374x Filetype XLSX File size 0.03 MB Source: www.in.gov

Sheet 1: Sheet1

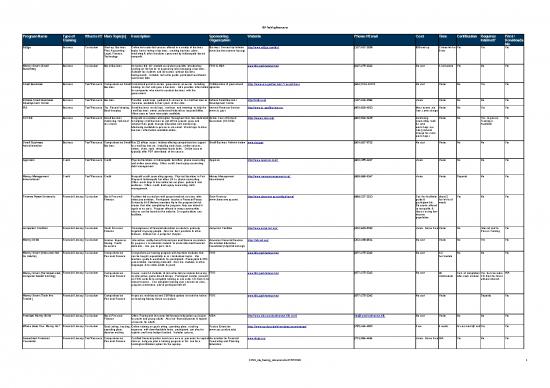

| Program Name | Type of Training | What is it? | Main Topic(s) | Description | Sponsoring Organization | Website | Phone #/Email | Cost | Time | Certification | Requires Internet? | Print / Downloadable Materials available? | |

| Ed2go | Business | Curriculum | Start-up, Business Plan, Accounting, Legal, Finance, Technology | Online instructor-led courses offered in a variety of business topics from starting a business, creating business plans, marketing & other functions sponsored by Indianapolis-based nonprofit. | Business Ownership Intiative (www.businessownership.org) | http://www.ed2go.com/boi/ | (317) 917-3266 | $99 and up | 2 times/wk for 6 wks | Yes | Yes | Yes | |

| Money Smart (Small Business) | Business | Curriculum | Basic Business | Instructor-led, 10- module curriculum provides introductory training on the basics to organizing and managing a business. Suitable for students and instructors without business backgrounds. Includes instructor guide, participant workbooks, overhead slides | FDIC & SBA | www.fdic.gov/moneysmart | (817) 275-3342 | No cost | 1 hr/module | Yes | No | Yes | |

| Small Business | Business | Tool/Resource | Comprehensive Small Business | Centralized portal to access government resources, including training, to start and grow a business. Also provides information for companies who want to conduct business with the government. | Collaboration of government agencies | https://www.usa.gov/business?source=busa | (844) USA-GOV1 | No cost | Varies | No | Yes | Yes | |

| Indiana Small Business Development Center | Business | Tool/Resource | Business | Provides workshops, guidance & resources to small businesses. Services available in most parts of the state. | Indiana Small Business Development Center | http://isbdc.org/ | (317) 234-2082 | Varies | Varies | No | No | Yes | |

| IRS | Business | Tool/Resource | Tax, Record-keeping, Book-keeping | Small business workshops, seminars and meetings to help the small business owner understand federal tax responsibilities. Video courses have transcripts available. | Internal Revenue Service (www.irs.gov) | http://www.irs.gov/Businesses | (800) 829-4933 | Most events are free, some charge | Varies | No | Yes | Yes | |

| SCORE | Business | Tool/Resource | Small business mentoring, technical assistance | Nonprofit association w/chapters throughout the state dedicated to helping small businesses get off the ground, grow and achieve their goals through education and mentorship. Mentoring available in-person or via email. Workshops & other business information available online. | Senior Core of Retired Executives (SCORE) | https://www.score.org/ | (800) 634-0245 | mentoring, counseling, tools & some workshops are free (nominal charge for some workshops) | Varies | No | Yes, In-person Training is Available | Yes | |

| Small Business Administration | Business | Tool/Resource | Comprehensive Small Business | Has 33 offices across Indiana offering comprehensive support for small businesses, including workshops, online courses, videos, chats, tools, templates/worksheets. Online courses typically offer PDF downloads of the course. | Small Business Administration | www.sba.gov | (800) 827-5722 | No cost | Varies | No | No | Yes | |

| Apprisen | Credit | Tool/Resource | Credit | Physical locations in Indianapolis but offers phone counseling and online counseling. Offers credit, bankruptcy counseling, debt management. | Apprisen | http://www.apprisen.com/ | (800) 355-2227 | Varies | Varies | No | No | Yes | |

| Money Management International | Credit | Tool/Resource | Credit | Nonprofit credit counseling agency. Physical locations in Fort Wayne & Indianapolis but offers 24 hr. phone counseling. Offers workshops & free online lesson plans, podcasts and webinars. Offers credit, bankruptcy counseling, debt management. | Money Management International | http://www.moneymanagement.org/ | (866) 889-9347 | Varies | Varies | Depends | No | Yes | |

| Finance Peace University | Financial Literacy | Curriculum | Basic Personal Finance | Facilator-led curriculum with group breakout sessions after video presentation. Participants receive a Financial Peace University kit & lifetime membership to the program (which means that after completing the program, they can attend it again at no cost). Program offered in many communities, classes can be found on the website. Or organizations can facilitate. | Dave Ramsey (www.daveramsey.com) | http://www.daveramsey.com/fpu/home/ | (888) 227-3223 | Cost for facilitator guide & participant kits. Discounts offered to nonprofits & those serving low-income population. | about 2 hrs/wk for 9 weeks | Yes | No | Yes | |

| Jumpstart Coalition | Financial Literacy | Curriculum | Youth Personal Finance | Clearinghouse of financial education curriculum, primarily targeted at young people. Also has best practices & other features. Indiana has a jumpstart chapter. | Jumpstart Coalition | http://www.jumpstart.org/ | (202) 846-6780 | Varies, Some Free | Varies | No | Internet and In-Person Training | Yes | |

| Money Skills | Financial Literacy | Curriculum | Income, Expenses, Saving, Credit, Insurance | interactive, reality-based Internet personal finance curriculum. Its purpose is to educate students to make informed financial decisions. Has pre- & post- tests. | American Financial Services Association Education Foundation (http://afsaef.org/) | https://afsaef.org/ | (202) 466-8611 | No cost | Varies | No | Yes | Yes | |

| Money Smart (Instructor-led for Adults) | Financial Literacy | Curriculum | Comprehensive Personal Finance | Comprehensive training program with fourteen modules that can be taught sequentially or as stand-alone topics. Has teachers guide & workbooks for participants, Powerpoint & PDF presentation, marketing materials. Also has modules in other languages & for older adults & youth | FDIC | www.fdic.gov/moneysmart | (877) 275-3342 | No cost | 1-2 hrs/module | No | No | Yes | |

| Money Smart (Participant-led, computer based training) | Financial Literacy | Curriculum | Comprehensive Personal Finance | Covers same 11 modules of instructor-led curriculum but using an interactive, game-based design. Participant creates account on FDIC website to complete training or can order CD-Rom if no internet access. Can complete training over several sessions, program remembers where participant left off | FDIC | www.fdic.gov/moneysmart | (877) 275-3342 | No cost | 30 min/module | Cert. of completion after each module | Yes, but can order CD-Rom for those without internet | N/A | |

| Money Smart (Train the Trainer) | Financial Literacy | Curriculum | Comprehensive Personal Finance | In-person, web-based and CD/Video options to train the trainer on teaching Money Smart curriculum | FDIC | www.fdic.gov/moneysmart | (877) 275-3342 | No cost | Varies | Depends | Yes | ||

| Practical Money Skills | Financial Literacy | Curriculum | Basic Personal Finance | Offers Powerpoint instructor-led financial education curriculum for youth and young adults. Also has financial games & topical resources for adults. | VISA | http://www.icba.practicalmoneyskills.com/ | info@practicalmoneyskills | No cost | Varies | No | No | Yes | |

| Where does Your Money Go? | Financial Literacy | Curriculum | Goal setting, tracking, spending plans, decision making | Online training on goal setting, spending plans, tracking expenses with downloadable forms, participants can elect to register and have budget tracked. Includes quizzes. | Purdue Extension (www.ces.purdue.edu) | https://www.purdue.edu/wheredoesyourmoneygo/ | (765) 494-4600 | Free | 4 weeks | Assessment @ end | Yes | Yes | |

| Accredited Financial Counselor | Financial Literacy | Tool/Resource | Comprehensive Personal Finance | Certified financial professional can serve as presenter for topical classes, help you plan a training program or this can be a training/certification option for the agency. | Association for Financial Counseling and Planning Education | www.afcpe.org | (703) 684-4484 | Varies, Some Free | N/A | Yes | No | Yes | |

| BankRate | Financial Literacy | Tool/Resource | Comprehensive Personal Finance | For profit financial publishing company offering financial articles, videos, tools, Q&A. Wealth of financial calculators for loans, savings and other topics. | BankRate | www.bankrate.com | Online Question Submission | No cost | Varies | No | Yes | Yes | |

| Cash Course | Financial Literacy | Tool/Resource | Basic Personal Finance & College | Interactive money management program geared toward traditional college students. Available online of via class workshops. Offers workshop kits & marketing materials. | National Endowment for Financial Education (http://www.nefe.org/) | www.cashcourse.org | (303) 224-3536 | No cost | Varies | No | Yes | Yes | |

| Consumer Finance Protection Bureau | Financial Literacy | Tool/Resource | Consumer Financial Products | Educates consumers & enforces consumer protection laws for financial products/services. Users can submit complaints about loan & other financial products, get updates on legislation, get questions answered and find topical information | Consumer Financial Protection Bureau | www.consumerfinance.gov | (855) 411-2372 | No cost | Varies | No | Yes | Yes | |

| Consumer Finance Protection Bureau | Financial Literacy | Tool/Resource | Basic Personal Finance | Not really a curriculum but a toolkit with worksheets and scripts to assist service providers in talking to clients about financial goals, tracking & budgeting, credit & general financial decision-making. Follows sequential topics but can be stand alone as well. Train the trainer available. | Consumer Financial Protection Bureau | http://www.consumerfinance.gov/your-money-your-goals/ | (855) 411-2372 | No cost | Varies | No | No | Yes | |

| Credit Builders Alliance | Financial Literacy | Tool/Resource | Credit | Connects nonprofits to credit reporting agencies, provides credit report access & ability to report loans. | Credit Builders Alliance | http://www.creditbuildersalliance.org/ | (202) 730-9390 | Varies | Varies | No | Yes | Yes | |

| Economic Development - Family Financial Management | Financial Literacy | Tool/Resource | Variety of personal finance topics | Workbooks, articles, handouts, downloadable | Purdue Extension (www.ces.purdue.edu) | https://mdc.itap.purdue.edu/newsearch.asp?subCatID=224 &CatID=7 | (765) 494-6794 | No Cost | Varies | No | Yes | Yes | |

| FDIC Consumer News(letter) | Financial Literacy | Tool/Resource | Various | Quarterly consumer newsletter of various financial topics. Can subscribe to email distribution or access on website or download PDF. | FDIC | www.fdic.gov/consumernews | (877) 275-3342 | No cost | Varies | Yes | Yes | Yes | |

| Financial Planning Association | Financial Literacy | Tool/Resource | Comprehensive Personal Finance | Certified financial professional can serve as presenter for topical classes, help you plan a training program or this can be a training/certification option for the agency. | Financial Planning Association | http://www.plannersearch.org/Pages/Home.aspx | (800) 322-4237 | Varies | Varies | No | No | No | |

| Financial Social Work | Financial Literacy | Tool/Resource | Comprehensive Personal Finance | Certified financial professional can serve as presenter for topical classes, help you plan a training program or this can be a training/certification option for the agency. | Center for Financial Social Work | http://www.financialsocialwork.com/ | (800) 707-1002 | Varies | Varies | Yes | Yes | Yes | |

| FTC | Financial Literacy | Tool/Resource | Comprehensive Personal Finance | Wealth of consumer financial information covering variety of topics, includes videos, downloadable information & worksheets, ability to submit complaints (ID theft, do not call). | Federal Trade Commision (www.ftc.gov) | www.consumer.ftc.gov | (202) 326-2222 | Varies | Varies | No | Yes | Yes | |

| Indiana Saves | Financial Literacy | Tool/Resource | Savings | Part of AmericaSaves, campaign to urge participants to save money. | America Saves (https://americasaves.org/) | https://americasaves.org/local-campaigns/indiana-saves/ | (202) 387-6121 | No cost | Varies | No | No | Yes | |

| Money Smart Podcast Network | Financial Literacy | Tool/Resource | Basic Personal Finance |

Short, audio sessions on financial topics in english & spanish | FDIC | https://www.fdic.gov/consumers/consumer/moneysmart/podcast/index.html | (877) 275-3342 | No cost | 15 min /podcast | No | Yes, but can order CD-Rom for those without internet or download PDF transcripts | Yes | |

| My Money | Financial Literacy | Tool/Resource | Various | Comprehensive and inclusive financial literacy program and resource clearinghouse for individuals with developmental disabilities, their family members and caregivers | Florida Department of Financial Services | http://www.myfloridacfo.com/mymoney/ | CFOConsumerSerivces@MyFloridaCFO.com | No cost | Varies | No | Yes | Yes | |

| My Money Five | Financial Literacy | Tool/Resource | Save & Invest, Protect, Borrow, Earn, Spend, Life Events | Consumer-oriented. Promotes five building blocks to manage & grow money. Can serve as framework for financial ed training. Has resources, templates, calculators | Financial Literacy & Education Commision | www.mymoney.gov | (800) FED-INFO | No cost | Varies | No | Yes | Yes | |

| Save to Win | Financial Literacy | Tool/Resource | Savings | Prize-linked savings program primarily offered through credit union networks. Appeals to people who like to play the lottery. As participants save, they are entered into monthly drawings & a grand prize drawing. Piloted by Centra Credit Union in Indiana. | Commonwealth fka Doorway 2 Dreams Fund (https://buildcommonwealth.org/) | www.savetowin.org | (877) 642-3167 | No cost | Varies | No | Yes | Yes | |

| Save Your Refund | Financial Literacy | Tool/Resource | Savings | Prize-linked savings effort during tax season to encourage participants to save some of their tax refund. Although promoted at free tax preparation sites, any program an encourage and help taxpayers enter contest. Taxpayers split refund using form 8888 & enter contest online or using their cell phone. | America Saves and Commonwealth | https://saveyourrefund.com/home/ | (877) 642-3167 | No cost | Varies | No | No | Yes | |

| Smart About Money (SAM) | Financial Literacy | Tool/Resource | Basic Personal Finance | Geared towards consumers, offers worksheets, tools, calculators and information on variety of personal finance and life situation issues. | National Endowment for Financial Education (http://www.nefe.org/) | www.smartaboutmoney.org | (303) 741-6333 | No cost | Varies | No | Yes | Yes | |

| IHCDA Homebuyer Education Powered by Framework | Home Ownership | Curriculum | Home Ownership | The virtual homeownership advisor guides potential buyers through nine interactive modules, including money management, understanding credit, mortgage loans, and life as a homeowner. | Indiana Housing & Community Development Authority | https://www.in.gov/ihcda/homeownership/2362.htm | (855) 659-2267 | $100 | Varies | Yes | Yes | Yes | |

| Framework | Home Ownership | Curriculum | Home Ownership | Provides online homeownership training to individuals, HUD-certified, | Housing Partnership Network | http://www.frameworkhomeownership.org/why-framework | (855) 659-2267 | $75 | 9-30 min sessions | Yes | Yes | Yes | |

| Home Buyer Education (online) | Home Ownership | Curriculum | Home Ownership | Comprehensive HUD-certified online home ownership training program available across the state from Indianapolis-based nonprofit. | Indianapolis Neighborhood Housing Partnership (www.inhp.org) | https://inhp.frameworkhomeownership.org/Default.aspx | (317) 610-4663 | $75, discounts offered occasionally | 4-6 hrs | Yes | Yes | Yes | |

| HUD | Home Ownership | Tool/Resource | Home Ownership | Wealth of information on homeownership, access to HUD-certified agencies, downpayment assistance & lending programs. | HUD | www.hud.gov | (317) 226-6303 | No cost | Varies | No | Yes | Yes | |

| Indiana Foreclosure Prevention Network | Home Ownership | Tool/Resource | Foreclosure Prevention | Refers homeowners at risk of losing home to HUD-certified housing counselors. Agencies in several areas of the state. | Indiana Foreclosure Prevention Network | http://www.877gethope.org/ | (877) 438-4673 | No cost | Varies | No | No | Yes | |

| NeighborWorks | Home Ownership | Tool/Resource | Home Ownership | Provides certified homeownership training to agencies. | Neighborworks | http://www.neighborworks.org/Home.aspx | (202) 760-4000 | Varies | Varies | Yes | No | No | |

| Money Matters | Finacial Literacy | Tool/Resource | Retirement Planning | Offers practical advice and humorous tips for overcoming common retirement fears, and insights on everything from mutual funds to annuities. | Retirment Planners of America | https://moneymatters.net/ | (800) 994-0302 | No Cost | Varies | No | No | No | |

| Pathways to Your Financial Destination | Finacial Literacy | Curriculum | Personal Finances | In-house developed curriculum covering Financial Vision & Goal Setting, Spending Plans, Credit, Savings & Investment, Identity Theft & Asset Protection | John Boner Neighborhood Centers | https://www.eventbrite.com/o/john-boner-neighborhood-centers-7505224371 | (317) 633-8210 | $25(Finacial Assistance Is available | N/A | Yes | No | No | |

| CreditSmart | Home Ownership | Curriculum | Home Ownership | Provides 12 modules that provide valuable information to help improve credit, manage money and be a responsible homeowner. | Freddie Mac | http://www.freddiemac.com/creditsmart/online_curriculum.html | (800) 424-5401, Online Question Submission | No Cost | 20-30 minutws for each module | No | Yes | Yes | |

| Understanding Credit | Home Ownership | Curriculum | Home Ownership | Provides steps to help improve credit score to qualify for a mortgage. | INHP | https://www.inhp.org/classes-and-advising/classes/understanding-credit-class | (317) 610-4663, Online Question Submission | No cost | 1.5-2.5 Hours | No | No | No | |

| Business Ownership | Business | Curriculum | Business Ownership | Provides one-on-one business coaching, access to financing, business workshops and online business courses | Business Ownership Initiative (BOI) | http://www.businessownership.org | (202) 559-1473 (D.C.), (216) 282-2022 (Cleveland) | No Cost | Varies | No | No | No | |

| Your Money Your Goals | Financial Literacy | Tool/Resource | Basic Personal Finance | Provides resources to help people set goals and solve financial problems | Consumer Financial Protection Bureau | https://www.consumerfinance.gov/practitioner-resources/your-money-your-goals/Yes | (855) 411-2372 | No Cost | Varies | No | Yes | Yes | |

| Money Mangement | Financial Literacy | Tool/Resource | Basic Personal Finance | Money Management is a user-friendly budgeting tool that gives you an all-inclusive view of your finances. | German American Bank | https://germanamerican.com/personal/online/money-management | (800) 482-1314 | No Cost | Varies | No | Yes | Yes |

no reviews yet

Please Login to review.