328x Filetype XLSX File size 0.06 MB Source: www.industry.gov.au

Sheet 1: A-5 income statement

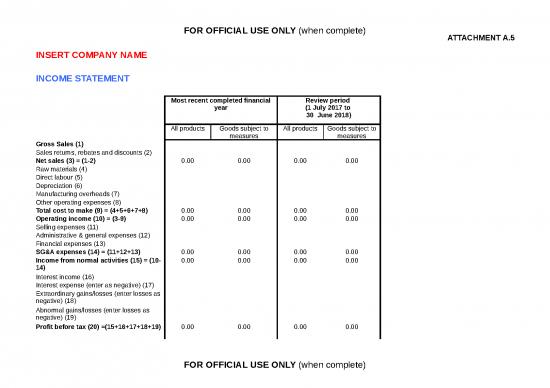

| INSERT COMPANY NAME | ||||

| INCOME STATEMENT | ||||

| Most recent completed financial year | Review period (1 July 2017 to 30 June 2018) |

|||

| All products | Goods subject to measures | All products | Goods subject to measures | |

| Gross Sales (1) | ||||

| Sales returns, rebates and discounts (2) | ||||

| Net sales (3) = (1-2) | 0.00 | 0.00 | 0.00 | 0.00 |

| Raw materials (4) | ||||

| Direct labour (5) | ||||

| Depreciation (6) | ||||

| Manufacturing overheads (7) | ||||

| Other operating expenses (8) | ||||

| Total cost to make (9) = (4+5+6+7+8) | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating income (10) = (3-9) | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling expenses (11) | ||||

| Administrative & general expenses (12) | ||||

| Financial expenses (13) | ||||

| SG&A expenses (14) = (11+12+13) | 0.00 | 0.00 | 0.00 | 0.00 |

| Income from normal activities (15) = (10-14) | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest income (16) | ||||

| Interest expense (enter as negative) (17) | ||||

| Extraordinary gains/losses (enter losses as negative) (18) | ||||

| Abnormal gains/losses (enter losses as negative) (19) | ||||

| Profit before tax (20) =(15+16+17+18+19) | 0.00 | 0.00 | 0.00 | 0.00 |

| Tax (21) | ||||

| Net profit (22) = (20-21) | 0.00 | 0.00 | 0.00 | 0.00 |

| INSERT COMPANY NAME | ||||

| SALES SUMMARY | ||||

| Most recent completed financial year | Review period (1 July 2017 to 30 June 2018) |

|||

| Volume | Value | Volume | Value | |

| Total company turnover (all products) | ||||

| domestic market | ||||

| exports to Australia | ||||

| exports to other countries | ||||

| Turnover of the nearest business unit, for which financial statements are prepared, which includes the goods subject to measures | ||||

| domestic market | ||||

| exports to Australia | ||||

| exports to other countries | ||||

| Turnover of the goods subject to measures | ||||

| domestic market | ||||

| exports to Australia | ||||

| exports to other countries | ||||

| INSERT COMPANY NAME | |||||||||||||||||||||||||||||||||||

| EXPORT SALES SUMMARY (1 July 2017 to 30 June 2018) | |||||||||||||||||||||||||||||||||||

| Customer name | Level of trade | Model | Product code | Grade | Patterns in relief | Surface finish | Form (i.e. coil or sheet) |

Thickness (BMT) |

Width | Prime/non-prime | Invoice number | Invoice date | Date of sale | Order number | Shipping terms | Payment terms | Quantity (tonnes) | Gross invoice value | Discounts | Rebates | Other charges | Currency | Exchange rate | Net invoice value | Other discounts | Ocean freight | Marine insurance | FOB export price | Packing | Inland transport | Handling & other | Warranty expenses | Technical support | Commissions | Other costs |

| [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] | [10] | [11] | [12] | [13] | [14] | [15] | [16] | [17] | [18] | [19] | [20] | [21] | [22] | [23] | [24] | [25] | [26] | [27] | [28] | [29] | [30] | [31] | [32] | [33] | [34] | [35] | [36] |

| Notes: | |||||||||||||||||||||||||||||||||||

| [1] | Names of your customers. | ||||||||||||||||||||||||||||||||||

| [2] | Indicate the level of trade of your customers. | ||||||||||||||||||||||||||||||||||

| [3] | Commercial model, grade or type. | ||||||||||||||||||||||||||||||||||

| [4] | Code used in your records for the model/grade/type identified. Explain the product codes in your submission. | ||||||||||||||||||||||||||||||||||

| [5] | The steel grade determines the guaranteed or typical mechanical properties of the product. | ||||||||||||||||||||||||||||||||||

| [6] | Whether the final rolling process has imparted a 'pattern in relief' onto the plate steel. | ||||||||||||||||||||||||||||||||||

| [7] | Surface finish of the HRC product, e.g. rolled, pickled (oiled or not) etc. | ||||||||||||||||||||||||||||||||||

| [8] | Form of the product, e.g. coil or sheet. | ||||||||||||||||||||||||||||||||||

| [9] | The Base Metal Thickness (BMT) of the HRC product. | ||||||||||||||||||||||||||||||||||

| [10] | The width of the HRC product. | ||||||||||||||||||||||||||||||||||

| [11] | Whether the product is prime or non-prime (i.e. secondary) product. Non-prime could also be described as not meeting the intended or applicable specification. | ||||||||||||||||||||||||||||||||||

| [12] | Number on the sales invoice. | ||||||||||||||||||||||||||||||||||

| [13] | Invoice date shown on the sales invoice. | ||||||||||||||||||||||||||||||||||

| [14] | If you consider that a date other than the invoice date best establishes the material terms of sale, report that date. For example, order confirmation, contract, or purchase order date. | ||||||||||||||||||||||||||||||||||

| [15] | If applicable, show order confirmation, contract or purchase order number (if you have shown a date other than invoice date as being the date of sale). | ||||||||||||||||||||||||||||||||||

| [16] | Delivery terms, e.g. CIF, CFR, FOB, DDP (in accordance with Incoterms). | ||||||||||||||||||||||||||||||||||

| [17] | Agreed payment terms, e.g. 60 days. | ||||||||||||||||||||||||||||||||||

| [18] | Quantity in units shown on the invoice. | ||||||||||||||||||||||||||||||||||

| [19] | Gross invoice value shown on invoice (in the currency of sale, excluding taxes). | ||||||||||||||||||||||||||||||||||

| [20] | If applicable, the amount of any discount deducted on the invoice on each transaction. If a %age discount applies, show the applicable % in another column. | ||||||||||||||||||||||||||||||||||

| [21] | The amount of any deferred rebates or allowances paid to the importer (in the currency of sale). | ||||||||||||||||||||||||||||||||||

| [22] | Any other charges, or price reductions, that affect the net invoice value. Insert additional columns and provide a description. | ||||||||||||||||||||||||||||||||||

| [23] | The currency used on the invoice. | ||||||||||||||||||||||||||||||||||

| [24] | Indicate the exchange rate used to convert the currency of the sale to the currency used in your accounting system. | ||||||||||||||||||||||||||||||||||

| [25] | The net invoice value expressed in your domestic currency, as it is entered in your accounting system. | ||||||||||||||||||||||||||||||||||

| [26] | The actual amount of discounts not deducted from the invoice. Show a separate column for each type of discount. | ||||||||||||||||||||||||||||||||||

| [27] | The actual amount of ocean freight incurred on each export shipment listed (if applicable). | ||||||||||||||||||||||||||||||||||

| [28] | Amount of marine insurance (if applicable). | ||||||||||||||||||||||||||||||||||

| [29] | The free-on-board price at the port of shipment. | ||||||||||||||||||||||||||||||||||

| [30] | Packing expenses. | ||||||||||||||||||||||||||||||||||

| [31] | Inland transportation costs included in the selling price. For export sales this is the inland freight from the factory to the port in the country of export. | ||||||||||||||||||||||||||||||||||

| [32] | Handling, loading & ancillary expenses. For example, terminal handling, export inspection, wharfage & other port charges, container tax, document fees and customs. | ||||||||||||||||||||||||||||||||||

| [33] | Warranty & guarantee expenses. | ||||||||||||||||||||||||||||||||||

| [34] | Expenses for after sale services, such as technical assistance or installation costs. | ||||||||||||||||||||||||||||||||||

| [35] | Commissions paid. If more than one type is paid, insert additional columns of data. Indicate in your response to question B-2 whether the commission is a pre or post exportation cost. | ||||||||||||||||||||||||||||||||||

| [36] | Any other costs, charges or expenses incurred in relation to the exports to Australia (include additional columns as required). See question B-5. | ||||||||||||||||||||||||||||||||||

| brokers fees, clearance fees, bank charges, letter of credit fees, & other ancillary charges . | |||||||||||||||||||||||||||||||||||

| exportation expense having regard to the date of sale. |

no reviews yet

Please Login to review.