340x Filetype XLSX File size 0.02 MB Source: nrdc.org

Sheet 1: Value Analysis

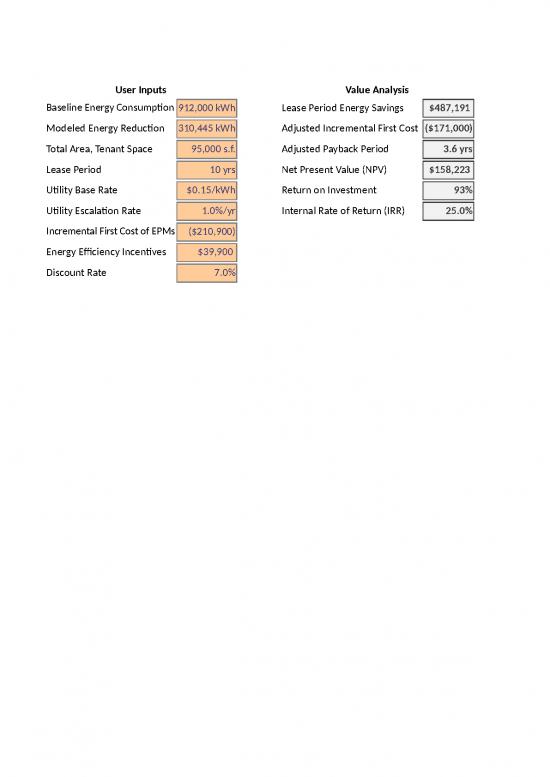

| User Inputs | Value Analysis | |||

| Baseline Energy Consumption | 912,000 kWh | Lease Period Energy Savings | $487,191 | |

| Modeled Energy Reduction | 310,445 kWh | Adjusted Incremental First Cost | ($171,000) | |

| Total Area, Tenant Space | 95,000 s.f. | Adjusted Payback Period | 3.6 yrs | |

| Lease Period | 10 yrs | Net Present Value (NPV) | $158,223 | |

| Utility Base Rate | $0.15/kWh | Return on Investment | 93% | |

| Utility Escalation Rate | 1.0%/yr | Internal Rate of Return (IRR) | 25.0% | |

| Incremental First Cost of EPMs | ($210,900) | |||

| Energy Efficiency Incentives | $39,900 | |||

| Discount Rate | 7.0% | |||

| Energy Performance Measure | Annual Energy Use Reduction | Annual Energy Cost Savings | Incremental First Cost | Simple Payback | ||

| Envelope | 31,464 | kWh | 3.5% | $4,720 | ($21,850) | 4.6 yrs |

| Lighting | 65,117 | kWh | 7.1% | $9,768 | ($47,500) | 4.9 yrs |

| Equipment | 37,757 | kWh | 4.1% | $5,664 | ($24,700) | 4.4 yrs |

| Heating | 58,915 | kWh | 6.5% | $8,837 | ($43,700) | 4.9 yrs |

| Cooling | 98,496 | kWh | 10.8% | $14,774 | ($59,850) | 4.1 yrs |

| Ventilation | 18,696 | kWh | 2.1% | $2,804 | ($13,300) | 4.7 yrs |

no reviews yet

Please Login to review.