293x Filetype XLSX File size 0.70 MB Source: wirc-icai.org

Home

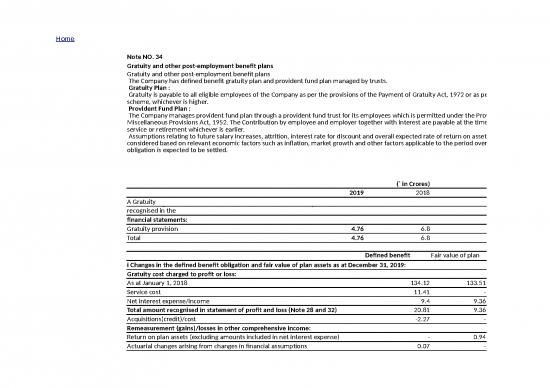

Note NO. 34

Gratuity and other post-employment benefit plans

Gratuity and other post-employment benefit plans

The Company has defined benefit gratuity plan and provident fund plan managed by trusts.

Gratuity Plan :

Gratuity is payable to all eligible employees of the Company as per the provisions of the Payment of Gratuity Act, 1972 or as per the Company’s

scheme, whichever is higher.

Provident Fund Plan :

The Company manages provident fund plan through a provident fund trust for its employees which is permitted under the Provident Fund and

Miscellaneous Provisions Act, 1952. The Contribution by employee and employer together with interest are payable at the time of separation from

service or retirement whichever is earlier.

Assumptions relating to future salary increases, attrition, interest rate for discount and overall expected rate of return on assets have been

considered based on relevant economic factors such as inflation, market growth and other factors applicable to the period over which the

obligation is expected to be settled.

(` in Crores)

2019 2018

A Gratuity

The following table sets out movement in defined benefits liability and the amount

recognised in the

financial statements:

Gratuity provision 4.76 6.8

Total 4.76 6.8

Defined benefit Fair value of plan

i Changes in the defined benefit obligation and fair value of plan assets as at December 31, 2019: obligation

Gratuity cost charged to profit or loss:

As at January 1, 2018 134.12 133.51

Service cost 11.41 -

Net interest expense/income 9.4 9.36

Total amount recognised in statement of profit and loss (Note 28 and 32) 20.81 9.36

Acquisitions(credit)/cost -2.27 -

Remeasurement (gains)/losses in other comprehensive income:

Return on plan assets (excluding amounts included in net interest expense) - 0.94

Actuarial changes arising from changes in financial assumptions 0.07 -

Experience adjustments -2.12 -

Total amount recognised in other comprehensive income -2.05 0.94

Benefits paid -14.14 -14.14

As at December 31, 2018 136.47 129.67

Service cost 8.56 -

Net interest expense 6.95 7.61

Total amount recognised in statement of profit and loss (Note 28 and 32) 15.51 7.61

Demerger adjustment# -61.81 -55.32

Remeasurement (gains)/losses in other comprehensive income:

Return on plan assets (excluding amounts included in net interest expense) - -3.93

Actuarial changes arising from changes in financial assumptions 2.81 -

Experience adjustments -1.64 -

Total amount recognised in other comprehensive income 1.17 -3.93

Contributions by employer - 8.55

Benefits paid -3.69 -3.69

As at December 31, 2019 87.65 82.89

#Pursuant to demerger, plan assets have been transferred in the ratio of liability.

Amount recognized in balance sheet (including discontinued 2019 2018

ii operations related)

Present value of funded obligations 87.65 136.47

Fair value of plan assets 82.89 129.67

Net funded obligation -4.76 -6.8

Net defined benefit (liability) / asset recognised in balance sheet -4.76 -6.8

Expense recognised in profit or loss (includes discontinued operations

iii related)

Current Service Cost 8.56 11.41

Interest Cost -0.66 0.04

7.9 11.45

iv Remeasurements recognised in other comprehensive income

Actuarial (gain)/loss on defined benefit obligation 1.17 -2.05

Return on plan assets excluding interest income 3.93 -0.94

5.1 -2.99

v The major categories of plan assets of the fair value of the total plan assets are as follows:

Investments quoted in active markets

Government of India Securities (Central and State) 8.28% 12.00%

PSU securities 6.45% 8.20%

Special deposit scheme / Funds with LIC 67.78% 74.00%

Others (including bank balances) 17.49% 5.80%

Total 100.00% 100.00%

The principal assumptions used in determining gratuity obligations

vi are shown below:

Discount rate 6.90% 7.30%

Future salary increases 7.75% 7.75%

The following payments are expected contributions to the defined

vii benefit plan in future years

Within the next 12 months (next annual reporting period) 5.43 9.55

Between 2 and 5 years 37.13 63.64

Beyond 5 years 63.78 96.68

Total expected payments 106.34 169.87

The average duration of the defined benefit plan obligation at the end of the reporting period is 10 years.

(` in Crores)

December 31, 2019

Future salary

Discount rate increases

viii A quantitative sensitivity analysis for significant assumption as at

December 31, 2019 is as shown below:

Assumptions

Sensitivity analysis

1% increase -6.74 7.64

1% decrease 7.78 -6.76

Impact on defined benefit obligation

The sensitivity analyses above have been determined based on a method that extrapolates the impact on defined benefit obligation as a

result of reasonable changes in key assumptions occurring at the end of the reporting period.

(' in Crores)

Fair value of

Defined benefit obligation plan assets Benefit liability

i Changes in the defined benefit obligation and fair value of plan

assets

As at January 1, 2018 561.47 559.12 2.35

Current service cost 96.55 - 96.55

Interest expense 50.89 50.71 0.18

Return on plan assets - -13.85 13.85

Contributions - 93.35 -93.35

Benefit payments -53.03 -53.03 -

Actuarial (gain)/loss -20.95 - -20.95

As at December 31, 2018 634.93 636.3 -1.37

Current service cost 60.73 - 60.73

Demerger adjustment# -208.18 -204.63 -3.55

Interest expense/income 38.61 38.17 0.44

Return on plan assets - -13.54 13.54

Contributions - 59.15 -59.15

Benefit payments -33.89 -33.89 -

Actuarial (gain)/loss -10.32 - -10.32

As at December 31, 2019 481.88 481.56 0.32

#Pursuant to demerger, plan assets have been transferred in the ratio of liability.

(' in Crores)

2019 2018

ii Amount recognized in balance sheet

Present value of funded obligations 481.88 634.93

Fair value of plan assets 481.56 636.3

Net funded obligation -0.32 1.37

Net defined benefit (liability) / asset recognised

in balance sheet -0.32 -

iii The principal assumptions are shown below:

Discount rate 6.90% 7.30%

Expected return on EPFO 8.65% 8.55%

A quantitative sensitivity analysis for significant

assumption as at December 31, 2019 is as

iv shown below:

no reviews yet

Please Login to review.