230x Filetype XLSX File size 0.13 MB Source: oamp.od.nih.gov

Sheet 1: INSTRUCTIONS

| OMB Control No. 9000-0013 |

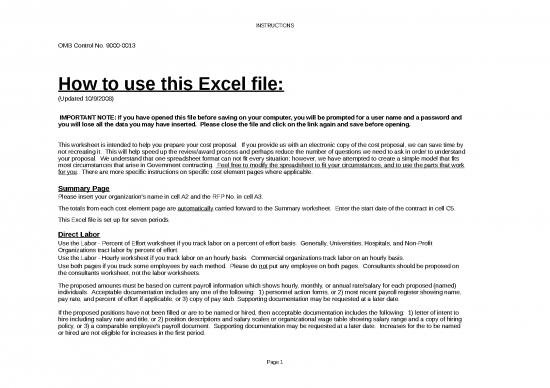

| How to use this Excel file: |

| (Updated 10/9/2008) |

| IMPORTANT NOTE: If you have opened this file before saving on your computer, you will be prompted for a user name and a password and you will lose all the data you may have inserted. Please close the file and click on the link again and save before opening. |

| This worksheet is intended to help you prepare your cost proposal. If you provide us with an electronic copy of the cost proposal, we can save time by not recreating it. This will help speed up the review/award process and perhaps reduce the number of questions we need to ask in order to understand your proposal. We understand that one spreadsheet format can not fit every situation; however, we have attempted to create a simple model that fits most circumstances that arise in Government contracting. Feel free to modify the spreadsheet to fit your circumstances, and to use the parts that work for you. There are more specific instructions on specific cost element pages where applicable. |

| Summary Page |

| Please insert your organization's name in cell A2 and the RFP No. in cell A3. |

| The totals from each cost element page are automatically carried forward to the Summary worksheet. Enter the start date of the contract in cell C5. |

| This Excel file is set up for seven periods. |

| Direct Labor |

| Use the Labor - Percent of Effort worksheet if you track labor on a percent of effort basis. Generally, Universities, Hospitals, and Non-Profit Organizations tract labor by percent of effort. |

| Use the Labor - Hourly worksheet if you track labor on an hourly basis. Commercial organizations track labor on an hourly basis. |

| Use both pages if you track some employees by each method. Please do not put any employee on both pages. Consultants should be proposed on the consultants worksheet, not the labor worksheets. |

| The proposed amounts must be based on current payroll information which shows hourly, monthly, or annual rate/salary for each proposed (named) individuals. Acceptable documentation includes any one of the following: 1) personnel action forms, or 2) most recent payroll register showing name, pay rate, and percent of effort if applicable, or 3) copy of pay stub. Supporting documentation may be requested at a later date. |

| If the proposed positions have not been filled or are to be named or hired, then acceptable documentation includes the following: 1) letter of intent to hire including salary rate and title, or 2) position descriptions and salary scales or organizational wage table showing salary range and a copy of hiring policy, or 3) a comparable employee's payroll document. Supporting documentation may be requested at a later date. Increases for the to be named or hired are not eligible for increases in the first period. |

| Indirect Rates Including Fringe Benefit Rate(s) for Commercial Organizations |

| If your organization does not have negotiated rates, the following website contains information which will assist you in computing indirect rates: http://oamp.od.nih.gov/dfas/IdCSubmission.asp |

| Please do not submit your indirect proposal to the Division of Financial Advisory Services at this time. |

| Points of Contact |

| If you have any questions regarding this Excel file, please contact Stephen Shaffer (301-496-3140) email at Stephen.Shaffer@nih.gov. |

| If you have contracting questions, please call the NIH Contracting Official who is listed in the RFP. |

| SUMMARY OF PROPOSED COSTS | |||||||||||||||||

| Contractor's Name** | |||||||||||||||||

| RFP No.** | |||||||||||||||||

| PERIOD I | PERIOD II | PERIOD III | PERIOD IV | PERIOD V | PERIOD VI | PERIOD VII | TOTAL | ||||||||||

| Period ( dates)## | 1/1/2007 | 1/1/2008 | 1/1/2009 | 1/1/2010 | 1/1/2011 | 1/1/2012 | 1/1/2013 | ||||||||||

| Through | Through | Through | Through | Through | Through | Through | |||||||||||

| 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | |||||||||||

| Direct Labor - Percent of Effort | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| Fringe Benefits - Percent of Effort | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Direct Labor - Hourly | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Fringe Benefits - Hourly | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Total Direct Labor & Fringe Benefits | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| Overhead (Note 1) | 0% | $0 | 0% | $0 | 0% | $0 | 0% | $0 | 0% | $0 | 0% | $0 | 0% | $0 | $0 | ||

| Materials and Supplies | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| Professional Travel | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Equipment | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Consultants | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Other Direct Costs | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Patient Care Costs | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Subcontracts | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Total Other Direct Costs | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| Subtotal: Direct Labor, Fringe Benefits, Overhead , & Other Directs | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| Exclusion(s) From Base For G&A | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Adjusted Base for G&A | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| G&A (Note 2) | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0 | ||

| Total Proposed Cost Excluding Fee | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Proposed Fee/Profit | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0 | ||

| Total Proposed Cost Plus Fee/Profit | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| NOTES: | |||||||||||||||||

| 1. | Not all organizations allocate indirect cost in the same way. It is important that you use the indirect rate structure applicable to your organization. | ||||||||||||||||

| For example, if you have a two tier indirect rate structure, then you will use a two tier structure when proposing indirect costs. | |||||||||||||||||

| Generally, Universities and Non-Profits have fringe benefit and G&A (or sometimes called F&A) rates, while For-Profit Companies can have | |||||||||||||||||

| various indirect rates such as fringe benefits, overhead, G&A, etc. | |||||||||||||||||

| The base for overhead costs includes direct labor and fringe benefits. Please modify if your base is different. | |||||||||||||||||

| If applicable, insert exclusions to the G&A base in row 26. | |||||||||||||||||

| 2. | If you have questions regarding indirect (F&A) rates see website: http://oamp.od.nih.gov/dfas/IdCSubmission.asp | ||||||||||||||||

| This website also contains definitions, examples, and training. | |||||||||||||||||

| LEGEND: | |||||||||||||||||

| ** | Please insert the Company's name and the RFP #. | ||||||||||||||||

| ## | Please insert the Company's name and the RFP #. |

| SUMMARY OF DIRECT LABOR | ||||||||||||||||||||||||||||||||||||||||||||||||

| AND FRINGE BENEFITS | ||||||||||||||||||||||||||||||||||||||||||||||||

| PERCENT OF EFFORT | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contractor's Name** | PERIOD I* | PERIOD II* | PERIOD III* | PERIOD IV* | PERIOD V* | PERIOD VI* | PERIOD VII* | |||||||||||||||||||||||||||||||||||||||||

| RFP No.** | 1/1/2007 | Through | 12/31/2007 | 1/1/2008 | Through | 12/31/2008 | 1/1/2009 | Through | 12/31/2009 | 1/1/2010 | Through | 12/31/2010 | 1/1/2011 | Through | 12/31/2011 | 1/1/2012 | Through | 12/31/2012 | 1/1/2013 | Through | 12/31/2013 | TOTAL | TOTAL | |||||||||||||||||||||||||

| CURRENT | ADJUSTED | PERCENT OF |

NUMBER | SALARY | FRINGE | FRINGE | PERCENT OF |

NUMBER | SALARY | FRINGE | FRINGE | PERCENT OF |

NUMBER | SALARY | FRINGE | FRINGE | PERCENT OF |

NUMBER | SALARY | FRINGE | FRINGE | PERCENT OF |

NUMBER | SALARY | FRINGE | FRINGE | PERCENT OF |

NUMBER | SALARY | FRINGE | FRINGE | PERCENT OF |

NUMBER | SALARY | FRINGE | FRINGE | SALARY | FRINGE | ||||||||||

| EMPLOYEE | POSITION | BASE SALARY | BASE SALARY | EFFORT | MONTHS | COST | RATE | COST | EFFORT | MONTHS | COST | RATE | COST | EFFORT | MONTHS | COST | RATE | COST | EFFORT | MONTHS | COST | RATE | COST | EFFORT | MONTHS | COST | RATE | COST | EFFORT | MONTHS | COST | RATE | COST | EFFORT | MONTHS | COST | RATE | COST | COST | COST | ||||||||

| 1 | $0 | $0 | 0% | 12.00 | $0 | 0% | $0 | 0% | 12.00 | $0 | 0% | $0 | 0% | 12.00 | $0 | 0% | $0 | 0% | 12.00 | $0 | 0% | $0 | 0% | 12.00 | $0 | 0% | $0 | 0% | 12.00 | $0 | 0% | $0 | 0% | 12.00 | $0 | 0% | $0 | $0 | $0 | |||||||||

| 2 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 3 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 4 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 5 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 6 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 7 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 8 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 9 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 10 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 11 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 12 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 13 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 14 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 15 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 16 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 17 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 18 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 19 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 20 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 21 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 22 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 23 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 24 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 25 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 26 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 27 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 28 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 29 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 30 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| 31 | 0 | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0% | 12.00 | 0 | 0% | 0 | 0 | 0 | |||||||||

| SUBTOTALS = | 0% | $0 | $0 | 0% | $0 | $0 | 0% | $0 | $0 | 0% | $0 | $0 | 0% | $0 | $0 | 0% | $0 | $0 | 0% | $0 | $0 | $0 | $0 | |||||||||||||||||||||||||

| THE FOLLOWING BOXES IN COLUMN "D" BELOW MAY BE USED TO | ||||||||||||||||||||||||||||||||||||||||||||||||

| CALCULATE THE ADJUSTED BASE SALARY, AS INDICATED: | ||||||||||||||||||||||||||||||||||||||||||||||||

| (Use of these cells will affect all of the adjusted base salary column; if individual | ||||||||||||||||||||||||||||||||||||||||||||||||

| anniversary dates differ, the adjusted base salaries must be entered individually | ||||||||||||||||||||||||||||||||||||||||||||||||

| in Column "D" of the spreadsheet and explained in the budget justification) | ||||||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL INCREASE FACTOR: | 0.00% | - | Insert annual cost of living % and/or merit increases | |||||||||||||||||||||||||||||||||||||||||||||

| as applicable and explain the % in the budget justification | ||||||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL INCREASE DATE: | 00/00/00 | - | Insert annual increase date. | |||||||||||||||||||||||||||||||||||||||||||||

| NUMBER OF MONTHS AT NEXT ANNUAL INCREASE | 0 | - | Insert number of months at the new salary. | |||||||||||||||||||||||||||||||||||||||||||||

| *Adjust the number of months per period as recommended in the RFP. |

no reviews yet

Please Login to review.