326x Filetype XLSX File size 0.17 MB Source: barnard.edu

Sheet 1: Instructions

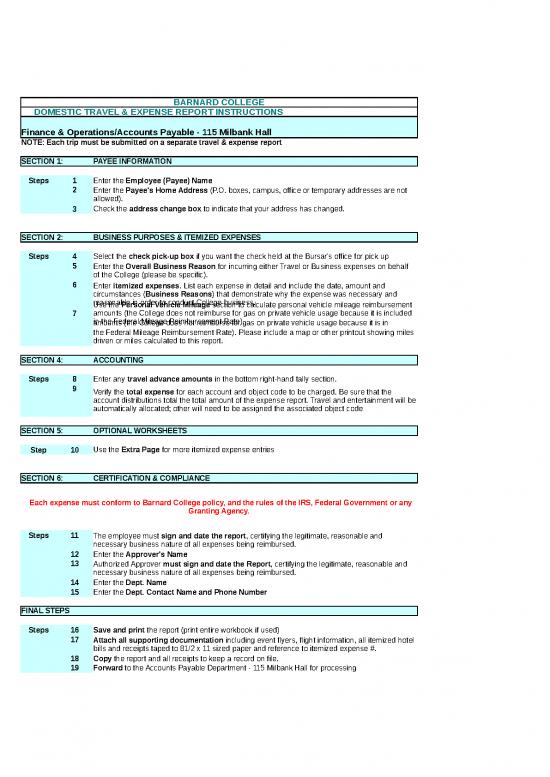

| BARNARD COLLEGE | |||||||||

| DOMESTIC TRAVEL & EXPENSE REPORT INSTRUCTIONS | |||||||||

| Finance & Operations/Accounts Payable - 115 Milbank Hall | |||||||||

| NOTE: Each trip must be submitted on a separate travel & expense report | |||||||||

| SECTION 1: | PAYEE INFORMATION | ||||||||

| Steps | 1 | Enter the Employee (Payee) Name | |||||||

| 2 | Enter the Payee's Home Address (P.O. boxes, campus, office or temporary addresses are not allowed). | ||||||||

| 3 | Check the address change box to indicate that your address has changed. | ||||||||

| SECTION 2: | BUSINESS PURPOSES & ITEMIZED EXPENSES | ||||||||

| Steps | 4 | Select the check pick-up box if you want the check held at the Bursar's office for pick up | |||||||

| 5 | Enter the Overall Business Reason for incurring either Travel or Business expenses on behalf of the College (please be specific). | ||||||||

| 6 | Enter itemized expenses. List each expense in detail and include the date, amount and circumstances (Business Reasons) that demonstrate why the expense was necessary and reasonable in order to conduct College business. | ||||||||

| 7 | Use the Personal Vehicle Mileage section to calculate personal vehicle mileage reimbursement amounts (the College does not reimburse for gas on private vehicle usage because it is included in the Federal Mileage Reimbursement Rate). | ||||||||

| amounts (the College does not reimburse for gas on private vehicle usage because it is in | |||||||||

| the Federal Mileage Reimbursement Rate). Please include a map or other printout showing miles driven or miles calculated to this report. | |||||||||

| SECTION 4: | ACCOUNTING | ||||||||

| Steps | 8 | Enter any travel advance amounts in the bottom right-hand tally section. | |||||||

| 9 | Verify the total expense for each account and object code to be charged. Be sure that the account distributions total the total amount of the expense report. Travel and entertainment will be automatically allocated; other will need to be assigned the associated object code | ||||||||

| SECTION 5: | OPTIONAL WORKSHEETS | ||||||||

| Step | 10 | Use the Extra Page for more itemized expense entries | |||||||

| SECTION 6: | CERTIFICATION & COMPLIANCE | ||||||||

| Each expense must conform to Barnard College policy, and the rules of the IRS, Federal Government or any Granting Agency. | |||||||||

| Steps | 11 | The employee must sign and date the report, certifying the legitimate, reasonable and necessary business nature of all expenses being reimbursed. | |||||||

| 12 | Enter the Approver's Name | ||||||||

| 13 | Authorized Approver must sign and date the Report, certifying the legitimate, reasonable and necessary business nature of all expenses being reimbursed. | ||||||||

| 14 | Enter the Dept. Name | ||||||||

| 15 | Enter the Dept. Contact Name and Phone Number | ||||||||

| FINAL STEPS | |||||||||

| Steps | 16 | Save and print the report (print entire workbook if used) | |||||||

| 17 | Attach all supporting documentation including event flyers, flight information, all itemized hotel bills and receipts taped to 81/2 x 11 sized paper and reference to itemized expense #. | ||||||||

| 18 | Copy the report and all receipts to keep a record on file. | ||||||||

| 19 | Forward to the Accounts Payable Department - 115 Milbank Hall for processing | ||||||||

| BARNARD COLLEGE | ||||||||||||||

| Revised January 4, 2022 DOMESTIC - TRAVEL & EXPENSE REPORT | ||||||||||||||

| VOUCHER # | ||||||||||||||

| Finance & Operations/Accounts Payable - 1320 Interchurch Center | ||||||||||||||

| US$ Only | ||||||||||||||

| EMPLOYEE (PAYEE) NAME | CHECK PICK-UP (OPTIONAL) Check box to request check pick-up at Bursar's Office (5) | |||||||||||||

| PAYEE'S HOME ADDRESS STREET | ||||||||||||||

| CITY STATE | STATE | ZIP | ||||||||||||

| Please check box if your home address has changed (3) | ||||||||||||||

| OVERALL BUSINESS PURPOSE (for conference, attach flyer or forms) | ||||||||||||||

| ITEMIZED EXPENSE DESCRIPTIONS (13) | ||||||||||||||

| EXPENSE NO. | DATE OF EXPENSE | BUSINESS PURPOSES | In the space below, describe each expense, including the business purpose. | Amounts in US $ (15) | Total Expense Amount | |||||||||

| Travel | Entertainment | Other | ||||||||||||

| 578104 | 578102 | 5XXXXX | ||||||||||||

| 1 | 2022 Mileage Rate | # miles | rate/mile | $0.585 | $0.00 | $0.00 | ||||||||

| 2 | $0.00 | |||||||||||||

| 3 | $0.00 | |||||||||||||

| 4 | $0.00 | |||||||||||||

| 5 | $0.00 | |||||||||||||

| 6 | $0.00 | |||||||||||||

| 7 | $0.00 | |||||||||||||

| 8 | $0.00 | |||||||||||||

| 9 | $0.00 | |||||||||||||

| 10 | $0.00 | |||||||||||||

| 11 | $0.00 | |||||||||||||

| 12 | $0.00 | |||||||||||||

| 13 | $0.00 | |||||||||||||

| 14 | $0.00 | |||||||||||||

| 15 | $0.00 | |||||||||||||

| Subtotal in US $ | $0.00 | $0.00 | $0.00 | $0.00 | ||||||||||

| Totals from Extra Page | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| Subtotal Expenses US$ | $0.00 | $0.00 | $0.00 | $0.00 | ||||||||||

| Grand Total Expenses US$ | $0.00 | $0.00 | $0.00 | $0.00 | ||||||||||

| ACCOUNT NUMBER OBJECT CODE | AMOUNT | SUMMARY OF BALANCE DUE | ||||||||||||

| XX-XX-XXXX-XXXXXX | 578104 | $0.00 | ||||||||||||

| 578102 | 0.00 | TOTAL EXPENSES | $0.00 | |||||||||||

| 5XXXXX | 0.00 | ENTER TRAVEL ADVANCE (IF ANY) | ||||||||||||

| Travel Advance | 0.00 | SUBTOTAL | $0.00 | |||||||||||

| AMOUNT DUE BARNARD COLLEGE | $0.00 | |||||||||||||

| ACCOUNT DISTRIBUTION TOTAL | $0.00 | AMOUNT DUE EMPLOYEE | $0.00 | |||||||||||

| PAYEE'S SIGNATURE | DATE | |||||||||||||

| X | ||||||||||||||

| I certify that these expenses were actual and reasonable and incurred in accordance with policy for the official business of Barnard College. | ||||||||||||||

| I certify that no portion of this claim was free of charge, previously reimbursed from any other source, or will be paid from any resource in the future. | DEPARTMENT CONTACT (15) | |||||||||||||

| APPROVER'S NAME | DEPT. NAME (14) | NAME | ||||||||||||

| APPROVER'S SIGNATURE | DATE | PHONE | ||||||||||||

| X | ||||||||||||||

| I certify that I have reviewed all claims associated with this reimbursement. I have found them to be in accordance with both Barnard College | ||||||||||||||

| policies and procedures and the policies of any sponsoring agencies funding these activities and I hereby authorize payment. | ||||||||||||||

no reviews yet

Please Login to review.