269x Filetype PDF File size 0.72 MB Source: www.rationalargumentator.com

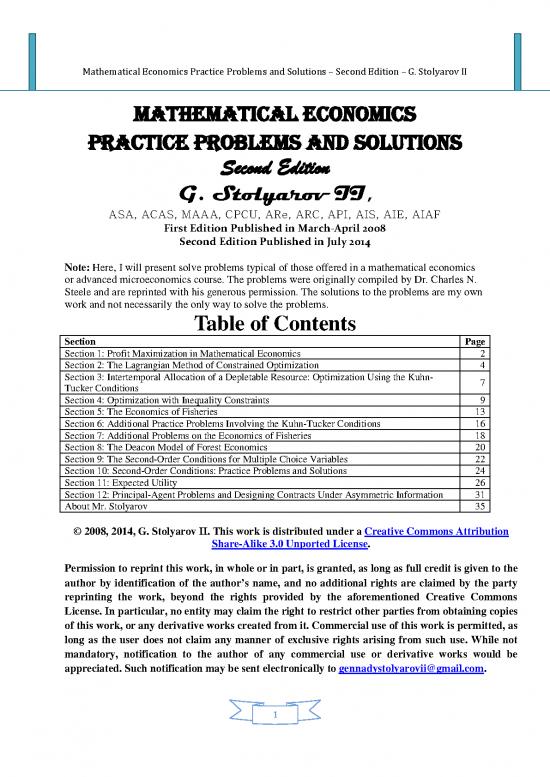

Mathematical Economics Practice Problems and Solutions – Second Edition – G. Stolyarov II

MatheMatical econoMics

Practice ProbleMs and solutions

Second Edition

G. Stolyarov II,

ASA, ACAS, MAAA, CPCU, ARe, ARC, API, AIS, AIE, AIAF

First Edition Published in March-April 2008

Second Edition Published in July 2014

Note: Here, I will present solve problems typical of those offered in a mathematical economics

or advanced microeconomics course. The problems were originally compiled by Dr. Charles N.

Steele and are reprinted with his generous permission. The solutions to the problems are my own

work and not necessarily the only way to solve the problems.

Table of Contents

Section Page

Section 1: Profit Maximization in Mathematical Economics 2

Section 2: The Lagrangian Method of Constrained Optimization 4

Section 3: Intertemporal Allocation of a Depletable Resource: Optimization Using the Kuhn- 7

Tucker Conditions

Section 4: Optimization with Inequality Constraints 9

Section 5: The Economics of Fisheries 13

Section 6: Additional Practice Problems Involving the Kuhn-Tucker Conditions 16

Section 7: Additional Problems on the Economics of Fisheries 18

Section 8: The Deacon Model of Forest Economics 20

Section 9: The Second-Order Conditions for Multiple Choice Variables 22

Section 10: Second-Order Conditions: Practice Problems and Solutions 24

Section 11: Expected Utility 26

Section 12: Principal-Agent Problems and Designing Contracts Under Asymmetric Information 31

About Mr. Stolyarov 35

© 2008, 2014, G. Stolyarov II. This work is distributed under a Creative Commons Attribution

Share-Alike 3.0 Unported License.

Permission to reprint this work, in whole or in part, is granted, as long as full credit is given to the

author by identification of the author’s name, and no additional rights are claimed by the party

reprinting the work, beyond the rights provided by the aforementioned Creative Commons

License. In particular, no entity may claim the right to restrict other parties from obtaining copies

of this work, or any derivative works created from it. Commercial use of this work is permitted, as

long as the user does not claim any manner of exclusive rights arising from such use. While not

mandatory, notification to the author of any commercial use or derivative works would be

appreciated. Such notification may be sent electronically to gennadystolyarovii@gmail.com.

1

Mathematical Economics Practice Problems and Solutions – Second Edition – G. Stolyarov II

Section 1

Profit Maximization in Mathematical

Economics

Problem 1. Suppose a firm faces a demand curve for its product P = a - bQ, and the firm's costs

of production and marketing are C(Q) = cQ + d, where P is price, Q is quantity, and a, b, c, and d

are positive constants. Find the following:

a. The formula for profit Π in terms of Q.

b. The first order condition (FOC) for maximum profit.

c. The second order condition (SOC) for maximum profit.

2 2

Solution 1a. Π = TR - TC = PQ - C(Q) = aQ - bQ - cQ - d = Π = - bQ + (a-c)Q - d

Solution 1b. FOC: dΠ/dQ = -2bQ + (a-c) ≡ 0. Thus, -2bQ = -(a-c) and Q = (a-c)/2b.

2 2

Solution 1c. SOC: d Π/dQ = -2b < 0, since it is given that b > 0. Thus, Q = (a-c)/2b is a

maximum.

Problem 2. Suppose the firm faces a demand curve for its product P = 32 - 2Q, and the firm's

2

costs of production and marketing are C(Q) = 2Q . Find the following.

a. The formula for profit Π in terms of Q.

b. The FOC and SOC for maximum total revenue.

c. The price and quantity that maximize total revenue, and the corresponding value of total

revenue.

d. The FOC and SOC for maximum profit.

e. The price and quantity that maximize profit, and the corresponding value of profit.

2

f. What would the competitive price and quantity be, assuming C(Q) = 2Q represented the

industry cost function?

2 2 2

Solution 2a. Π = TR - TC = PQ - C(Q) = 32Q - 2Q - 2Q = Π = 32Q - 4Q

2

Solution 2b. TR = 32Q - 2Q

2

Mathematical Economics Practice Problems and Solutions – Second Edition – G. Stolyarov II

FOC: d[TR]/dQ = 32 - 4Q ≡ 0. Thus, Q = 8.

2 2

SOC: d [TR]/dQ = -4 < 0. Thus, Q = 8 is a maximum.

Solution 2c. The quantity that maximizes total revenue is Q = 8, according to the first and

second-order conditions in Solution 2b. The price that maximizes total revenue is

32 - 2*8 = P = 16. Total revenue at this level is PQ = 16*8 = TR =128. We note that AVC here

is 2Q = 2*8 = 16, so price is at least equal to average variable cost.

Solution 2d. FOC: dΠ/dQ = 32 - 8Q = 0. Thus, Q = 4.

2 2

SOC:d Π/dQ = -8 < 0. Thus, Q = 4 is a maximum.

Solution 2e. The quantity that maximizes profit is Q = 4, according to the first and second-order

conditions in Solution 2d. The price that maximizes profit is

2

32 - 2*4 = P = 24. Total profit at this level is 32*4 - 4*4 = Π = 64.

Here, 24 > 16, so P > AVC, and it is optimal for the firm to produce Q = 4.

2

Solution 2f. The firm will produce at P = MC, where P = 32 - 2Q. TC = 2Q , so MC = 4Q. Thus,

32 - 2Q = 4Q. Thus, 32 = 6Q and Q = 32/6 = Q = 16/3. P = 32 - 2(16/3) = P = 64/3

3

Mathematical Economics Practice Problems and Solutions – Second Edition – G. Stolyarov II

Section 2

The Lagrangian Method of Constrained

Optimization

Note: Here, I will present solve problems typical of those offered in a mathematical economics

or advanced microeconomics course. The problems were authored by Dr. Charles N. Steele and

are reprinted with his generous permission. The solutions to the problems are my own work and

not necessarily the only way to solve the problems.

3. Find the maximum values of the objective function F subject to the given constraint for each

of the following, using the Lagrangian method.

a. F(x, y) = xy, subject to 5x + 2y = 20

1/2 1/2 2 2

b. F(x, y) = 2x y subject to x + y = 8

2 2 2

c. F(x, y, z) = xyz subject to x + y + z = 12

2 2 2

d. F(x, y, z) = x + y + z subject to x + y + z = 12

Solution 3a. Lagrangian: L(x, y, λ) = xy + λ[20 - 5x - 2y]

Lx = y - 5λ ≡ 0

Ly = x - 2λ ≡ 0

Lλ = 20 - 5x - 2y ≡ 0

Thus, 2λ = x and 5λ = y (from the transformed for Lx and Ly).

So 20 - 5x - 2y = 20 - 5*2λ - 2*5λ = 20 - 20λ = 0, so 20 = 20λ and λ =1,

whereby x = 2 and y = 5.

1/2 1/2 2 2

Solution 3b. Lagrangian: L(x, y, λ) = 2x y + λ[8 - x - y ]

-1/2 1/2

Lx = x y - 2λx ≡ 0

1/2 -1/2

Ly = x y - 2λy ≡ 0

2 2

Lλ = 8 - x - y ≡ 0

4

no reviews yet

Please Login to review.