222x Filetype XLSX File size 0.02 MB Source: www.tokuyama.co.jp

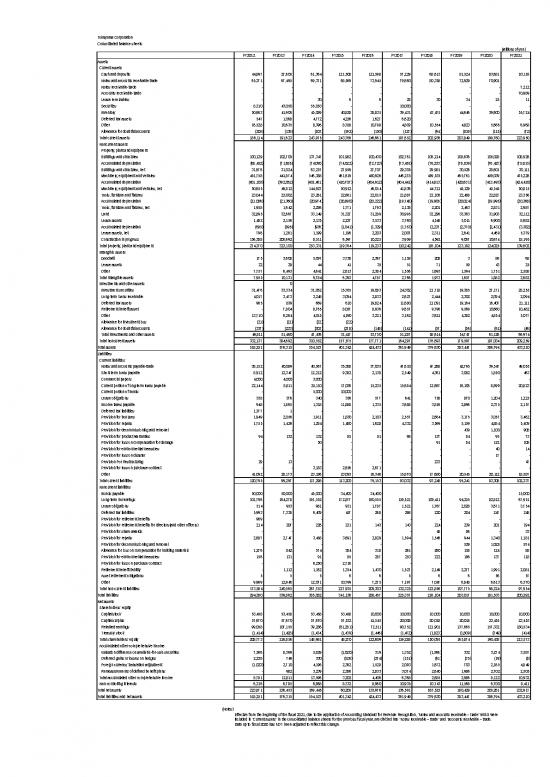

Tokuyama Corporation

Consolidated balance sheets

(Millions of yen)

FY2012 FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021

Assets

Current assets

Cash and deposits 44,897 27,605 61,364 121,508 121,598 57,229 68,613 81,524 83,681 83,116

Notes and accounts receivable-trade 65,371 67,495 69,371 68,569 73,945 79,660 80,358 72,929 70,901 -

Notes receivable-trade - - - - - - - - - 7,212

Accounts receivable-trade - - - - - - - - - 70,989

Lease receivables - - 30 6 6 28 30 34 25 11

Securities 8,310 43,050 55,053 - - 10,000 - - - -

Inventory 50,663 41,906 45,089 40,828 38,835 39,431 43,475 44,646 39,600 55,724

Deferred tax assets 547 1,068 4,772 4,256 1,627 6,620 - - - -

Other 16,528 10,635 8,396 8,788 10,798 4,809 10,554 4,823 5,666 6,968

Allowance for doubtful accounts (205) (138) (103) (192) (150) (127) (94) (108) (115) (72)

Total current assets 186,114 191,623 243,975 243,766 246,661 197,652 202,936 203,849 199,760 223,950

Noncurrent assets

Property, plant and equipment

Buildings and structures 100,129 102,709 137,347 101,982 100,430 102,761 106,214 108,636 105,028 108,926

Accumulated depreciation (68,452) (71,685) (74,090) (74,022) (72,723) (73,455) (76,233) (78,109) (76,427) (78,815)

Buildings and structures, net 31,676 31,024 63,257 27,959 27,707 29,305 29,981 30,526 28,601 30,111

Machinery, equipment and vehicles 451,758 441,874 546,388 461,619 450,926 446,278 459,535 465,761 459,039 475,226

Accumulated depreciation (401,103) (392,062) (401,461) (410,707) (404,912) (404,441) (414,813) (420,631) (413,493) (424,410)

Machinery, equipment and vehicles, net 50,655 49,812 144,927 50,912 46,014 41,836 44,721 45,129 45,545 50,815

Tools, furniture and fixtures 23,044 23,002 23,261 22,661 22,015 21,887 22,106 22,488 22,827 23,356

Accumulated depreciation (21,086) (21,360) (20,974) (20,890) (20,222) (19,748) (19,905) (20,024) (19,995) (20,368)

Tools, furniture and fixtures, net 1,958 1,642 2,286 1,771 1,793 2,138 2,201 2,463 2,831 2,987

Land 32,895 32,667 33,149 31,327 31,289 30,995 32,296 33,363 31,903 32,112

Lease assets 1,482 2,156 2,135 2,237 3,533 3,760 4,548 5,011 6,900 8,682

Accumulated depreciation (685) (895) (936) (1,041) (1,329) (1,753) (2,237) (2,370) (2,431) (3,302)

Lease assets, net 796 1,261 1,199 1,196 2,203 2,007 2,311 2,641 4,469 5,379

Construction in progress 156,388 206,692 8,511 6,597 10,225 3,959 4,592 9,067 10,674 18,195

Total property, plant and equipment 274,370 323,100 253,331 119,764 119,233 110,242 116,104 123,192 124,025 139,602

Intangible assets

Goodwill 175 3,608 5,097 3,738 2,367 1,158 208 3 86 68

Lease assets 22 29 44 41 35 51 71 59 43 25

Other 7,757 6,493 4,641 2,613 2,384 1,556 1,693 1,594 1,751 2,588

Total intangible assets 7,955 10,131 9,784 6,393 4,787 2,766 1,973 1,657 1,882 2,682

Investments and other assets 0

Investment securities 31,476 33,334 31,062 15,765 19,083 24,302 21,718 19,385 27,171 28,255

Long-term loans receivable 4,017 3,473 3,248 3,094 2,833 2,627 2,444 2,302 2,094 2,094

Deferred tax assets 965 839 669 610 19,824 11,680 21,091 19,164 16,407 21,111

Retirement benefit asset - 7,804 8,765 8,057 8,936 9,657 9,796 9,569 10,660 10,482

Other 13,710 6,264 4,015 4,190 3,221 3,162 3,621 4,382 4,854 5,077

Allowance for investment loss (21) (21) (22) (22) - - - - - -

Allowance for doubtful accounts (337) (233) (303) (278) (148) (141) (57) (56) (61) (46)

Total investments and other assets 49,811 51,460 47,436 31,417 53,750 51,287 58,614 54,747 61,126 66,974

Total noncurrent assets 332,137 384,692 310,552 157,575 177,771 164,297 176,693 179,597 187,034 209,259

Total assets 518,251 576,315 554,527 401,342 424,433 361,949 379,630 383,447 386,794 433,210

Liabilities

Current liabilities

Notes and accounts payable-trade 38,152 40,089 40,567 35,388 37,035 47,610 47,268 42,795 39,547 49,055

Short-term loans payable 8,912 12,347 12,212 9,382 2,138 2,549 4,361 3,082 1,850 463

Commercial papers 4,000 4,000 3,000 - - - - - - -

Current portion of long-term loans payable 22,144 8,811 25,110 17,036 15,235 15,684 12,667 16,106 8,899 20,823

Current portion of bonds - - 5,000 10,000 - - - - - -

Lease obligations 338 376 340 356 577 641 758 870 1,204 1,225

Income taxes payable 948 1,865 1,318 11,888 1,335 3,688 3,816 2,896 2,375 2,157

Deferred tax liabilities 1,377 1 - - - - - - - -

Provision for bonuses 1,949 2,056 1,911 1,830 2,103 2,557 2,664 3,175 3,057 3,462

Provision for repairs 1,755 1,429 1,284 1,480 1,628 4,332 3,569 5,159 4,884 5,409

Provision for decommissioning and removal - - - - - - - 439 1,100 908

Provision for product warranties 94 132 132 85 81 98 137 84 95 73

Provision for loss on compensation for damage - - 50 - - - 91 84 122 108

Provision for environmental measures - - - - - - - - 40 14

Provision for loss on disaster - - - - - - - - 17 -

Provision For Restructuring 29 13 - - - - 233 - - 47

Provision for loss on purchase contract - - 3,183 2,656 2,671 - - - - -

Other 41,092 28,173 23,186 23,093 16,346 15,870 17,680 20,545 20,112 18,587

Total current liabilities 120,795 99,297 117,298 113,200 79,153 93,032 93,248 95,241 83,308 102,337

Noncurrent liabilities

Bonds payable 50,000 50,000 45,000 34,400 34,400 - - - - 15,000

Long-term borrowings 101,796 164,278 191,552 172,877 160,555 119,521 109,411 94,255 82,812 67,951

Lease obligations 514 953 981 931 1,787 1,521 1,767 2,028 3,671 3,754

Deferred tax liabilities 5,993 7,338 6,409 457 268 298 220 204 247 248

Provision for retirement benefits 969 - - - - - - - - -

Provision for retirement benefits for directors(and other officers) 214 207 226 231 143 143 224 239 201 194

Provision for share awards - - - - - - 48 86 - 33

Provision for repairs 2,687 2,747 3,458 3,691 2,829 1,594 1,546 944 1,340 1,181

Provision for decommissioning and removal - - - - - - - 529 1,028 874

Allowance for loss on compensation for building materials 1,276 842 574 384 318 261 260 158 124 88

Provision for environmental measures 156 131 91 85 287 253 222 196 137 118

Provision for loss on purchase contract - - 6,250 2,716 - - - - - -

Retirement benefit liability - 1,112 1,162 1,354 1,430 1,527 2,149 2,277 1,991 2,081

Asset retirement obligations 5 5 5 6 6 5 6 6 56 57

Other 9,969 12,946 12,071 10,799 7,275 7,197 7,047 6,848 6,613 6,370

Total non-current liabilities 173,584 240,565 267,783 227,935 209,303 132,325 122,856 107,775 98,224 97,954

Total liabilities 294,380 339,862 385,082 341,136 288,457 225,357 216,104 203,017 181,533 200,292

Net assets

Shareholders' equity

Capital stock 53,458 53,458 53,458 53,458 10,000 10,000 10,000 10,000 10,000 10,000

Capital surplus 57,670 57,670 57,670 57,532 41,545 20,008 20,018 20,018 23,455 23,453

Retained earnings 99,058 107,155 39,286 (61,281) 72,511 90,752 121,901 137,665 157,332 180,534

Treasury stock (1,414) (1,428) (1,434) (1,439) (1,446) (1,472) (1,823) (1,809) (349) (414)

Total shareholders' equity 208,773 216,856 148,981 48,270 122,609 119,288 150,095 165,874 190,438 213,573

Accumulated other comprehensive income

Valuation difference on available-for-sale securities 7,566 8,369 5,829 (1,020) 319 1,352 (1,566) 332 3,274 3,587

Deferred gains or losses on hedges 2,238 749 330 (526) (274) (151) (61) (35) (19) (8)

Foreign currency translation adjustment (1,023) 2,710 4,196 2,362 1,528 2,093 1,672 703 2,165 4,849

Remeasurements of defined benefit plans - 982 3,239 2,386 2,833 3,074 2,640 1,986 2,702 2,505

Total accumulated other comprehensive income 8,781 12,811 13,596 3,202 4,406 6,368 2,685 2,986 8,122 10,932

Non-controlling interests 6,316 6,785 6,868 8,732 8,960 10,935 10,743 11,568 6,700 8,411

Total net assets 223,871 236,453 169,445 60,205 135,976 136,591 163,525 180,429 205,261 232,917

Total liabilities and net assets 518,251 576,315 554,527 401,342 424,433 361,949 379,630 383,447 386,794 433,210

(Notes)

Effective from the beginning of the fiscal 2021, due to the application of Accounting Standard for Revenue Recognition, “Notes and accounts receivable – trade” which were

included in “Current assets” in the consolidated balance sheets for the previous fiscal year, are divided into “Notes receivable – trade” and “accounts receivable – trade.

Data up to fiscal 2020 has NOT been adjusted to reflect this change.

no reviews yet

Please Login to review.