483x Filetype PDF File size 0.35 MB Source: tnp.com.ng

Newsletter

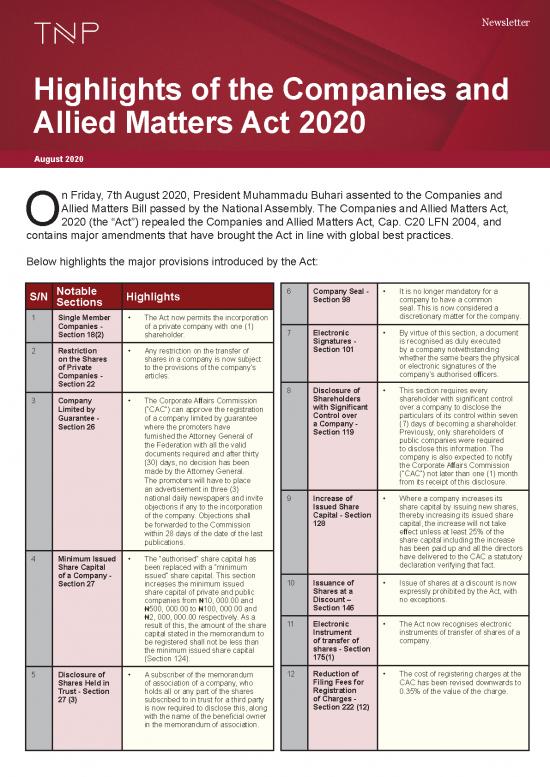

Highlights of the Companies and

Allied Matters Act 2020

August 2020

n Friday, 7th August 2020, President Muhammadu Buhari assented to the Companies and

Allied Matters Bill passed by the National Assembly. The Companies and Allied Matters Act,

O2020 (the “Act”) repealed the Companies and Allied Matters Act, Cap. C20 LFN 2004, and

contains major amendments that have brought the Act in line with global best practices.

Below highlights the major provisions introduced by the Act:

S/N Notable Highlights 6 Company Seal - • It is no longer mandatory for a

Sections Section 98 company to have a common

seal. This is now considered a

1 Single Member • The Act now permits the incorporation discretionary matter for the company.

Companies - of a private company with one (1) 7 Electronic • By virtue of this section, a document

Section 18(2) shareholder. Signatures - is recognised as duly executed

2 Restriction • Any restriction on the transfer of Section 101 by a company notwithstanding

on the Shares shares in a company is now subject whether the same bears the physical

of Private to the provisions of the company’s or electronic signatures of the

Companies - articles. company’s authorised officers.

Section 22 8 Disclosure of • This section requires every

3 Company • The Corporate Affairs Commission Shareholders shareholder with significant control

Limited by (“CAC”) can approve the registration with Significant over a company to disclose the

Guarantee - of a company limited by guarantee Control over particulars of its control within seven

Section 26 where the promoters have a Company - (7) days of becoming a shareholder.

furnished the Attorney General of Section 119 Previously, only shareholders of

the Federation with all the valid public companies were required

documents required and after thirty to disclose this information. The

(30) days, no decision has been company is also expected to notify

made by the Attorney General. the Corporate Affairs Commission

The promoters will have to place (“CAC”) not later than one (1) month

an advertisement in three (3) from its receipt of this disclosure.

national daily newspapers and invite 9 Increase of • Where a company increases its

objections if any to the incorporation Issued Share share capital by issuing new shares,

of the company. Objections shall Capital - Section thereby increasing its issued share

be forwarded to the Commission 128 capital, the increase will not take

within 28 days of the date of the last effect unless at least 25% of the

publications. share capital including the increase

has been paid up and all the directors

4 Minimum Issued • The “authorised” share capital has have delivered to the CAC a statutory

Share Capital been replaced with a “minimum declaration verifying that fact.

of a Company - issued” share capital. This section 10 Issuance of • Issue of shares at a discount is now

Section 27 increases the minimum issued Shares at a expressly prohibited by the Act, with

share capital of private and public Discount – no exceptions.

companies from ₦10, 000.00 and Section 146

₦500, 000.00 to ₦100, 000.00 and

₦2, 000, 000.00 respectively. As a 11 Electronic • The Act now recognises electronic

result of this, the amount of the share Instrument instruments of transfer of shares of a

capital stated in the memorandum to of transfer of company.

be registered shall not be less than shares - Section

the minimum issued share capital 175(1)

(Section 124).

5 Disclosure of • A subscriber of the memorandum 12 Reduction of • The cost of registering charges at the

Shares Held in of association of a company, who Filing Fees for CAC has been revised downwards to

Trust - Section holds all or any part of the shares Registration 0.35% of the value of the charge.

27 (3) subscribed to in trust for a third party of Charges -

is now required to disclose this, along Section 222 (12)

with the name of the beneficial owner

in the memorandum of association.

13 Annual General • Small companies or any company 24 Exemption • A company that has not carried on

Meetings – having a single shareholder are of certain business since incorporation or that

Section 237 (1) now been exempted from holding a companies is a small company is exempted from

general meeting. from audit auditing its account for any financial

requirements - year. This exemption does not

14 Businesses • Companies are now required to Section 402 however apply to banks, insurance

Transacted at disclose at their annual general companies or any other company

Annual General meetings, information on the prescribed by the CAC.

Meetings – renumeration of their managers.

Section 238 25 Qualification • The Act has expanded the scope of

15 General • Private companies are now allowed of Auditors - persons that are disqualified from

meetings to hold their general meetings Section 403 being appointed as auditors of a

can be held electronically provided that the company. These include: a person

electronically - meetings are held in accordance indebted to the company or to a

Section 240 with the Articles of the company. company related to that company

In addition, small companies and (by virtue of interest in shares)

private companies with a single in an amount exceeding ₦500,

shareholder can hold their statutory 000.00 (Five Hundred Thousand

and general meetings outside of Naira); a shareholder or a spouse

Nigeria. However, all other categories of a shareholder of a company

of companies are still required to hold whose employee is an officer of the

theirs in Nigeria. company; a person who is or whose

partner, employee or employer is

16 Persons entitled • The Act now entitles the CAC responsible for keeping the register

to notice of to receive notice of the general of holders of debentures of the

meetings - meetings of public companies. company; and an employee of or a

consultant to the company who has

Section 243 been engaged for more than one

year in the maintenance of any of

17 Dual • The Act prohibits the Chairman of the company’s financial records or

Appointment - a public company from also acting preparation of any of its financial

Section 265 (6) as the Chief Executive Officer of the statements.

same company.

18 Number of • Small companies are permitted to 26 Composition • This section requires the Audit

Directors - have a single director. of Audit Committee of a public company to be

Section 271 Committee - have five (5) members comprising of

19 Independent • Every public company is now Section 404(3) three (3) members and two (2) non-

Directors - required to have at least three (3) executive directors. The members of

Section 275 independent directors. the Audit Committee are not entitled

to remuneration and are subject to

election in each year.

20 Disclosure • This section mandates any person

of multiple proposed to be appointed as a 27 Prohibition • The Act makes it an offence for an

directorships director of a public company to of Improper officer, director or any person acting

in a public disclose his directorship in any other Influence on under their direction to influence an

company - public company at the meeting where Conduct of external auditor in any form in the

Section 278 (2) his appointment is proposed. Audit - Section course of audit of the company’s

406 (1) financial statements.

21 Period of • The Act has clarified that the 10-year

disqualification disqualification period – of a person 28 Unclaimed • Where dividends paid by a company

of a person from convicted of an offence in connection Dividends - remain unclaimed, the company

being a director with the promotion, formation, Section 429 must publish a list of such unclaimed

of a company - management or winding up of a dividends and the names of persons

Section 280 company – will commence after entitled to these dividends in two (2)

serving the sentence or paying the national newspapers. This list is also

fine stipulated for the offence. required to be attached to the notice

of the next Annual General Meeting

and sent to shareholders.

22 Appointment • The Act now makes it optional

of Company for small companies to appoint a

Secretary - company secretary. In addition,

Section 330 Section 332(c) of the Act provides 29 Right of the • Shareholders of a company can sue

that a public company can now Shareholders to recover their dividends from the

appoint a member of any professional to sue for company at any time within 12 years

body of accountants as its company Dividends - from the date such dividend was

secretary. Section 432 declared. In addition, dividends which

have remained unclaimed for more

than 12 years shall be included in the

23 Qualification • In order to qualify as a small profit of the company which would be

as a small company, a company must either distributed to its shareholders.

company - have an annual turnover not

Section 394 exceeding ₦120, 000, 000.00 or a net

asset value not exceeding ₦60, 000,

000.00 (Sixty Million Naira), in any

given year.

30 Administration • The Act introduced Administration as 36 Banks’ • Banks are now obligated to notify

of companies an additional insolvency mechanism obligation the CAC of any dormant account

- Sections 443 available to companies. The key to notify the previously maintained by an

to 549 function of an appointed Administrator CAC of funds association and the CAC may order

is to rescue the company, maintain in dormant the transfer of funds in that account

it as a going concern, and ultimately accounts of to another association.

achieve a better result for creditors dissolved

than would have been likely if the associations -

company was wound up. Section 842

37 Merger of • The merger of associations with

Association - similar objects is now permissible

Section 849 under the Act.

31 Threshold for • The threshold for determining a 38 Establishment • The Act mandates the CAC

determining company’s inability to pay its debt of to establish an Administrative

inability to pay to a creditor has been revised from Administrative Proceedings Committee (APC) with

debt - Section ₦2, 000.00 (Two Thousand Naira) Proceedings power to impose administrative

572 to ₦200, 000.00 (Two Hundred Committee - penalties for contravention of

Thousand Naira). Section 851 the provisions of the Act or its

regulations. Decisions of the APC are

subject to confirmation by the Board

32 Power of the • The Act now recognises the right of of the CAC and may be appealed to

Commission companies (by special resolution) to the Federal High Court.

to strike off apply for their names to be struck off 39 Electronic Filing • The Act now makes provisions for

company from the register of companies - Section 860(1) electronic filing of documents at the

Register of CAC

Companies -

Section 692

33 Qualification of • A person will only be qualified to 40 Prohibition of • It is unlawful for a person or group

an insolvency act as an insolvency practitioner doing business of persons to carry on business in

practitioner - where he is has obtained a degree without Nigeria as a company, limited liability

Section 705 in law, accountancy or any other registration - partnership, limited partnership or

relevant discipline from a recognized Section 863 under a business name without being

University or Polytechnic. Such registered under the Act.

a professional must have at

least 5 years’ post qualification 41 Retention of • All companies, firms and corporate

experience in insolvency matters records in soft bodies registered under the Act are

and must be registered with BRIPAN copies- Section expected to retain soft copies of all

(Business Recovery and Insolvency 864 documents stored in pursuance of the

Practitioners Association of Nigeria) provisions of the Act for a period of

or any other professional body six (6) years from the date of storage.

recognised by the CAC.

34 Limited Liability • The Act now recognises and permits 42 Power of • This section allows the CAC to

Partnership - the incorporation of limited liability the CAC to compound administrative offences

Section 753 to partnerships (“LLP”). An LLP is compound and accept a lump sum for these

760 recognised as a corporate entity and offences - offences

can sue and be sued. Section 866

35 Power of • The CAC now has the power to direct

the CAC to that two or more associations with the

merge related same trustees be treated as a single

associations - association.

Section 831

It is important to state that most of the monetary fines contained in the previous CAMA have been

amended in the new Act to reflect today’s realities. In addition, every director and or officer of a

company may now be liable for non-compliance with certain provisions of the Act.

This places and extra duty on the directors to ensure that the company complies with the provisions

of the Act as they will be held liable whether or not such director or officer is actually in default of such

provisions.

For further information, please contact;

tnp.com.ng/socialmedia

Baba Alokolaro Bukola Bankole

Managing Partner Partner

M: (+234) 808 867 0001 M: (+234) 808 867 0008

E: baba@tnp.com.ng E: bukola@tnp.com.ng

© TNP, 2020. All Rights Reserved. TNP is an Andersen Global Collaborating firm

no reviews yet

Please Login to review.