300x Filetype XLS File size 0.05 MB Source: www.kellogg.northwestern.edu

Sheet 1: ATM

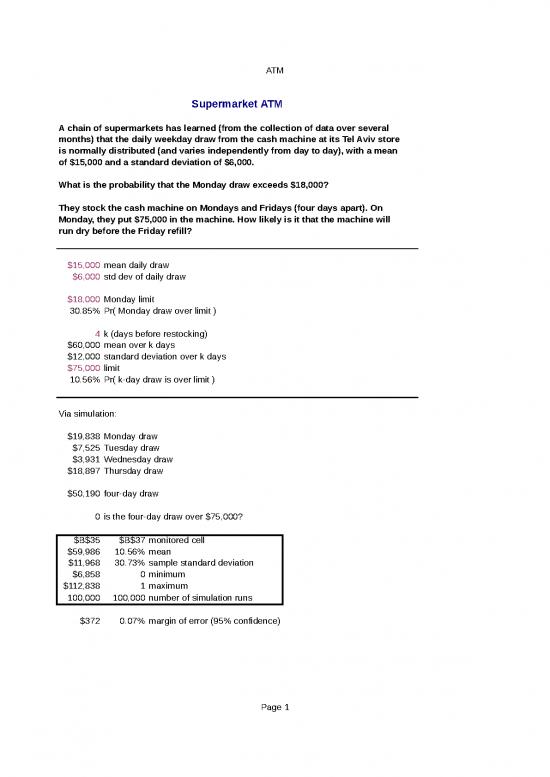

| Supermarket ATM | |||||||

| A chain of supermarkets has learned (from the collection of data over several | |||||||

| months) that the daily weekday draw from the cash machine at its Tel Aviv store | |||||||

| is normally distributed (and varies independently from day to day), with a mean | |||||||

| of $15,000 and a standard deviation of $6,000. | |||||||

| What is the probability that the Monday draw exceeds $18,000? | |||||||

| They stock the cash machine on Mondays and Fridays (four days apart). On | |||||||

| Monday, they put $75,000 in the machine. How likely is it that the machine will | |||||||

| run dry before the Friday refill? | |||||||

| $15,000 | mean daily draw | ||||||

| $6,000 | std dev of daily draw | ||||||

| $18,000 | Monday limit | ||||||

| 30.85% | Pr( Monday draw over limit ) | ||||||

| 4 | k (days before restocking) | ||||||

| $60,000 | mean over k days | ||||||

| $12,000 | standard deviation over k days | ||||||

| $75,000 | limit | ||||||

| 10.56% | Pr( k-day draw is over limit ) | ||||||

| Via simulation: | |||||||

| $18,359 | Monday draw | ||||||

| $20,814 | Tuesday draw | ||||||

| $17,108 | Wednesday draw | ||||||

| $5,803 | Thursday draw | ||||||

| $62,084 | four-day draw | ||||||

| 0 | is the four-day draw over $75,000? | ||||||

| $B$35 | $B$37 | monitored cell | |||||

| $59,986 | 10.56% | mean | |||||

| $11,968 | 30.73% | sample standard deviation | |||||

| $6,858 | 0 | minimum | |||||

| $112,838 | 1 | maximum | |||||

| 100,000 | 100,000 | number of simulation runs | |||||

| $372 | 0.07% | margin of error (95% confidence) | |||||

| Feingeld Industries | |||||||

| Once a year, in December, Feingeld Industries prints a product catalog for the | |||||||

| coming year. The press run (done by an outside firm) costs them $7,000 (for | |||||||

| setup), plus $10 per catalog. (At this point, they throw away any old catalogs.) | |||||||

| Marketing estimates a need for 2000 catalogs over the next year, with a forecast | |||||||

| standard error of 200 (i.e., one standard-deviation's-worth of uncertainty in the | |||||||

| forecast is 200 units); actual demand is normally distributed. They also estimate | |||||||

| a cost of $50 for each catalog request which cannot be immediately fulfilled. | |||||||

| What is their “critical fractile ” for product catalogs? | |||||||

| How many catalogs should they print this December? | |||||||

| $7,000 | setup cost; irrevelant to problem | ||||||

| $10 | variable cost per catalog | ||||||

| 2000 | mean demand for next year | ||||||

| 200 | standard deviation of demand | ||||||

| $50 | cost of leaving a catalog order unfilled | ||||||

| Assuming that, when a request cannot be immediately fulfilled, it | |||||||

| $10 | per-unit cost of being "over" | is put on temporary hold and filled out of the next-December | |||||

| $50 | per-unit cost of being "under" | publication run, then - one way or the other - $10 will be spent | |||||

| fulfilling that request. The net cost difference between fulfilling it | |||||||

| 83.3% | critical fractile | immediately, and fulfilling it after a delay, is $50. | |||||

| 2193 | number of catalogs to print | ||||||

| If requests which can't be fulfilled immediately are never fulfilled, | |||||||

| the cost of being "under" would be $50-$10 = $40. | |||||||

| Similarly, if fulfilling a delayed request with next-year's edition | |||||||

| cancels out a request for that addition, the cost of being "under" | |||||||

| is only $40. | |||||||

| Accounting is a non-trivial subject! | |||||||

| Demand for weekly newspaper | |||||||

| Weekly newsstand sales of a local (weekly, nonsubscription) newspaper are | |||||||

| normally distributed, with a mean of 6,000 and a standard deviation of 700. | |||||||

| How likely is it that a press run of 7,000 copies will sell out? | |||||||

| What total monthly sales (4 issues) could the newspaper publisher guarantee to | |||||||

| a regular advertiser, while having a 90% chance of meeting the guarantee? | |||||||

| 6,000 | mean weekly sales | ||||||

| 700 | standard deviation | ||||||

| 7,000 | press run | ||||||

| 7.66% | Pr( press run insufficient ) | ||||||

| 4 | issues / month | ||||||

| 24,000 | mean monthly sales | ||||||

| 1,400 | monthly standard deviation | ||||||

| 90% | Pr( meet guarantee ) | ||||||

| 22,206 | sales that can be guaranteed | ||||||

no reviews yet

Please Login to review.