301x Filetype XLSX File size 0.11 MB Source: pmg.org.za

Sheet 1: AR PAAP

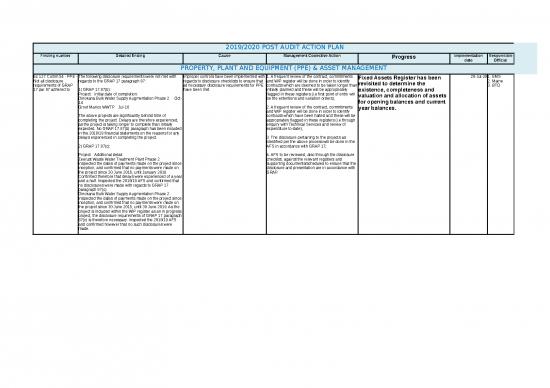

| 2019/2020 POST AUDIT ACTION PLAN | |||||||

| Finding number | Detailed finding | Cause | Management Corrective Action | Progress | Implementation date | Responsible Official | Verification date |

| PROPERTY, PLANT AND EQUIPMENT (PPE) & ASSET MANAGEMENT | |||||||

| Ex 127 Comm 54 - PPE - Not all disclosure requirements of GRAP 17 par 87 adhered to | The following disclosure requirements were not met with regards to the GRAP 17 paragraph 87: 1) GRAP 17.87(b): Project: Initial date of completion: Dinokana Bulk Water Supply Augmentation Phase 2 Oct-14 Groot Marico WWTP Jul-16 The above projects are significantly behind time of completing the project. Delays are therefore experienced, as the project is taking longer to complete than initially expected. No GRAP 17.87(b) paragraph has been included in the 2018/19 financial statements on the reasons for any delays experienced in completing the project. 2) GRAP 17.87(c): Project: Additional detail: Zeerust Waste Water Treatment Plant Phase 2 Inspected the dates of payments made on the project since inception, and confirmed that no payments were made on the project since 20 June 2016, until January 2018. Confirmed therefore that delays were experienced of a year and a half. Inspected the 2018/19 AFS and confirmed that no disclosures were made with regards to GRAP 17 paragraph 87(c). Dinokana Bulk Water Supply Augmentation Phase 2 Inspected the dates of payments made on the project since inception, and confirmed that no payments were made on the project since 30 June 2015, until 30 June 2019. As the project is included within the WIP register as an in progress project, the disclosure requirements of GRAP 17 paragraph 87(c) is therefore necessary. Inspected the 2018/19 AFS and confirmed however that no such disclosures were made. |

Improper controls have been implemented with regards to disclosure checklists to ensure that all necessary disclosure requirements for PPE have been met. |

1. A frequent review of the contract, commitments and WIP register will be done in order to identify contracts which are deemed to be taken longer than initially planned and these will be appropriately flagged in these registers (i.e first point of entry will be the extentions and variation orders); 2. A frequent review of the contract, commitments and WIP register will be done in order to identify contracts which have been halted and these will be appropriately flagged in these registers (i.e through enquiry with Technical Services and review of expenditure to-date); 3. The disclosure pertaining to the projects as identified per the above process will be done in the AFS in accordance with GRAP 17; 4. AFS to be reviewed, also through the disclosure checklist, against the relevant registers and supporting documents/schedules to ensure that the disclosure and presentation are in accordance with GRAP. |

Fixed Assets Register has been revisited to determine the existence, completeness and valuation and allocation of assets for opening balances and current year balances. | 28-Jul-20 | 1. EMS 2. Maine 3. BTO |

11-Aug-20 |

| Ex 99 Comm 50 - PPE: Differences on WIP project payments as at 30 June 2017 | The following differences were noted between the invoices inspected of payments made to WIP projects, and the amount of WIP capitalised on the project as at 30 June 2017 (opening balance of the 2017/18 financial period): Project name - Amount recognised as WIP as at 30 June 2017 - Recalculated amount of WIP to be recognised as at 30 June 2017 - Difference: a) Zeerust Waste Water Treatment Plant Phase 2 - R19 658 766,29 - R16 341 146,30 - R(3 317 620,00) b) Selosesha Water Supply - R3 288 047,28 - R3 176 390,51 - R(111 656,77) c) Mayaeyane Water Supply - R3 341 662,10 - R3 172 794,51 - R(168 867,59) d) Groot Marico WWTP - R14 537 938,62 - R17 717 614,10 - R3 179 675,48 - R(418 468,87) |

Improper record-keeping of payments made on projects. Improper reconciliation controls have been implemented to ensure that WIP payments are accurately valued. |

1. WIP Registers to be reconstructed/updated and new values of the assets and WIP to be determined (Accuracy, Completeness and Validity/Existence): (a) Perform 100% WIP verification and determine the values of the WIP; (b) Reconstruct the WIP register based on all the payments vouchers and other supporting documents related to each WIP project to determine the carrying amount of WIP at final; (c) Reconcile the WIP register with payments as per the GL, contract and commitment register and update the register; (d) On a bi-monthly basis, confirm all WIP projects. Any completed projects will be identified when the last payment in terms of the project has been made. Compilation of the following information needed in terms of completed projects: i. Bill of material/quantities ii. As-built drawings iii. Completion certificate (e) Create complete files for WIP projects including all the relevant supporting documentation; (g) Update the assets and WIP disclosure in the AFS (interim and final) |

1. Fixed Assets Register has been revisited to determine the existence, completeness and valuation and allocation of assets for opening balances and current year balances. | 28-Jul-20 | 1. EMS 2. Maine 3. BTO |

11-Aug-20 |

| Ex 149 Comm 61 - PPE - differences in WIP payments as at 30 June 2017 | The following differences were noted between the invoices inspected of payments made to WIP projects, and the amount of WIP capitalised on the project as at 30 June 2017 (opening balance of the 2017/18 financial period): Project name - Amount recognised as WIP as at 30 June 2017 - Recalculated amount of WIP to be recognised as at 30 June 2017 - Difference: a) Setlagole Water Supply - 14 701 529,69 - R13 566 489,32 - R1 135 040,37 b) Springbokpan water supply - 1 111 571,61 - R 856 379,20 - R 255 192,41 c) Top Village water supply - 7 599 519,77 - 7 696 786,75 - 97 266,98 |

Improper record-keeping of payments made on projects. Improper reconciliation controls have been implemented to ensure that WIP payments are accurately valued. |

1. WIP Registers to be reconstructed/updated and new values of the assets and WIP to be determined (Accuracy, Completeness and Validity/Existence): (a) Perform 100% WIP verification and determine the values of the WIP; (b) Reconstruct the WIP register based on all the payments vouchers and other supporting documents related to each WIP project to determine the carrying amount of WIP at final; (c) Reconcile the WIP register with payments as per the GL, contract and commitment register and update the register; (d) On a bi-monthly basis, confirm all WIP projects. Any completed projects will be identified when the last payment in terms of the project has been made. Compilation of the following information needed in terms of completed projects: i. Bill of material/quantities ii. As-built drawings iii. Completion certificate (e) Create complete files for WIP projects including all the relevant supporting documentation; (g) Update the assets and WIP disclosure in the AFS (interim and final) |

1. Fixed Assets Register has been revisited to determine the existence, completeness and valuation and allocation of assets for opening balances and current year balances. | 28-Jul-20 | 1. EMS 2. Maine 3. BTO |

11-Aug-20 |

| Ex 152 Comm 61 - PPE - Differences in WIP additions for 2018 on projects | The following differences were noted between the amounts recognised as WIP additions for the 2017/18 financial period, and the project's actual payments and invoices: Project name - Amount recognised as WIP addition for 2018 - Amount recalculated based on supplier's invoices - Difference a) Setlagole Water Supply - 24 083 532,02 - 25 118 978,99 1 035 446,90 b) Ditloung water supply - 3 073 832,07 - 2 852 321,40 - 221 510,67 c) Sasane Water Supply - 3 554 200,37 - 3 492 432,75 - 61 767,62 d) Tlhabologang Bulk Sanitation - 1 427 691,75 - 1 438 122,68 - 10 430,93 e) Zeerust Waste Water Treatment Plant Phase 2 - 2 482 130,18 - 5 799 750,18 - 3 317 620,00 d) Groot Marico WWTP - 21 710 153,50 - 19 440 255,48 -2 269 898,02 |

Management did not correctly reconcile and disclose the amounts of WIP additions as per the 2017/18 financial period | 1. WIP Registers to be reconstructed/updated and new values of the assets and WIP to be determined (Accuracy, Completeness and Validity/Existence): (a) Perform 100% WIP verification and determine the values of the WIP; (b) Reconstruct the WIP register based on all the payments vouchers and other supporting documents related to each WIP project to determine the carrying amount of WIP at final; (c) Reconcile the WIP register with payments as per the GL, contract and commitment register and update the register; (d) On a bi-monthly basis, confirm all WIP projects. Any completed projects will be identified when the last payment in terms of the project has been made. Compilation of the following information needed in terms of completed projects: i. Bill of material/quantities ii. As-built drawings iii. Completion certificate (e) Create complete files for WIP projects including all the relevant supporting documentation; (g) Update the assets and WIP disclosure in the AFS (interim and final) |

1. Fixed Assets Register has been revisited to determine the existence, completeness and valuation and allocation of assets for opening balances and current year balances. | 28-Jul-20 | 1. EMS 2. Maine 3. BTO |

11-Aug-20 |

| Ex 154 Comm 67 - PPE: Not all completed projects as per the APR taken into account in WIP transfers for 2017/18 | The following projects were reported on as completed during the 2017/18 financial year as per the 2017/18 APR, but they were not transferred out of WIP during the 2017/18 financial period. They were only transferred out of WIP during the 2018/19 financial period. These project's completion certificates are also dated as completed during the 2017/18 financial period: Project name - Amount that should have been transferred during 2018: Selosesha - 7 875 363,13 Moshana - 16 084 482,09 Makgogoane - 11 794 638,71 Tlhabologang (outfall sewer) - 39 811 787,44 Setlagole - 38 785 061,78 - 114 351 333,15 |

Management did not implement proper controls regarding the review of the fixed asset register. |

1. Fixed Asset and WIP Registers to be revisited and new values of the assets and WIP to be determined (Accuracy, Completeness and Validity/Existence): (a) Perform 100% physical assets and WIP verification and determine the values of the assets and WIP; (b) Reconstruct the WIP register based on all the payments vouchers and other supporting documents related to each WIP project to determine the carrying amount of WIP at interim and final; (c) Reconcile the WIP register with the FAR and commitment register and update the register with completed projects to be transferred to the FAR; (d) On a bi-monthly basis, confirm all WIP projects. Any completed projects will be identified when the last payment in terms of the project has been made. Compilation of the following information needed in terms of completed projects: i. Bill of material/quantities ii. As-built drawings iii. Completion certificate (e) Unbundle the completed projects into the necessary components using the above stated information on a continuous basis (i.e monthly review of transactions pertaining to WIP projects for capitalization and unbundling once the project is completed). (f) Create complete files for WIP projects including all the relevant supporting documentation; (g) Update the assets and WIP disclosure in the AFS (interim and final) |

1. Fixed Assets Register has been revisited to determine the existence, completeness and valuation and allocation of assets for opening balances and current year balances. | 28-Jul-20 | 1. EMS 2. Maine 3. BTO |

11-Aug-20 |

| Ex 156 Comm 61 - PPE - Difference between amounts transferred from WIP and amount added to completed assets | The following difference was noted between the amount recognised as transfers from WIP for the 2018 financial period, and the amount recognised as additions to assets from completed projects for the 2018 financial period: Amount of 2018 transfers out of WIP as per WIP register - 162 886 658,75 Amount of 2018 additions of assets as per the FAR and AFS - 116 483 653,00 Difference - 46 403 005,75 |

Improper controls implemented to reconcile transactions on the FAR | 1. Fixed Asset and WIP Registers to be revisited and new values of the assets and WIP to be determined (Accuracy, Completeness and Validity/Existence): (a) Perform 100% physical assets and WIP verification and determine the values of the assets and WIP; (b) Reconstruct the WIP register based on all the payments vouchers and other supporting documents related to each WIP project to determine the carrying amount of WIP at interim and final; (c) Reconcile the WIP register with the FAR and commitment register and update the register with completed projects to be transferred to the FAR; (d) On a bi-monthly basis, confirm all WIP projects. Any completed projects will be identified when the last payment in terms of the project has been made. Compilation of the following information needed in terms of completed projects: i. Bill of material/quantities ii. As-built drawings iii. Completion certificate (e) Unbundle the completed projects into the necessary components using the above stated information on a continuous basis (i.e monthly review of transactions pertaining to WIP projects for capitalization and unbundling once the project is completed). (f) Create complete files for WIP projects including all the relevant supporting documentation; (g) Update the assets and WIP disclosure in the AFS (interim and final) |

1. Fixed Assets Register has been revisited to determine the existence, completeness and valuation and allocation of assets for opening balances and current year balances. | 28-Jul-20 | 1. EMS 2. Maine 3. BTO |

11-Aug-20 |

| Ex 164 Comm 65 - PPE: Difference between 2019 WIP transfers and 2019 additions per the FAR | The following differences were noted between the amount of transfers out of WIP to completed assets for the 2019 financial year, and the amount recognised as additions from projects in the fixed asset register for the 2019 financial year: Amount of 2019 transfers out of WIP as per WIP register - 256 112 309,26 Amount of 2019 additions of assets as per the FAR and AFS - 233 017 200,79 Difference - 23 095 108,47 |

Improper controls implemented with regards to the reconciliation of the fixed asset register. | 1. Fixed Asset and WIP Registers to be revisited and new values of the assets and WIP to be determined (Accuracy, Completeness and Validity/Existence): (a) Perform 100% physical assets and WIP verification and determine the values of the assets and WIP; (b) Reconstruct the WIP register based on all the payments vouchers and other supporting documents related to each WIP project to determine the carrying amount of WIP at interim and final; (c) Reconcile the WIP register with the FAR and commitment register and update the register with completed projects to be transferred to the FAR; (d) On a bi-monthly basis, confirm all WIP projects. Any completed projects will be identified when the last payment in terms of the project has been made. Compilation of the following information needed in terms of completed projects: i. Bill of material/quantities ii. As-built drawings iii. Completion certificate (e) Unbundle the completed projects into the necessary components using the above stated information on a continuous basis (i.e monthly review of transactions pertaining to WIP projects for capitalization and unbundling once the project is completed). (f) Create complete files for WIP projects including all the relevant supporting documentation; (g) Update the assets and WIP disclosure in the AFS (interim and final) |

1. Fixed Assets Register has been revisited to determine the existence, completeness and valuation and allocation of assets for opening balances and current year balances. | 28-Jul-20 | 1. EMS 2. Maine 3. BTO |

11-Aug-20 |

| VAT | |||||||

| 2017-18 Qualification - Findings relating to the 2017-18 financial year. | No detailed finding in the current financial year | No detailed finding in the current financial year | 1. Reconciliations will be performed for the, 2017-18 and 2018-19 financial years between the VAT201s/Statement of Accounts from SARS and GL (Cash Book) to ensure accurate and complete VAT balances; 2. A listing of invoice not paid at the end of the financial year(s) will be compiled and the VAT relating thereto journalised as VAT accrued; 3. The necessary adjustment arising from the prior financial periods will be done on the GL (comparatives); 4. Prior period error note will be compiled on the Interim AFS together with the supporting schedule and submitted to the CFO; 5. The Interim and Final AFS will be independently reviewed to ensure compliance with GRAP. |

Refer to DEC Submission - VAT Recons. The GL amount of R20. 9million was incorrect as it included VAT on prepayments on mobile VIP toilets of R7.1 million for Izwelethu Cemforce. Therefore the correct VAT receivable amount is R13,8million which was reconciled per the attached reconciliation. The balance per the VAT 201 is R20.9million whereas the GL amount is R13,6 million, therefore a difference of R7.3million exists which has been supported by the attached reconciliation. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| CASH & CASH EQUIVALENTS | |||||||

| Ex 235 Comm 82 - Scope limitation: Prior period error: Cash and cash equivalent | The following information requested in request for information number 57 dated 10/09/2019 was not submitted for audit: Cash and cash equivalent: >A schedule of workings >supporting documents >approved journals |

There is a lack of proper record keeping by management. | 1. Manageement will review all RFI's not submitted in the previous audit cycle and submit to the AGSA in order for them to obtain reasonable assurance on prior year balances before commencing with the current audit cycle. 2. Information relating to the reconciling items will be sorted and kept; 3. Monthly reconciliations are being performed and these will be submitted to the AG together with the support for any adjustments made/reconciling items. |

Supporting documents for reconciling items are are put into 2019/20 Audit File |

29-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

29-Jul-20 |

| Ex 302 Comm 103 - Cash and cash equivalent: Difference between the AFS and bank statement | During the audit of cash and cash equivalent we noted that there is a difference between the amount as per the bank statement and the amount disclosed in the AFS The auditor takes note of management response and removed the investment account from the calculation however after taking reconciling items as stated below it resulted in cash and cash equivalent being overstated by: R130 712,40 |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy Inadequate review of the Annual Financial Statements before submission for audit. |

1. Bank reconciliations will be done on a monthly basis with the relevant support for reconciling items. 2. Management will obtain a list of all bank accounts registered in the name of the municipality and send out bank confirmations at year-end and reconcile these to the municipal records/GL. 3. Prepare a Cash and Cash Equivalent Note to be disclosed in the AFS after the necessary reconciliations have been performed and signed off by the CFO. 4. All journals processed will be reviewed by the CFO with the help of consaltants that have been appointed by the municipality. |

Refer to DEC Submission - Cash and Cash equivalents Management still disagrees with the finding. The difference between the bank statements and amount disclosed in the AFS is reconciling items on the primary account. Momentum investment should not be included in cash and cash equivalent as it is disclosed as separately as other financial assets on the AFS. Managements has identified the difference as follows: Balance as per Bank Statement - R302 188 581 Less: Reconciling items - R2 021 794 Balance after reconciling items - R300 166 787 Amount as per signed AFS - R300 182 935 Difference - R16 148 Further support has been included in the audit file under the cash and cash equivalents folder. |

29-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

29-Jul-20 |

| INVENTORY | |||||||

| Ex 35 Comm 17 - Inventory - differences between AFS and registers | The following differences were noted on the amount recognised and disclosed for inventory in the 2018/2019 Annual Financial Statements and the supporting inventory registers: Amounts as per the inventory register: Amounts as per the 2018/2019 AFS: Difference: Maintenance 11 523 983,94 12 376 830,00 852 846,06 Consumable's 852 840,14 1 483 400,00 630 559,86 Total inventory 12 415 269,41 13 898 675,00 1 483 405,59 |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy. Inadequate review of the Annual Financial Statements before submission for audit. |

1.Conduct a comprehensive inventory count and ensuring that all the stock count rules are followed, specifically ensuring that the team comprises of a counter and a verifier to ensure accurate quantities. 2. Prepare a reconciliation of the stock count sheets with the stock as per the system and ensure that the system values are accurate; 3. Revisit the prior year stock register and reperform the reconciliations to identify descrepancies and do the necessary adjustements; 4. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; |

Still in progress. | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 151 Comm 66 - Inventories - misstatement of VIP toilets recognised in Inventory | During the audit of transfers & subsidies it was noted that the municipality reported R72 359 539 as the total amount relating to completed toilets that had been handed over to the beneficiaries. On Finding number 88 that was issued on Comm 48 we indicated that this amount was incorrectly disclosed as transfers and subsidies and management requested an adjustment to disclose this amount as expenditure. Through discussions with management it was noted that managed relied on the happy letters to determine the number of toilets completed at year-end. As discussed with management, happy letter cannot be used to determine the expenditure incurred at year-end as the construction of some toilets would have been completed at year-end but the hand-over process not yet taken place. Per inspection of the MGI expenditure reconciliation we noted the following expenditure that was incurred for the 2018/19 financial year relating to the Rural Sanitation Project: Project title Current FY - Total Actual Expenditure on MIG funds in the 2018/19 FY Ditsobotla Rural Sanitation Programme R46 756 386,98 Mafikeng Rural Sanitation Programme R80 845 309,71 Ramotshere Moiloa LM Rural Sanitation R5 558 022,69 Tswaing Rural Sanitation Programme R0,00 Total cost R133 159 719,38 The amount disclosed for transfers and subsidies is therefore incorrect. Management need to do a reconciliation of the expenditure incurred for the rural sanitation project as follows: 1. Completed toilets and handed over to beneficiaries = expensed 2. Completed but not yet handed over to the beneficiaries = Inventory The request for adjustment in Comm 48 will therefore not be granted as it is based on incorrect amount. Management has subsequently corrected the transfers and subsidies amounts accurately. The finding is therefore resolved for the fact that the VIP toilets amounts were previously recognised within transfers and subsidies. The finding now remains within Inventory line item, as management has taken the amounts previously recognised within Transfers and Subsidies to Inventories. The amount recognised within Inventories for VIP toilets is still however misstated, as the adjustment for correcting Inventories was disallowed as was previously communicated with management on this matter. The updated misstatement for Inventories is as follows: Balance of VIP toilets which should be recognised within Inventory: 128 770 801,91 Balance of VIP toilets currently within Inventory: 72 359 539,00 Misstatement 56 411 262,91 |

Financial statements were not properly reviewed and agreed to supporting documents before being submitted for audit. | 1. Disclose the completed and handed over toilets in expenditure (transfers) and the not yet handed over projects as inventory; 2. Make the necessary adjustments in the comparatives; 3. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; |

The amount recognised within Inventories for VIP toilets has bee corrected in the AFS. The expenditure amount has been allocate dto the correct expenditure vote and the prior period error has been updated accordingly with relevant support |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 217 Comm 80 - Scope limitation prior period error: Inventory | The following prior period adjustment was made on inventory however an inventory list that agree to the adjusted amount was not provided. Previously reported R17 403 618 Prior year adjustment R2 747 922 restated balance R 14 655 696 |

There is a lack of proper record keeping by management | 1. Revisit the prior year stock register and reperform the reconciliations to identify descrepancies and do the necessary adjustements; 2. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; |

Prior Periods errors disclosed per AFS line item | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 287 Comm 98 - Journals: Inventory - Information not submitted for audit | During the audit of journals relating to expenditure, it was noted that the below mentioned information/journals relating to RFI 73 that was issued on the 13 September 2019 and due on the 17th September 2019 were not received for audit. Initially communication of audit findings number 37 dated 18 September 2019 due on the 20th September 2019 was issued and the conclusion was as follows: Number Date Reference Description Credit Debit 67 2018/11/07 correction of incorrect entry ADJUSTMENTS 7 500,00 2018/11/07 correction of incorrect entry ADJUSTMENTS 7 500,00 68 2018/12/06 correction of incorrect entry ADJUSTMENTS 15 000,00 2018/12/06 correction of incorrect entry ADJUSTMENTS 15 000,00 70 2018/12/29 correction of incorrect entry ADJUSTMENTS 30 000,00 2018/12/29 correction of incorrect entry ADJUSTMENTS 30 000,00 71 2019/06/30 JNL00216 Inventory write down 1 506 363,02 2019/06/30 JNL00216 Inventory write down 90 269,73 2019/06/30 JNL00216 Inventory write down 24 284,82 2019/06/30 JNL00216 Inventory write down 1 620 917,57 1 673 417,57 1 673 417,57 "Management comment noted. However, the finding is not entirely resolved as the supporting documents for the below mentioned journals were not submitted for audit. The finding will be evaluated together with other uncorrected misstatements in the summary of uncorrected misstatements (SUM) and reported in the management report and its impact for the audit report to be evaluated". Subsequently, the municipality we granted the permission to resubmit the outstanding journals. However, the above mentioned journals no supporting documentation was submitted. It should be noted that no further information will be accepted relating to the above journals as the finding is closed. Management can however submit their response indicating why these documents could not be provided. There is a lack of proper record keeping by management. Management did not ensure that for all journals passed on the systems, they are supported by sufficient and appropriate audit evidence. This results in a Projected limitation of R5 309 837.82 |

Financial and performance management Management did not implement proper record keeping in a timely manner to ensure that complete, relevant and accurate information is accessible and available to support financial and performance reporting |

1. Revisit the prior year stock register and reperform the reconciliations to identify descrepancies and do the necessary adjustements; 2. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; |

Refer to DEC Submission - Inventory Of the journals selected, support for R1 620 917,57 has been attached hereto. The journal relates to a write down of inventory that has been damaged and rendered useless as per opened police case number 279/10/2018. This finding is not applicable for the current year audit as the comparative is 2018/19. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 175 Comm 69: Inventory - Correction of error amount recognised not agreeing to list | The following differences were noted between the amount recognised as prior year error corrected for inventory in note 44 of the 2018/19 AFS, and the list provided for audit purposes: Amount of correction of error as per AFS: 2 747 922 Amount of correction of error as per PoE listing: 1 942 234 Difference: 805 688 |

Improper reconciliations of the amounts recognised in the AFS regarding AFS, and the lists for inventory. | 1. Revisit the prior year stock register and reperform the reconciliations to identify descrepancies and do the necessary adjustements; 2. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 3. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. |

This finding is not applicable for the current year audit as the comparative is 2018/19. | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| ACCOUNTS RECEIVABLES | |||||||

| Ex 313 Comm 109 - WSIG Overstatement of capital expenditure and understatement of Receivables | During the audit of WSIG, we have identified that Sedibeng water charges the municipality for total amount inclusive of VAT for work done by contractors, however the municipality is unable to claim Input VAT as Sedibeng does not charge Output VAT to the municipality As a result, the municipality capitalise the total contractor amount inclusive of vat, this result in overstatement of Expenditure and understatement of Receivable as the municipality is unable to claim input vat. |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy. Lack of review of the Annual Financial Statements before submission for audit. |

1. Management to revisit and review invoices from Sedibeng Water and reclassify the Input VAT portion from the actual capital expenditure to the Input VAT account. 2. Sedibeng Water to be made aware of the SARS VAT requirements for implenting agents on behalf of principals that are VAT vendors as SARS views the sales/ purchases to be done by the principal. This excersice will ensure that the implementation of Sec 54 of the VAT Act is correctly applied and thus Sedibeng Water will then have to pay the municipality the Input VAT claimed over to the municipality. 3. Retrospective adjustment on the VAT and affected capital assets will then be made on the AFS and the relevant comparatives. |

1. Management revisited and reviewed invoices from Sedibeng Water and reclassified the Input VAT portion from the actual capital expenditure to the Input VAT account. 2. Sedibeng Water was made aware of the SARS VAT requirements for implenting agents on behalf of principals that are VAT vendors as SARS views the sales/ purchases to be done by the principal. This excersice has ensured that the implementation of Sec 54 of the VAT Act is correctly applied and thus Sedibeng Water will then have to pay the municipality the Input VAT claimed over to the municipality. 3. Retrospective adjustment on the VAT and affected capital assets was made on the AFS and the relevant comparatives. Refer to VAT audit file |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| ACCOUNTS PAYABLES | |||||||

| Ex 282 Comm 101 - Journals: Scope limitation: Payables | The following information requested in RFI 73 dated:13 September 2019 was not provided for audit. Issue 79 was raised with regard to the outstanding information which was communicated in communication of audit findings no. 37 however the information was not submitted with the responses provided by management. The municipality was given a second opportunity to submit the information after the communication of audit findings was due however the information mentioned below was still not submitted. This finding is to inform management of information no additional information will be accepted subsequent to this issue, only management responses will be accepted. Per the General Ledger No Date Ref Description Debit Credit 48 2018/07/01 NN Correction of opening balance Payables from exchange transaction 1 721 008,29 2018/07/01 NN Correction of opening balance Auditors remuneration 1 721 008,29 24 2019/06/30 SS Reversal of June 2018 invoice in the 2019 period Payables from exchange transaction 42 191,95 2019/06/30 SS Reversal of June 2018 invoice in the 2019 period Payables from exchange transaction 42 191,95 25 2019/06/30 30/06/2019 Correcting payables to Grant Payables from exchange transaction 1 073 387,00 2019/06/30 30/06/2019 Correcting payables to Grant Government grant & subsidies 1 073 387,00 2019/06/30 30/06/2019 Correction of Incorrect Entry Government grant & subsidies 1 073 387,00 2019/06/30 30/06/2019 Correction of Incorrect Entry Payables from exchange transaction 1 073 387,00 27 2019/06/30 30/06/2019 Correcting payables to Grant Payables from exchange transaction 1 073 387,00 2019/06/30 30/06/2019 Correction of Incorrect Entry Government grant & subsidies 1 073 387,00 29 2019/06/30 30/06/2019 Correcting payables to Grant Payables from exchange transaction 1 073 387,00 2019/06/30 30/06/2019 Correcting payables to Grant Payables from exchange transaction 1 073 387,00 32 2019/02/01 MEPF 201901 MEPF Payables from exchange transaction 2 865 539,92 2019/05/22 MEPF REVERSAL OF INCORRECT ENTRY Payables from exchange transaction 2 865 539,92 33 2019/02/01 MGF 191 REVERSAL Payables from exchange transaction 1 140 840,06 2019/05/22 MGF REVERSAL OF INCORRECT ENTRY Payables from exchange transaction 1 140 840,06 Total 10063128,2 No Date Ref Description Debit Credit 6 2019/06/30 SS Correction of consumer deposit refunded 9710 - Trade and Other Payable Exchange Transaction Consumer deposits 7 536,00 2019/06/30 SS Reversal of incorrectly recognised refunds for the current year 4710 - Operational Cost [Expenditure] Repairs and maintenance 7 536,00 |

There is a lack of proper record keeping by management. | 1. The entire population for payables pertaining to the 2018-19 financial year will be revisited for review and ensure that the balance is accurate and supported; 2. All the supporting documentation, including working schedules, will be sorted and kept on file; 3. Adjust the comparative figure (2018-19 financial year) where necessary; 4. Compile a clearly referenced POE/audit file for the prior period adjustments with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 5. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. 6. Information to be communicated timeosly with AGSA, register of RFIs and CoAFs to be kept and reconciled on a frequent basis with that of the AGSA to ensure that all information has been attended to and provided to the AGSA and that all findings have been adequately responded to by management. |

Refer to DEC Submission - Payables Issue 282 R1 721 008 - this journal was processed to reverse the 2017/18 audit fees incorrectly raised as an accrual. R42 191 - the journal relates to the reversal of the Konica Minolta invoice recognised in the incorrect financial year (June 2018 invoice incorrectly recorded in 2018/19). R1 073 387 - the journals processed were due to the grant being incorrectly recognised as payables instead of unspent conditional grants. The correction took the amounts out of payables and recorded these in the unspent liability account thereafter the next journal was passed to recognise the revenue. R2 865 539,92 - the journal relates to pension entries that were duplicated. An initial entry of R4 404 761 was passed to recognise pensions then individual pension fund entries were posted and therefore became duplicated transactions. R1 140 840,06 - the journal relates to pension entries that were duplicated. An initial entry of R4 404 761 was passed to recognise pensions then individual pension fund entries were posted and therefore became duplicated transactions. R7 536 - This journal relates to consumer deposit refunds for two individuals which were recorded incorrectly recorded under repairs and maintenance. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 234 Comm 82 - Scope limitation: Prior period error: Payables from exchange | The following information was not submitted for audit as requested in RFI 57 dated 10/09/2019: Restated Amount per 2019 AFS Amount per 2018 AFS Difference (Period Error) Information not submitted Trade payables R110 106 002,00 R81 939 045,00 R28 166 957,00 Supporting documents for the sample selected as listed in annexure A and approved journal for the corrections made Trade payables R0,00 R4 233 399,00 -R4 233 399,00 A schedule / list of transactions making up the adjustment, supporting documents, approved journals for the adjustment made Retention fees R17 322 148,00 R19 092 569,00 -R1 770 421,00 Supporting documents for the sample selected as listed in annexure B and approved journal for the corrections made Leave Provision R25 225 143,00 R33 678 921,00 -R8 453 778,00 Supporting documents for the sample selected as listed in annexure C and approved journal for the corrections made Suspense Control Account R3 165 424,00 R1 431 441,00 R1 733 983,00 A schedule / list of transactions making up the adjustment, supporting documents, approved journals for the adjustment made Third Party Control Account R0,00 R1 815 084,00 -R1 815 084,00 A schedule / list of transactions making up the adjustment, supporting documents, approved journals for the adjustment made Bonus Accrual R8 437 812,00 R7 485 132,00 R952 680,00 Supporting documents for the sample selected as listed in annexure D and approved journal for the corrections made Grants Payable R2 000 000,00 R0,00 R2 000 000,00 A schedule / list of transactions making up the adjustment, supporting documents, approved journals for the adjustment made Other Creditors R0,00 R68 477,00 -R68 477,00 A schedule / list of transactions making up the adjustment, supporting documents, approved journals for the adjustment made Unknown Deposits R0,00 R11 018,00 -R11 018,00 A schedule / list of transactions making up the adjustment, supporting documents, approved journals for the adjustment made Payable from exchange transactions R166 256 529,00 R149 755 086,00 R16 501 443,00 0 Annexure C (Leave) No Printed on: 2017/07/27 17:02:15 for Current Period 2017/07/31 Employee Surname (input cell) Employee Name (input cell) New Value of leave provision as at 30 June 2018 1 100098 Bereng Seonyatseng 76 411,85 2 100153 Njovu Dumisani 58 378,13 3 100160 Appolos Asaaf 78 412,09 4 100188 Bantsijang Lebogang 17 868,33 5 100189 Cindi Nokuzola 5 951,68 6 100207 Ngwane Zolile 42 027,57 7 100277 Phetjana Thabo 47 099,47 8 100298 Boikanyo Motsamai 104 261,98 9 100665 Voko Fikile 63 275,75 10 101613 Leteane Kedumetse 44 684,90 11 101618 March-Matsose SM 80 447,62 12 101625 Serope Lesego 17 855,55 13 101664 Mphehlo Jessica 42 173,86 14 101680 Tsiepe Kgomotso 17 438,15 15 101760 Sebokolodi Thapelo 28 630,78 16 102070 Zinyoka Tsietsi 29 985,71 17 102072 Beans Aubrey 30 569,70 18 102074 Setlhabi Mothusi 33 394,27 19 102141 Nhamane Kgotlaetsile 29 449,99 20 102194 Seane Otshabeng 58 170,54 Annexure D (bonus) No. Employee Code Surname Full Names Recalculated Bonus 1 100001 Tsetse Boitumelo 15 078,63 2 100018 Africa Thandiwe 15 078,63 3 100030 Mothibi Bonolo 15 078,63 4 100032 Kole Lindiwe 10 656,67 5 100038 Morwe Tebogo 10 141,59 6 100049 Matladi Mathebula 19 409,79 7 100050 Mothupi Koti 15 078,63 8 100055 Moabi Joseph 19 409,79 9 100062 Selogelo Didimalang 21 430,11 10 100067 Ditsele Oupa 21 430,11 11 100074 Medupe Ruth 19 409,79 12 100078 Hoffman Nomhle 15 078,63 13 100089 Sefawanyane Betty 10 656,67 14 100095 Bahetanye Moatlhodi 17 934,44 15 100097 Gause Ramosweu 19 409,79 16 100106 Seketema Kgosiemang 6 793,65 17 100113 Ramogapi Simon 15 078,63 18 100119 Lesabe Poroti 15 078,63 19 100123 Mogomotsi Solomon 15 078,63 20 100125 Mocuminyana Godisang 15 078,63 Annexure B(Retention) Status Ref: Project Name Retention 2018 Completed NMMDM_WIP_18_002 Gamotlatla Water Supply 1 305 188,60 Completed NMMDM_WIP_18_005 Setlagole Bulk Water Supply 998 045,51 WIP NMMDM_WIP_18_008 Ottosdal BWS & Reticulation Phase 2 2 880 003,32 WIP NMMDM_WIP_18_009 Meetekaar Water Supply 577 821,04 Completed NMMDM_WIP_18_010 Springbokpan Water Supply 596 731,94 Completed NMMDM_WIP_18_018 Matile 1 Water Supply 117 055,52 WIP NMMDM_WIP_18_023 Madibogo Water Supply 474 529,00 WIP NMMDM_WIP_18_024 Groot-Marico Waste Water Treatment 244 975,65 WIP NMMDM_WIP_18_025 Mogosane water supply 1 161 724,57 Completed NMMDM_WIP_18_027 Moshawane Water Supply Upgrading 546 946,04 WIP NMMDM_WIP_18_028 Moletsamongwe Water Supply 827 679,20 Sedibeng NMMDM_WIP_18_039 Mafikeng South Bulk Water Supply 1 311 063,32 Sedibeng NMMDM_WIP_18_044 Dinokana Bulk Water Supply Augmentation Phase 2 2 106 747,13 Completed NMMDM_18_014 Tlhabologang / Coligny Bulk Sanitation & Main Outfall Sewer (WWTP) - Volume B 1 648 084,15 Completed NMMDM_18_008 Makgokwane water supply 465 548,13 Completed NMMDM_18_012 Moshana Bulk Water Supply 685 179,98 Completed NMMDM_18_013 Ditloung Water Supply 180 665,72 Completed NMMDM_18_018 Mayaeyane Water Supply 385 417,98 Completed NMMDM_18_017 Selosesha Water Supply 320 046,62 Completed NMMDM_18_019 Sasane Water Supply 221 796,08 Completed NMMDM_18_003 Delareyville Sewerage Treatment Plant Phase 2 266 898,67 Annexure A (Trade payable) Supplier Code New Balance Old Balance Difference AUD001 - 1 777 381,70 - 56 373,41 - 1 721 008,29 JSM001 - 24 000,00 - - 24 000,00 KONI001 - 42 191,91 - - 42 191,91 MANY001 - 404 091,70 - - 404 091,70 MAXP001 - 1 380 973,57 - 202 027,52 - 1 178 946,05 MOGO019 - 328 309,90 - - 328 309,90 MOLI001 - 19 200,00 - - 19 200,00 MOTH021 - 16 560,00 - - 16 560,00 MOTS031 - 16 560,00 - - 16 560,00 NOEK001 - 202 232,67 - - 202 232,67 NTSA003 - 174 942,78 - - 174 942,78 SEBE004 - 16 188,76 - - 16 188,76 SEDI004 - 42 810 172,81 - 3 116 634,60 - 39 693 538,21 SELE013 - 74 202,56 - - 74 202,56 SHER001 - 44 720,99 - - 44 720,99 TELK001 - 324 250,02 0,00 - 324 250,02 TIRI001 - 137 545,62 - 286 654,34 149 108,72 TSHE017 - 1 754 198,18 - 1 261 367,15 - 492 831,03 TSHI018 - 18 899,92 - - 18 899,92 YOVU001 - 856 578,89 - 1 002 187,79 145 608,90 |

There is a lack of proper record keeping by management. | 1. The entire population for payables pertaining to the 2018-19 and 2017-18 financial years will be revisited for review and ensure that the balance is accurate and supported; 2. All the supporting documentation, including working schedules, will be sorted and kept on file; 3. Adjust the comparative figure (2018-19 financial year) where necessary; 4. Compile a clearly referenced POE/audit file for the prior period adjustments with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 5. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. 6. Information to be communicated timeosly with AGSA, register of RFIs and CoAFs to be kept and reconciled on a frequent basis with that of the AGSA to ensure that all information has been attended to and provided to the AGSA and that all findings have been adequately responded to by management. |

Refer to DEC Submission - Payables Comm 82 The entire population for payables pertaining to the 2018-19 financial years has been revisited and restated according to support. Please refer to the payables audit file for any prior period adjustments. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 233 Comm 82 - Scope limitation: Prior period error: Consumer deposit | The following information as requested in request for information no.57 dated 10/09/2019 was not submitted for audit: Consumer deposit: >Schedule detailing the breakdown of the adjustment made of R 1754417 > Approved journals >Supporting documents for the adjustment made. |

There is a lack of proper record keeping by management. | 1. The entire population for consumer deposits pertaining to the 2018-19 and 2017-18 financial years will be revisited for review and ensure that the balance is accurate and supported; 2. All the supporting documentation, including working schedules, will be sorted and kept on file; 3. Adjust the comparative figure (2018-19 financial year) where necessary; 4. Compile a clearly referenced POE/audit file for the prior period adjustments with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 5. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. 6. Information to be communicated timeosly with AGSA, register of RFIs and CoAFs to be kept and reconciled on a frequent basis with that of the AGSA to ensure that all information has been attended to and provided to the AGSA and that all findings have been adequately responded to by management. |

The entire population for consumer deposits pertaining to the 2018-19 financial years did not have to be documented as there were no consumer deposits for the 2018-19 period. | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 222 Comm 80 - Retention fees: Difference between amount per retention register and recalculated amount | The following differences were noted during the recalculation of the retentions amounts payable at year end. Refer or excel spreadsheet. Project description Contractor Contract amount Payment date Invoice payments Recalculated Retention Retention Earned Retention Paid Recalculated Retention Balance as at 30 June 2019 Balance as at 30 June 2019 per retention register Difference Meetekaar Water Supply Selelane R30 250 179,42 15 640 226,21 1 241 669,96 R1 241 669,96 R0,00 R1 241 669,96 R1 276 572,62 -R34 902,66 May 2018 Certificate No 1 1 835 867,76 33 525,91 June 2018 certificate No 2 2 006 648,23 54 403,52 June 2018 certificate No 3 2 151 342,11 454 908,05 July 2018 Certificate No 4 2 159 320,03 206 338,18 August 2018 Certificate No 5 5 037 241,82 279 086,60 September 2018 Certificate No 6 690 351,23 66 700,60 November 2018 Certificate No 7 1 081 842,02 104 525,80 December 2018 Certificate No 8 677 613,01 42 181,30 Springbokpan Water Supply PLS Construction R41 368 766,42 22 946 772,45 2 136 135,01 R2 136 135,01 -R814 587,09 R1 321 547,92 R814 589,09 R506 958,83 Certificate No1 1 424 897,20 68 821,00 Certificate No2 1 887 554,65 199 468,54 Certificate No3 5 062 404,78 328 442,42 Certificate No4 4 434 868,92 449 970,53 Certificate No5 3 200 401,21 321 720,33 Certificate No6 2 425 157,66 243 879,97 Certificate No7 2 021 452,05 195 309,38 Certificate No8 1 553 260,82 328 522,84 Certificate No9 936 775,16 - Sannieshof/Agisanang Bulk Water Supply HT Pelatona R53 585 434,36 8 192 485,15 761 544,46 R761 544,46 R0,00 R761 544,46 R791 544,46 -R30 000,00 Certificate No1 1 348 959,20 - Certificate No2 1 290 725,80 225 042,03 Certificate No3 2 284 386,96 220 713,72 Certificate No4 1 266 091,90 122 327,72 Certificate No5 2 002 321,29 193 460,99 Matile 1 Water Supply Excellence Business Academy JV R4 659 711,54 2 836 290,71 269 055,07 R269 055,07 R136 229,42 R132 825,65 R117 055,52 R15 770,13 Certificate No1 989 048,91 107 505,32 Certificate No2 419 681,06 45 617,51 Certificate No3 568 747,97 67 522,62 Certificate No4 445 368,55 48 409,62 Certificate No5 256 780,39 - Certificate No6 156 663,83 - Matile 2 Water Supply Selenane R15 716 242,58 8 723 048,54 841 922,87 R841 922,87 R0,00 R841 922,87 R880 724,25 -R38 801,38 Certificate No1 1 051 883,15 101 631,22 Certificate No2 2 110 941,13 203 071,91 Certificate No3 677 722,91 65 480,47 Certificate No4 1 697 045,37 163 965,74 Certificate No5 1 527 280,94 147 563,38 Certificate No6 1 658 175,04 160 210,15 Schoongezight Water Supply Entle Project R9 855 526,05 6 606 703,67 638 328,86 R638 328,86 R0,00 R638 328,86 R617 341,56 R20 987,30 Certificate No1 516 410,95 49 894,78 Certificate No2 1 826 881,37 176 510,28 Certificate No3 848 233,57 81 954,93 Certificate No4 1 195 904,73 115 546,35 Certificate No5 1 321 596,38 127 690,47 Certificate No6 617 986,55 59 708,85 Certificate No7 279 690,12 27 023,20 Moshawane Water Supply Upgrading Kwena Mokone/Padime JV R7 897 977,98 9 938 533,76 1 092 036,91 R1 092 036,91 R0,00 R1 092 036,91 R16 606,36 R1 075 430,55 Certificate No1 4 810 342,52 210 979,94 Certificate No2 R620 464,78 R60 474,15 Certificate No3 R1 300 922,86 R126 795,60 Certificate No4 R1 165 828,01 R113 628,46 Certificate No5 R1 221 014,51 R0,00 Certificate No6 R171 875,82 R16 606,36 Certificate No7 R648 085,26 R563 552,40 Moletsamongwe Water Supply Mabaza Construction R11 914 399,75 R8 810 673,82 R927 665,79 R927 665,79 R0,00 R927 665,79 R861 254,94 R66 410,85 Certificate No1 R582 564,78 R113 363,04 Certificate No2 R844 026,45 R90 236,21 Certificate No3 R1 041 735,66 R101 533,69 Certificate No4 R1 813 444,56 R189 344,88 Certificate No5 R2 229 904,06 R0,00 Certificate No6 R1 535 880,26 R0,00 Certificate No7 R444 432,78 R402 397,12 Certificate No8 R318 685,27 R30 790,85 Mafikeng rural Sanitation Izwelethu Cemforce R115 859 509,30 R169 991 077,47 R9 164 447,81 R9 164 447,81 R0,00 R9 164 447,81 R9 218 447,80 -R53 999,99 Certificate No1 R21 845 768,00 R0,00 Certificate No2 R747 102,26 R202 850,46 Certificate No3 R74 737 086,00 R1 171 118,45 Certificate No4 R7 327 383,50 R1 140 403,71 Certificate No5 R6 368 511,56 R1 080 568,96 Certificate No6 R21 506 594,59 R520 643,93 Certificate No7 R2 643 741,73 R325 122,87 Certificate No8 R19 820 163,02 R2 554 597,35 Certificate No9 R4 229 779,37 R758 039,48 Certificate No10 R5 465 933,94 R704 280,30 Certificate No11 R5 299 013,50 R706 822,30 Mafikeng South Bulk Water Supply Sydwel Shabangu Projects R21 801 237,68 R12 238 597,62 R3 131 142,92 R3 131 142,92 R0,00 R3 131 142,92 R1 311 063,32 R1 820 079,60 Certificate No1 Certificate No2 R818 378,64 R190 984,00 Certificate No3 R1 219 036,32 R316 796,00 Certificate No4 529237,44 368378,6 Certificate No5 R308 682,36 R398 464,60 Certificate No6 R1 896 022,00 R545 454,40 Certificate No7 R5 078 816,74 R607 817,00 Certificate No8 R2 388 424,12 R703 248,32 Dinokana Bulk Water Supply Augmentation Phase 2 Beyond Build Construction R25 257 064,38 R19 115 153,13 R3 261 267,19 R3 261 267,19 R0,00 R3 261 267,19 R2 106 747,13 R1 154 520.06 Certificate No1 R3 371 560,20 R224 976,03 Certificate No2 R2 144 128,12 R438 203,54 Certificate No3 R1 709 721,95 R374 939,02 Certificate No4 R5 015 588,58 R716 316,60 Certificate No5 R6 874 154,28 R1 506 832,00 Makgokwane water supply Tshenolo Resources R16 774 762,28 R19 397 915,97 R1 416 390,52 R1 416 390,52 R0,00 R1 416 390,52 R465 548,13 R950 842,39 October 2017 Certicate No9 R604 305,24 R58 899,14 2017 Certificate No1 - 08 R8 986 636,31 R875 890,48 Certificate No10 R1 413 571,79 R64 694,36 Certificate No11 R118 536,25 R5 425,00 Certificate No12 R1 065 010,43 R48 741,90 Certificate No13 R1 180 747,09 R58 195,07 Certificate No14 R864 097,65 R59 939,61 Certificate No15 R5 165 011,21 R244 604,96 Delareyville Sewerage Treatment Plant Phase 2 MATLO PROJECTS R6 340 979,78 R6 059 211,25 R450 510,57 R450 510,57 R156 498,25 R294 012,32 R266 898,67 R27 113,65 Certificate No1 R1 294 895,65 R126 208,15 Certificate No2 R2 538 732,82 R247 439,85 Certificate No3 R788 609,95 R76 862,57 Certificate No4 R1 436 972,83 R0,00 R24 224 803,18 R18 744 393,85 R9 693 903,59 |

Management did not reconcile the retention fees as per the payment certificates to get to the balance of retention fees at year end. Instead they just took the balance reflected on the last payment certificate received from the supplier before year end. | 1. Perform a reconciliation of the retention register to the supporting documentation (payment certificates) and GL will be done to ensure that retention fees are correctly accounted for. 2. Perform a reconciliation of the retention register to the contract register and commitment to ensure that all contracted services has been included. 3. Disclosed retention fee amount in the AFS to be adjusted accordingly after the above has been carried out, where necessary. 4. Review the AFS and related notes prior to submission. |

Inspection of all retention amounts per payment certificates to ensure correct amounts were charged on each payment certificate was done. Reconciliation of the retention register to the supporting documentation (payment certificates) and GL was perfopayables supporting documentation included in the audit file. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 213 Comm 80 - Payables: Understatement of payables to Local Municipalities | Based on the audit work done for payable, it was noted that only the following has been disclosed relating to allocation to local municipalities in the notes to the financial statements: 14. Payable from exchange transactions 2018/19 2017/18 Grant payable - Ratlou local Municipality 5 000 000,00 2 000 000,00 28. Transfers and subsidies Transfers to Local Municipalities 15 000 000,00 10 000 000,00 The following differences were noted between allocation as per the division of revenue and the amount disclosed in the financial statements: Breakdown of equitable share for district municipalities authorised for services Amount accounted for in the AFS of the Municipality Category Municipality Water Sanitation Transfers Payable 2018/19 R'(000) 2018/19 R'(000) 2018/19 R'(000) B NW381 Ratlou 34 906,00 26 648,00 3 000,00 5 000,00 B NW382 Tswaing 37 538,00 28 657,00 3 000,00 B NW383 Mafikeng 98 277,00 75 027,00 3 000,00 B NW384 Ditsobotla 52 821,00 40 325,00 3 000,00 B NW385 Ramotshere Moiloa 50 975,00 38 916,00 3 000,00 C DC38 Ngaka Modiri Molema District Municipality - - Totals 274 517,00 209 573,00 15 000,00 5 000,00 Therefore, differences between the allocation as per DoRA and the amounts accounted for in the financial statements is R464 090 000 as the municipality has not disclosed any other payable for the amount to the local municipalities for both the prior year and current year. Even if this money is not physically transferred to the LM, the municipality should provide evidence that, that money was used to benefit that LM with regards to water and sanitation. Management did not adequately review the financial statements. This will result in a material scope limitation on payables as we cannot determine the amount that the District Municipality should disclose as a payable relating to provision of the water services by the local municipalities on behalf of the district municipality as nothing was submitted in relation to this payable. |

Management did not adequately review the financial statements. | 1. Management to review the DoRA allocations and payables requirements and ensure that payables to Local Municipalities balance is updated accordingly (2018-19 and 2019-20). 2. Management to further review the AFS and ensure that AFS submitted are supported by reliable evidence and that all account balance have been accurately presented and valued in the AFS. |

Review of the DoRA allocations and payables requirements has been performed. Management requires auditors to consider that the amount transferred to local municipalities is as per budget that has been approved by District council which constitutes of councillors who also sit on the local municipality councils. The council has approved R15 000 000 budget for Transfers to local municipality which gives rights and obligation that make the district liable for this amount only. Management further reiterates that there is nowhere in the DORA indicating that the District municipality must transfer these allocations to the local municipalities. As the Water Service Authority the district municipality is responsible for water and sanitation services across the district. Local municipalities benefit in the form of the allocation through expenditure on water infrastructure project and provision of water services which are classified under other expenditure line items such as Contracted services. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 160 Comm 66 - Payables: Understatement of payables relating to Sedibeng invoices | The following invoices relating to the water supply project of magogwe ward that have not yet been paid were not included in trade payables for the year ended 2018/19 therefore resulting to understatement of payables amounting to R 11 521 370.43. IN000110988 2019/06/28 R 1 685 606.27 IN000111091 2019/06/30 R 5 738 789.60 IN000111092 2019/06/30 R 286 177.50 IN000110983 2019/06/28 R 3 592 174.11 IN000110987 2019/06/28 R 218 622.95 Total R 11 521 370.43 |

Financial statements were not properly reviewed against supporting documents before being submitted for audit. | 1. Perform monthly reconciliations between supplier statements and supplier subsystem balances to ensure that balances are accurate and complete and investigate any discrepancies identified. 2. Perform payments after year review whereby all the payments after year will be reviewed against the supporting documentation to ensure that the invoice and delivery of goods or services belong to the correct financial year; 3. Compile a separate listing and audit file for payments after year review for services/goods received but not yet paid and disclose in the AFS. |

Based on the information the auditors received from Sedibeng the agreement reached with DWS for payment of the retention fees was only reached after year-end, thus at year end a payable should have been disclosed. Amounts to be raised as payables within the comparative figures in the 2019/20 AFS, however will be reversed in the current year as the amount is not payable by NMMDM |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 269 Comm 93 - Prior period: Misstatements identified: Payables-Rention | During the audit of prior period error relating to payable: retention the following was identified: The prior year retention register was reconciled with the restated amount register to indicate the adjusted amount, however the difference between the list does not agree to the adjusted amount. The list indicates an adjustment of R 6 854 557,89 and the adjustment per the AFS is R 1 770 421,00 which results in a difference of R5 084 136,89. |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy Inadequate review of the Annual Financial Statements before submission for audit. |

1. Perform a reconciliation of the retention register to the supporting documentation (payment certificates) and GL will be done to ensure that retention fees are correctly accounted for. 2. Perform a reconciliation of the retention register to the contract register and commitment to ensure that all contracted services has been included. 3. Disclosed retention fee amount in the AFS to be adjusted accordingly after the above has been carried out, where necessary. 4. Review the AFS and related notes prior to submission. |

Due to the misstatement in 2018, management had to revisit the total population of projects that include retention. Management identified that there were errors in the 2018 retention register. This resulted in a prior period error of R1770 420.67. Refer to payables audit file for support. | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| OPERATING EXPENDITURE | |||||||

| Ex 239 Comm 89 - Prior period error: Information relating to RFI 148 not submitted for audit | The following information relating to request for information number 148 for general expenditure 2017/18 was not submitted for audit as requested. The RFI was requested on the 13th November 2019 and due on the 15th November 2019: Annexure Please provide us with the approved journals (where necessary) and the payment vouchers for the below mentioned transactions relating to general expenditure for 2017/18 financial year. Accounting fees - 2018/06/30 - 30/06/2018 - Reversal of Incorrect entry - R786 946,61 |

There is a lack of proper record keeping by management. | 1. Revisit the prior year AFS, GL and supporting document pertaining to the adjustments made and transactions/journals in question and reperform the reconciliations to identify descrepancies and do the necessary adjustments; 2. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 3. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. |

This finding is not applicable for the current year audit as the comparative is 2018/19. | 30-Jun-20 | 1. BTO 2. Maine 3. CFO |

14-Jul-20 |

| Ex 330 Comm 115 - Consulting fees incorrectly classified as accounting fees | During the audit of expenditure, we noted that consulting fees was incorrectly classified as accounting fees: Date Invoice number Description Supplier name Amount per GL 2019/06/20 NMMDM 1 Preparation of AFS: May 2019 Triple M Advisory (PTY)LTD R 1 324 800,00 2019/06/28 NMMDM0102 Preparation of AFS Eave Solutions JV MNB R 1 488 000,00 2019/06/28 INV414 Assisting With AFS Maine Management & Chartered Accountant R 430 434,78 2019/06/28 NMMDM0103 AFS PREPARATIONS Eave Solutions JV MNB R 1 019 617,39 |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy Inadequate review of the Annual Financial Statements before submission for audit. |

1. Perform a detailed analysis and review of the expenditure accounts as per the GL (2018-19 and 2019-20) to identify the possible missclassifications; 2. Obtain the supporting documents for the transactions which are possibly missclassified and review the support to determinne the descriptions and nature of the services/goods; 3. Classify/reclassify the transaction as identified in the correct accounts as per the support's description and nature of goods/services; 4. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 5. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. |

1. The mapping has been changed in order to correctly classify all the expenditure accounts in the AFS. |

30-Jun-20 | 1. BTO 2. Maine 3. CFO |

14-Jul-20 |

| Ex 329 Comm 115 - WIP incorrectly classified as consulting fees | During the audit of expenditure, we noted that the following transactions were incorrectly classified as consulting fees: No Date Invoice number Description Supplier name Amount per GL 18 2019/06/28 1066 Spatial Development Framework (SDF) 2019 Izwelwthu CEMFORCE CC R 262 500,00 19 2018/12/14 1495/2016 2018/11/29 Sunrise Wholesales Electrical//NMMDM Sunrise Electrical Wholesalers R 2 195 602,24 |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy Inadequate review of the Annual Financial Statements before submission for audit. |

1. Perform a detailed analysis and review of the expenditure accounts as per the GL (2018-19 and 2019-20) to identify the possible missclassifications; 2. Obtain the supporting documents for the transactions which are possibly missclassified and review the support to determinne the descriptions and nature of the services/goods; 3. Classify/reclassify the transaction as identified in the correct accounts as per the support's description and nature of goods/services; 4. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 5. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. |

1. The mapping has been changed in order to correctly classify all the expenditure accounts in the AFS. |

15-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

29-Jul-20 |

| Ex 328 Comm 115 - Accounting fees incorrectly classified as consulting fees | During the audit of expenditure, we noted that the following accounting and professional fees were incorrectly classified as consulting fees: Date Invoice number Description Supplier name Amount per GL 2019/06/07 11614 VAT RECOVERY Maximum Profit Recovery PTY LTD R 796 741,24 |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy Inadequate review of the Annual Financial Statements before submission for audit |

1. Perform a detailed analysis and review of the expenditure accounts as per the GL (2018-19 and 2019-20) to identify the possible missclassifications; 2. Obtain the supporting documents for the transactions which are possibly missclassified and review the support to determinne the descriptions and nature of the services/goods; 3. Classify/reclassify the transaction as identified in the correct accounts as per the support's description and nature of goods/services; 4. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 5. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. |

1. The mapping has been changed in order to correctly classify all the expenditure accounts in the AFS. |

15-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

29-Jul-20 |

| Ex 317 Comm 111 - General Expenditure: Overstatement of general expenditure and understatement of Prepaid expenditure | During the audit of General Expenditure-Membership fees, we have identified that Salga Membership fees invoice no 13586 for the 2019/2020 financial year for an amount of R3 409 493 paid on the 30/04/2019 has been recorded as General expenditure -Membership fees in the 2018/19 financial year. As this relates to the next financial year this amount should have been recorded as a pre-payment and only expensed in the next financial year. | Improper record-keeping of payments made on projects. Improper reconciliation controls have been implemented to ensure that WIP payments are accurately valued. |

1. The membership fees transaction in question will be reviewed against the invoice and the comparatives adjusted accordingly to record and disclose the pre-payment; 2. Detailed cut off tests will be done on the GL accounts to ensure that transactions are recorded in the correct financial year (in conjunction with bank reconciliations); 3. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 4. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. |

1. An analysis of the entire GL expenditure accounts was performed for the transaction ending December 2019, and the mapping has been changed in order to correctly classify all the expenditure accounts in the AFS. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 312 Comm 109 - Repairs and maintenance: Internal stock consumption value not quantified | During the audit of repairs and maintenance we noted that stock consumption as indicated below is recorded under repairs and maintenance, however the value of the stock issued is not indicated in the internal stock issue report provided by management only the quantity is indicated and the reports are not signed by any official of the municipality indicating the preparer and the reviewer. based on the above accuracy and validity of the stock consumption recorded under repairs could not be confirmed. GL Transaction date Transaction description per GL Amount per GL 2018/07/11 Internal Stock Consumption 60 000,00 2019/03/31 Internal Stock Consumption 300 000,00 2019/02/28 Internal Stock Consumption 254 400,00 |

Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy | 1. The stock custodians/store managers to prepare monthly reports based on the sotck issue and GRV documentation (with stock values) and submit these to BTO office for review; 2. BTO office to reconcile the stock issues and GRVs with the GL on a monthly basis and such reconciliation singed by both the preparer and reviewer; |

1. Stock issued and used (reports) have not yet been validated to ensure that values are included and correctly recorded in the GL. | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 306 Comm 105 - Journals: scope limitation: bulk purchases | The following information requested in RFI 73 dated:13 September 2019 was not provided for audit. Issue 79 was raised with regard to the outstanding information which was communicated in communication of audit findings no. 37 however the information was not submitted with the responses provided by management. The municipality was given a second opportunity to submit the information after the communication of audit findings was due however the information mentioned below was still not submitted. This finding is to inform management of information not submitted and no additional information will be accepted subsequent to this issue, only management responses will be accepted. 23 2019/06/30 30/06/2019 Reverse of journal back to Bulk Purchases Bulk Purchases 1 562 760,00 2019/06/30 30/06/2019 Reverse of journal back to Bulk Purchases Repairs and maintenance 1 562 760,00 |

There is a lack of proper record keeping by management. | 1. Sort and file the support for the journal in question for audit by the AGSA pertaining to prior year findings. 2. Information to be communicated and submitted timeosly to AGSA, register of RFIs and CoAFs to be kept and reconciled on a frequent basis with that of the AGSA to ensure that all information has been attended to and provided to the AGSA and that all findings have been adequately responded to by management. 3. A separate file will be kept at the CFO's office pertaining to the routine and non-routine (mostly year end journals) together with the supporting evidence. |

1. Information relating to journal and the related support is yet to be reviewed and resubmitted to AG. | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 294 Comm 100 - Journals: Repairs and maintenance 2017/18 Invoice incorrectly reversed from 2018/19 year and scope limitation | 1.During the audit of journals we noted that invoice no 000003429 dated 30/06/2018 (2017/18) relating to bulk purchases was incorrectly reversed from the 2018/19 year as detailed below: No Date Ref Description Debit Credit Account Amount per the support Diff 40 2019/06/30 PR Reversal of incorrect entry 1 169 251,03 Expenditure: repairs R1344 638 (175 386,97) 2019/06/30 PR Reversal of incorrect entry 1 169 251,03 Upon reversal of the 2017/18-year invoice incorrectly recorded in the 2019 year invoice no 000003429 dated 30/06/2018 2018 invoice was incorrectly taken out from 2019 records as an amount excluding VAT was taken as amount inclusive and VAT. Instead of DR payable with R1 344 638, CR Bulk purchases with R 1 169 251.03 and CR VAT with R175 388 the journal below was processed: Dr payable R1 169 251.03 CR VAT R152 511 CR Bulk purchases R1 016 740 Then the above journal was corrected as follows: Dr bulk purchases R1 016 740 CR Repairs and maintenance R 1 016 740 and the correct reversal was later done as follows: DR payable R1 344 638 CR Bulk purchases R1 169 251 .03 CR VAT R175 388 based on the above Repairs is incorrectly credited with R1 016 740(understated) VAT is incorrectly credited with R152 511 (understated) Payable incorrectly debited with R1 169 251.03(understated) 2.Supporting documents for the following journals was not submitted: No Date Ref Description Debit Credit 7 2019/06/30 30/06/2019 Capitalisation of Expenditure. Repairs and maintenance 6 528 435,00 2019/06/30 30/06/2019 Capitalisation of Expenditure. Repairs and maintenance 6 528 435,00 44 2019/06/30 SS Correction of Electricity for boreholes expenditure recorded in repairs Repairs and maintenance 1 040 839,68 2019/06/30 SS Correction of Electricity for boreholes expenditure recorded in repairs Electricity 1 040 839,68 |

1.Lack of internal controls to ensure financial information is prepared, reviewed and reconciled for accuracy Inadequate review of the Annual Financial Statements before submission for audit. 2.There is a lack of proper record keeping by management. |

1. The journal in question will be reviewed and adjustment will done on the comparatives where necessary on the affectec line items. 3. Compile a clearly referenced POE/audit file for the prior period adjustements with sufficient and appropriate evidence; and also ensure that such information safely kept in the records management office; 4. Management to ensure that a review of AFS (with emphasis on prior period errors) is done alongside the supporting documentation in order to ensure that amounts are transferred to the AFS at accurate figures. |

1. An analysis of the entire GL expenditure accounts was performed for the transaction ending December 2019, and the mapping has been changed in order to correctly classify all the expenditure accounts in the AFS. |

28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 196 Comm 74 - Water distribution losses: Limitation on auditing the water distribution losses | Per inspection of Afs note 44, there is no disclosure for a prior period error and on note 42 nothing is disclosed to indicate why the comparative amount had changed. | The afs are not adequately reviewed to ensure that they are complete and accurate | 1. Prepare and review the AFS and ensure that AFS submitted are supported by reliable evidence and prior period error notes are complete and adequately disclosed. 2. Prepare working paper for all the prior period error with supporting calculations and evidence. |

The AFS have been updated to ensure that chnages relating to any prior period errors have supporting listings. Refer to the prior period audit file. | 28-Jul-20 | 1. Maine 2. BDO/MMM 3. CFO |

11-Aug-20 |

| Ex 169 Comm 76 - Contracted services: Insufficient appropriate to support the kilometres claimed for water tinkering | Background In the beginning of 2017/18 financial year, municipality entered into a contract with Ziggy Investment CC tender number NMMDM 16/17/03 IDM for "Hire of trucks for draught relief, water and sanitation services for a period of two years on as and when required basis". The scope of work was to provide the municipality with trucks for the delivery of portable water to Polypropylene of varying sizes ranging from 2500 litres to 20000 litres placed throughout the District. As per the inspection of the special conditions of the contract the following were noted in terms of the payment: "3. Payment 3.3 Kilometres will be calculated from the hydrant not from the site of the contractor" During the audit of contracted services, we could not confirm the kilometres claimed for water tinkering as per the log sheets. The log sheets for kilometres claimed were not clear as to which areas in the villages where Ziggy Investment CC went to deliver water. Therefore, we could not confirm the start point location and the end point location to verify whether the kilometres claimed are accurate. Furthermore, it was noted that different kilometres were claimed for water delivered in the same villages. Below are some examples where there are different kilometres claimed for delivery of water at the same villages: Municipality: Mahikeng Local Municipality Invoice number: ZT0145 Water tinkering in Mafikeng villages Date Work description/ villages KM Reading beginning KM Reading End Km Claimed 2018/08/07 Seweding/Dibate/Koikoi/Magogo/Tsetse 247707 247887 180 2018/08/08 Seweding/Dibate/Koikoi/Magogo/Tsetse 247887 248067 180 2018/08/09 Seweding/Dibate/Koikoi/Magogo/Tsetse 248067 248307 240 2018/08/10 Seweding/Dibate/Koikoi/Magogo/Tsetse 248307 248487 180 2018/08/13 Seweding/Dibate/Koikoi/Magogo/Tsetse 248487 248687 200 2018/08/14 Seweding/Dibate/Koikoi/Magogo/Tsetse 248687 248887 200 2018/08/15 Seweding/Dibate/Koikoi/Magogo/Tsetse 248887 249107 220 2018/08/16 Seweding/Dibate/Koikoi/Magogo/Tsetse 249107 249347 240 2018/08/17 Seweding/Dibate/Koikoi/Magogo/Tsetse 249347 249567 220 |