366x Filetype XLSX File size 0.72 MB Source: www.fluvannacounty.org

Sheet 1: Guidance

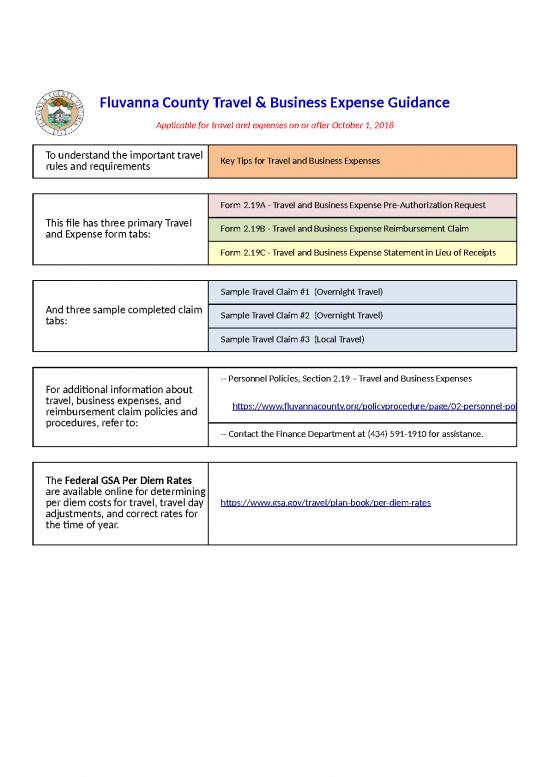

| Fluvanna County Travel & Business Expense Guidance Applicable for travel and expenses on or after October 1, 2018 |

|

| To understand the important travel rules and requirements | Key Tips for Travel and Business Expenses |

| This file has three primary Travel and Expense form tabs: | Form 2.19A - Travel and Business Expense Pre-Authorization Request |

| Form 2.19B - Travel and Business Expense Reimbursement Claim | |

| Form 2.19C - Travel and Business Expense Statement in Lieu of Receipts | |

| And three sample completed claim tabs: | Sample Travel Claim #1 (Overnight Travel) |

| Sample Travel Claim #2 (Overnight Travel) | |

| Sample Travel Claim #3 (Local Travel) | |

| For additional information about travel, business expenses, and reimbursement claim policies and procedures, refer to: | -- Personnel Policies, Section 2.19 – Travel and Business Expenses |

| https://www.fluvannacounty.org/policyprocedure/page/02-personnel-policies-and-forms | |

| -- Contact the Finance Department at (434) 591-1910 for assistance. | |

| The Federal GSA Per Diem Rates are available online for determining per diem costs for travel, travel day adjustments, and correct rates for the time of year. | https://www.gsa.gov/travel/plan-book/per-diem-rates |

| KEY TIPS FOR TRAVEL AND BUSINESS EXPENSES County of Fluvanna, Virginia | |

| ITEM | DISCUSSION |

| Pre-Authorization | Authorization required for local or overnight travel, training, or other business expenses obtained prior to commencing the activity. |

| Care in Incurring Expenses | Authorized travelers are expected to exercise the same care in incurring expenses that he or she would exercise if traveling on personal business and using personal funds. |

| Local Travel | Travel outside the county that does not include an overnight stay. |

| Overnight Travel | Travel outside of the county that exceeds twelve hours and includes an overnight stay. |

| Full Day | Travel departure before 7:00 a.m. and travel return after 6:00 p.m. |

| Meals and Incidental Expenses (M&IE) Per Diem | Per day amount a traveler may be reimbursed for such expenses in a host city. |

| Includes all meal costs with taxes and tips, and incidental expenses such as laundry and fees and tips to baggage carriers, concierges, hotel staff, etc. | |

| Per diem rates are daily rates – there is no roll-over of per diem from day to day. | |

| M&IE per diem is payable without itemized meal or incidental expense receipts. | |

| M&IE rates are determined based on the location of lodging as follows: | |

| Departure day: Where you spend the night. | |

| Return day: Where you spent the night before returning home. | |

| M&IE per diem is reimbursed at 75% for departure and return days. | |

| For travel less than a full day, the traveler may receive partial M&IE per diem if travelling or away from their work station at the following times: 7:00 am (breakfast), 12 noon (lunch), and/or 6:00 pm (dinner). | |

| Pre-Paid Expenses | Any expense paid by the County before or during the completion of training/travel (e.g., registration fees paid on a County credit card, lodging charged on a county card, etc.). Such expenses must be identified on the travel claim. |

| Itemized Receipts | Are required for reimbursable expenses (except meals and incidental expenses covered by a daily per diem rate or mileage for authorized use of a privately owned vehicle for official travel). |

| Per Diem and Other Expenses | Must appear on the travel claim each day and not summarized by trip, week, or other increment. |

| Non-Reimbursable Expenses | Laundry; personal telephone calls; entertainment, clothing, personal sundries and services, transportation to places of entertainment, and similar personal items; room service costs that exceed the fixed rate established for the meal incurred, except when necessitated by physical limitations; valet services, except when necessitated by physical limitations; personal "trip insurance" and medical or hospital services; alcoholic beverages; tobacco products; tips and gratuities; fines and penalties; dependent care. |

| Travel Advances | Cash advances may be authorized by the County Administrator when deemed to cover authorized expenses necessary and appropriate for the traveler’s circumstances. |

| Travel and Other Expense Reimbursement Claims | Traveler shall submit a fully itemized travel expense claim with required receipts within 10 days of the travel return date. |

| The Federal GSA Per Diem Rates are available online for determining per diem costs for travel, travel day | |

| adjustments, and correct rates for the time of year (https://www.gsa.gov/travel/plan-book/per-diem-rates). | |

| For questions or clarifications, please contact the Finance Department at (434) 591-1910. | |

| Travel and Business Expense Pre-Authorization Request | Form 2.19A | ||||||||

| Refer to Fluvanna County Policy "2.19 - Travel and Business Expenses" for specific rules and requirements. | Ver. 10-18 | ||||||||

| Requestor's Name | Department | Date of Request | |||||||

| Travel / Expense Purpose (Attach Training/Conference Brochure or other explanatory information) | |||||||||

| Travel Date(s) | Travelling To | TOTAL ESTIMATED COST | |||||||

| CATEGORY | ESTIMATED COST | DESCRIPTION | |||||||

| POV Mileage Cost | $- | ||||||||

| Airfare or Rail | $- | ||||||||

| Car Rental | $- | ||||||||

| Taxi / Bus | $- | ||||||||

| Parking & Tolls | $- | ||||||||

| Lodging | $- | ||||||||

| Meals & Incidental Expense Per Diem | $- | ||||||||

| Conference/ Registration Fee | $- | ||||||||

| Miscellaneous | $- | ||||||||

| Miscellaneous | $- | ||||||||

| Miscellaneous | $- | ||||||||

| Travel Advance Requested | $- | ||||||||

| I have reviewed and agreed to comply with the County’s Travel and Business Expenses policy and procedures. | I recommend approval of the travel and business expenses for the purpose listed. | I hereby authorize the travel and business expenses for the purpose listed. | |||||||

| Requestor Signature and Date | Supervisor / Dept Head Signature and Date | Approving Official Signature and Date | |||||||

no reviews yet

Please Login to review.