387x Filetype XLSX File size 0.69 MB Source: www.fluvannacounty.org

Sheet 1: Guidance

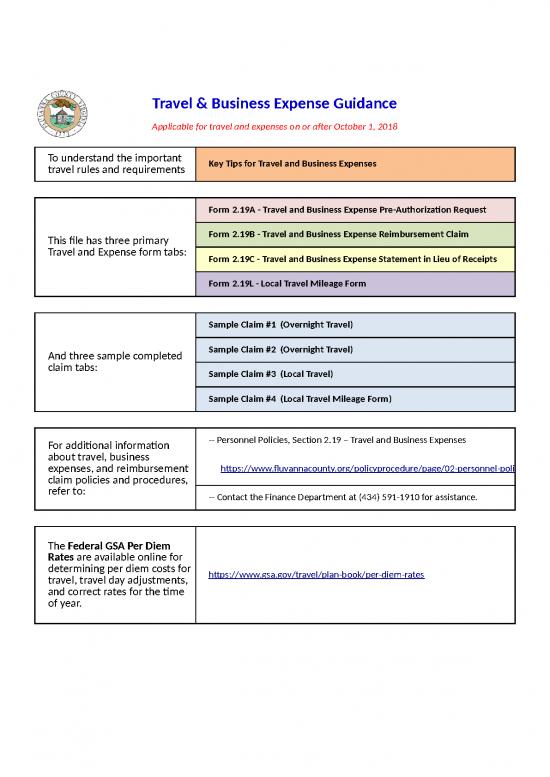

| Travel & Business Expense Guidance Applicable for travel and expenses on or after October 1, 2018 |

|

| To understand the important travel rules and requirements | Key Tips for Travel and Business Expenses |

| This file has three primary Travel and Expense form tabs: | Form 2.19A - Travel and Business Expense Pre-Authorization Request |

| Form 2.19B - Travel and Business Expense Reimbursement Claim | |

| Form 2.19C - Travel and Business Expense Statement in Lieu of Receipts | |

| Form 2.19L - Local Travel Mileage Form | |

| And three sample completed claim tabs: | Sample Claim #1 (Overnight Travel) |

| Sample Claim #2 (Overnight Travel) | |

| Sample Claim #3 (Local Travel) | |

| Sample Claim #4 (Local Travel Mileage Form) | |

| For additional information about travel, business expenses, and reimbursement claim policies and procedures, refer to: | -- Personnel Policies, Section 2.19 – Travel and Business Expenses |

| https://www.fluvannacounty.org/policyprocedure/page/02-personnel-policies-and-forms | |

| -- Contact the Finance Department at (434) 591-1910 for assistance. | |

| The Federal GSA Per Diem Rates are available online for determining per diem costs for travel, travel day adjustments, and correct rates for the time of year. | https://www.gsa.gov/travel/plan-book/per-diem-rates |

| KEY TIPS FOR TRAVEL AND BUSINESS EXPENSES Fluvanna County, Virginia | |

| ITEM | DISCUSSION |

| Pre-Authorization | Authorization required for local or overnight travel, training, or other business expenses obtained prior to commencing the activity. |

| Care in Incurring Expenses | Authorized travelers are expected to exercise the same care in incurring expenses that he or she would exercise if traveling on personal business and using personal funds. |

| Local Travel | Travel of less than 50 miles (one-way) from the work station that does not include an overnight stay. |

| Day Travel | Travel of 50 miles or more (one-way) from the work station that does not include an overnight stay. |

| Overnight Travel | Travel outside of the county that exceeds twelve hours and includes an overnight stay. |

| Full Day | Travel departure before 7:00 a.m. and travel return after 6:00 p.m. |

| Meals and Incidental Expenses (M&IE) Per Diem | Per day amount a traveler may be reimbursed for such expenses in a host city. |

| Includes all meal costs with taxes and tips, and incidental expenses such as laundry and fees and tips to baggage carriers, concierges, hotel staff, etc. |

|

| Per diem rates are daily rates (no roll-over of per diem from day to day). | |

| M&IE per diem is payable without itemized meal or incidental expense receipts. |

|

| M&IE rates are determined based on the location of lodging as follows: | |

| - Departure day: Where you spend the night. | |

| - Return day: Where you spent the night before returning home. | |

| M&IE per diem is reimbursed at 75% for departure and return days. | |

| For travel less than a full day and 50 miles or more from the work station, the traveler may receive partial M&IE per diem if travelling or away from their work station at the following times: 7:00 am (breakfast), 12 noon (lunch), and/or 6:00 pm (dinner). |

|

| Pre-Paid Expenses | Any expense paid by the County before or during the completion of training/travel (e.g., registration fees paid on a County credit card, lodging charged on a county card, etc.). Such expenses must be identified on the travel claim. |

| Itemized Receipts | Are required for reimbursable expenses (except meals and incidental expenses covered by a daily per diem rate or mileage for authorized use of a privately owned vehicle for official travel). |

| Per Diem and Other Expenses | Must appear on the travel claim each day and not summarized by trip, week, or other increment. |

| Non-Reimbursable Expenses | Laundry; personal telephone calls; entertainment, clothing, personal sundries and services, transportation to places of entertainment, and similar personal items; room service costs that exceed the fixed rate established for the meal incurred, except when necessitated by physical limitations; valet services, except when necessitated by physical limitations; personal "trip insurance" and medical or hospital services; alcoholic beverages; tobacco products; tips and gratuities; fines and penalties; dependent care. |

| Travel Advances | Cash advances may be authorized by the County Administrator when deemed to cover authorized expenses necessary and appropriate for the traveler’s circumstances. |

| Travel and Other Expense Reimbursement Claims | Traveler shall submit a fully itemized travel expense claim with required receipts within 10 days of the travel return date. NOTE: Authorized travelers may consolidate multiple reimbursement requests into one form when such action is deemed to be more efficient than submitting multiple single requests for processing (e.g., board or commission members who attend assigned meetings on a periodic or recurring basis). In such cases, claims will be submitted at least semi-annually. |

| The Federal GSA Per Diem Rates are available online for determining per diem costs for travel, travel day | |

| adjustments, and correct rates for the time of year (https://www.gsa.gov/travel/plan-book/per-diem-rates). | |

| For questions or clarifications, please contact the Finance Department at (434) 591-1910. | |

| Travel and Business Expense Pre-Authorization Request | Form 2.19A | ||||||||

| Refer to Fluvanna County Policy "2.19 - Travel and Business Expenses" for specific rules and requirements. | |||||||||

| Requestor's Name | Department | Date of Request | |||||||

| Travel / Expense Purpose (Attach Training/Conference Brochure or other explanatory information) | Travel Category (check one) | ||||||||

| Overnight Travel | |||||||||

| Day Travel (50+ miles one way) | |||||||||

| Local Travel (within 50 miles) | |||||||||

| TRAVEL DAY | 1 | 2 | 3 | 4 | 5 | 6 | 7 | ||

| Date | |||||||||

| Departing From | |||||||||

| Arriving At | |||||||||

| CATEGORY | PLANNED EXPENSES | TOTAL | |||||||

| POV Mileage | $- | ||||||||

| Airfare or Rail | $- | ||||||||

| Car Rental | $- | ||||||||

| Taxi/Bus | $- | ||||||||

| Parking & Tolls | $- | ||||||||

| Lodging | $- | ||||||||

| M&IE Per Diem | $- | ||||||||

| Conf./Registration Fee | $- | ||||||||

| $- | |||||||||

| $- | |||||||||

| Mileage rate per mile effective Jan 1, 2022 | $0.585 | TOTAL EXPECTED COST | $- | ||||||

| Notes and/or Travel Advance Justification (When Travel Advance requested, submit form to Finance after Approving Official signature.) | ADVANCE REQUESTED | ||||||||

| $- | |||||||||

| I have reviewed and agreed to comply with the County’s Travel and Business Expenses policy and procedures. | I recommend approval of the travel and business expenses for the purpose listed. | I hereby authorize the travel and business expenses for the purpose listed. | |||||||

| Requestor Signature and Date | Supervisor / Dept Head Signature and Date | Approving Official Signature and Date | |||||||

| Reimbursement Category | Org # | Object # | Total | ||||||

no reviews yet

Please Login to review.