258x Filetype XLSX File size 0.06 MB Source: taxguru.in

Sheet 1: Analysis

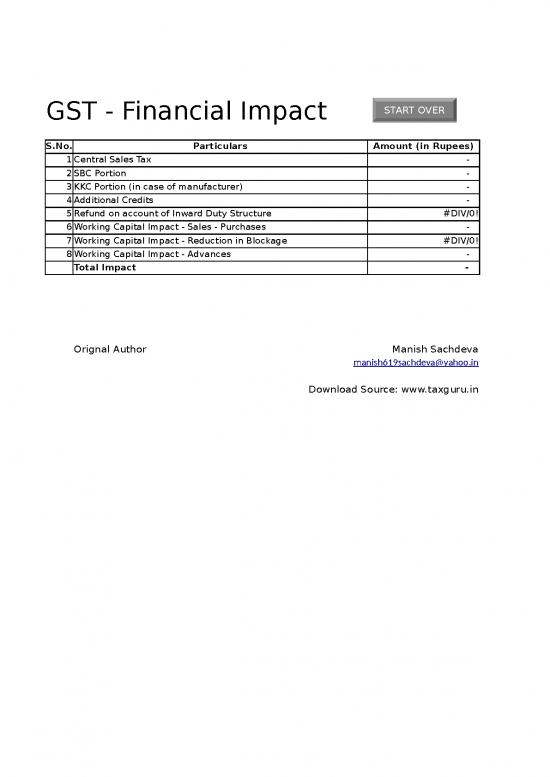

| GST - Financial Impact | ||

| S.No. | Particulars | Amount (in Rupees) |

| 1 | Central Sales Tax | - |

| 2 | SBC Portion | - |

| 3 | KKC Portion (in case of manufacturer) | - |

| 4 | Additional Credits | - |

| 5 | Refund on account of Inward Duty Structure | #DIV/0! |

| 6 | Working Capital Impact - Sales - Purchases | - |

| 7 | Working Capital Impact - Reduction in Blockage | #DIV/0! |

| 8 | Working Capital Impact - Advances | - |

| Total Impact | - | |

| Orignal Author | Manish Sachdeva | |

| manish619sachdeva@yahoo.in | ||

| Download Source: www.taxguru.in |

| 1 | Select GST Slabs out of the Rates Table | |||||||||

| Slabs | GST/ IGST | CGST | SGST | |||||||

| Sales | Zero Rated | 0% | 0.0% | 0.0% | Rates Table | |||||

| General Slab | 28% | 14.0% | 14.0% | Slabs | GST/ IGST | CGST | SGST | |||

| Exempt (Assumed that ITC reversal be half of the tax rate | 14% | 7.0% | 7.0% | Zero | 0% | 0% | 0% | |||

| Purchases | General Slab | 28% | 14.0% | 14.0% | 1st | 5% | 3% | 3% | ||

| 2nd | 12% | 6% | 6% | |||||||

| 3rd | 18% | 9% | 9% | |||||||

| 4th | 28% | 14% | 14% | |||||||

| Cess | 5% | 3% | 3% | |||||||

| Exempt (Assumed that ITC reversal be half of the tax rate | 14% | 7% | 7% | |||||||

| Download Source: www.taxguru.in | ||||||||||

| 1 | Insert Particulars of Sales/ Output Side | ||||||||||||||||||||||||

| 2 | Only Fill the Yellow Cells | Download Source: www.taxguru.in | |||||||||||||||||||||||

| 3 | Fill most specific details, to get the better accuracy | ||||||||||||||||||||||||

| 4 | Press Previous or Next to Analog | ||||||||||||||||||||||||

| 5 | Compensation Cess has been assumed as Nil | ||||||||||||||||||||||||

| Particulars | Value | Current Taxes | Current Tax % | GST | Change in Tax Amount | ||||||||||||||||||||

| Exports | Inter State | Intra State | Total | CST | VAT | ITC Reversal (Stock Transafers) | Cenvat Reversal | Export Duties | BED | Excise Cess | Basic Service Tax | SBC | KKC | Total | Total | % | IGST | CGST | SGST | Export Duties | Compensation Cess | ||||

| 1 | Sale of Finished Goods | ||||||||||||||||||||||||

| 1.1 | Exports | - | - | #DIV/0! | - | #DIV/0! | - | - | - | ||||||||||||||||

| 1.2 | Sale of Finished Goods - Excisable | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 1.3 | Sale of Finished Goods - Non Excisable | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 2 | Raw Material clearances | ||||||||||||||||||||||||

| 2.1 | Raw Material clearances | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 3 | Other Sales | ||||||||||||||||||||||||

| 3.1 | Capital Goods clearances | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 3.2 | FOC Sales | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 4 | Other Goods Clearances | ||||||||||||||||||||||||

| 4.1 | Stock Transfer Outwards | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 4.2 | Job work Income | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 5 | Services | ||||||||||||||||||||||||

| 5.1 | Output Services - Taxable | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 5.2 | Output Services - Non Taxable | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | |||||||||||||||

| 6 | Trading Business | #DIV/0! | |||||||||||||||||||||||

| 6.1 | Sale of Traded Goods | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | - | ||||||||||||||

| Total Outward Supplies | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | #DIV/0! | - | #DIV/0! | - | - | - | - | - | - | |

no reviews yet

Please Login to review.