191x Filetype DOC File size 0.17 MB Source: www.fema.gov

Tool III-1, Allowable & Unallowable Costs

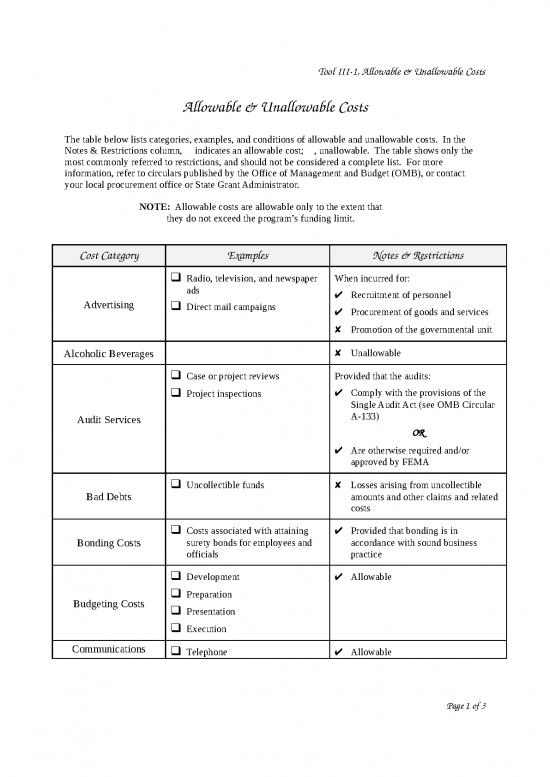

Allowable & Unallowable Costs

The table below lists categories, examples, and conditions of allowable and unallowable costs. In the

Notes & Restrictions column, indicates an allowable cost; , unallowable. The table shows only the

most commonly referred to restrictions, and should not be considered a complete list. For more

information, refer to circulars published by the Office of Management and Budget (OMB), or contact

your local procurement office or State Grant Administrator.

NOTE: Allowable costs are allowable only to the extent that

they do not exceed the program’s funding limit.

Cost Category Examples Notes & Restrictions

Radio, television, and newspaper When incurred for:

ads Recruitment of personnel

Advertising Direct mail campaigns Procurement of goods and services

Promotion of the governmental unit

Alcoholic Beverages Unallowable

Case or project reviews Provided that the audits:

Project inspections Comply with the provisions of the

Single Audit Act (see OMB Circular

Audit Services A-133)

OR

Are otherwise required and/or

approved by FEMA

Uncollectible funds Losses arising from uncollectible

Bad Debts amounts and other claims and related

costs

Costs associated with attaining Provided that bonding is in

Bonding Costs surety bonds for employees and accordance with sound business

officials practice

Development Allowable

Preparation

Budgeting Costs Presentation

Execution

Communications Telephone Allowable

Page 1 of 3

Tool III-1, Allowable & Unallowable Costs

Cost Category Examples Notes & Restrictions

Mail and messenger service

Wages and salaries Provided that compensation is

Compensation Fringe benefits reasonable for the services provided

Disbursing Services Costs associated with the accounts Allowable

payable function

Services volunteered by: The values of donated services are

Technical personnel unallowable as either direct or

Donated Services indirect costs. However, they may be

Consultants used to meet cost sharing or matching

requirements.

Skilled and unskilled labor

The net invoice price of Non-expendable items of equipment

equipment, including having a useful life of more than 1

Equipment and Other modifications, attachments, or year and costing $5,000 or more.

Capital Expenditures accessories (Items of equipment costing less than

Ancillary charges, including taxes $5,000 are considered supplies.)

and freight

Salaries and expenses of the Unallowable

Office of the Governor and/or

State legislatures, tribal councils,

General Government or other local governmental bodies

Expenses Costs associated with government

services normally provided to the

general public (e.g. fire and

police)

Professional and/or support staff Legal expenses required for program

time administration

Legal Expenses Filing fees Legal expenses for prosecutions of

claims against the Federal

Government

Utilities Allowable if they:

Insurance Keep property in efficient operating

Security condition

Maintenance, Do not add to the permanent value of

Operation, and Repairs Janitorial services

the property

Equipment repairs Are not included in rental charges for

space

Page 2 of 3

Tool III-1, Allowable & Unallowable Costs

Cost Category Examples Notes & Restrictions

Stationery Allowable after deducting:

General office supplies Cash and/or trade discounts

Materials and Supplies Rebates

Items of equipment costing less

than $5,000 Other allowances

Maintenance If charged to the program at a

Motor Pools Inspection mileage or fixed rate

Repair services

Activities directed toward: When:

Maintaining the image of the Incurred to communicate with the

governmental unit public and press pertaining to the

Promoting understanding and specific program

Public Relations favorable relations with the public Necessary to conduct general liaison

Legal or Public Notices with the news media and government

public affairs officers to keep the

public informed

Incurred solely to promote the

governmental unit

Employee training To the extent that the training is

Training required for sub-grant related

activities

Transportation Provided that:

Lodging Employees are traveling on official

Travel Subsistence business

The costs do not exceed the amount

normally allowed by the agency in its

regular operations

Page 3 of 3

This page intentionally left blank.

no reviews yet

Please Login to review.