car maintenance* | ||

| Home maintenance* | ||

| Staff bonuses* | ||

| Pet vaccinations* | ||

| Car licences* | ||

| TV licence* | ||

| Birthdays* | ||

| Debt repayments | ||

| Savings & investments | ||

| Sub-Total | R - | |

| Surplus/Deficit | R - | |

| Annual expenses | ||

| Plan for annual expenses by saving towards them every month. Do this by totalling the expense and dividing it by 12 to get a rough idea of how much you should be saving monthly. | ||

no reviews yet

Please Login to review.