297x Filetype XLSX File size 0.02 MB Source: www.okcommerce.gov

Business Planning for Success: Whoever started the rumor that new business ventures must lose money

during the first few years was full of horse feathers. There’s no such business principle. Planning to lose money

is a hard habit to break. Plan to succeed in business from day one.

Also, don’t let an absence of business experience preclude you from establishing a reasonable and healthy

business plan. If you’re not sure where to begin, begin at the end, i.e. with a net income target. Net

income, that’s the goal most “for profit” businesses seek. That’s the reason why you work so hard, put

up with unreasonable vendors and smile at impatient customers. Net income, perhaps better known as the

“bottom line” is the reward for business owners and investors. If you don’t plan for it, it probably won’t

happen.

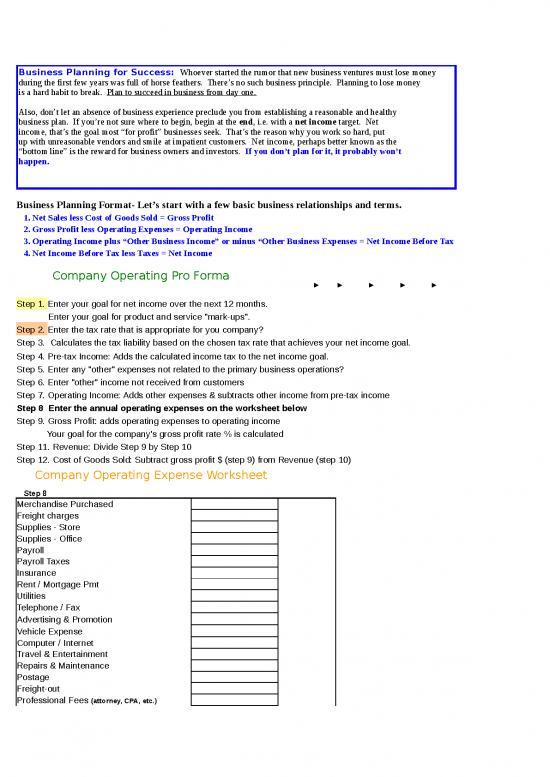

Business Planning Format- Let’s start with a few basic business relationships and terms.

1. Net Sales less Cost of Goods Sold = Gross Profit

2. Gross Profit less Operating Expenses = Operating Income

3. Operating Income plus “Other Business Income” or minus “Other Business Expenses = Net Income Before Tax

4. Net Income Before Tax less Taxes = Net Income

Company Operating Pro Forma

► ► ► ► ►

Step 1. Enter your goal for net income over the next 12 months.

Enter your goal for product and service "mark-ups".

Step 2. Enter the tax rate that is appropriate for you company?

Step 3. Calculates the tax liability based on the chosen tax rate that achieves your net income goal.

Step 4. Pre-tax Income: Adds the calculated income tax to the net income goal.

Step 5. Enter any "other" expenses not related to the primary business operations?

Step 6. Enter "other" income not received from customers

Step 7. Operating Income: Adds other expenses & subtracts other income from pre-tax income

Step 8 Enter the annual operating expenses on the worksheet below

Step 9. Gross Profit: adds operating expenses to operating income

Your goal for the company's gross profit rate % is calculated

Step 11. Revenue: Divide Step 9 by Step 10

Step 12. Cost of Goods Sold: Subtract gross profit $ (step 9) from Revenue (step 10)

Company Operating Expense Worksheet

Step 8

Merchandise Purchased

Freight charges

Supplies - Store

Supplies - Office

Payroll

Payroll Taxes

Insurance

Rent / Mortgage Pmt

Utilities

Telephone / Fax

Advertising & Promotion

Vehicle Expense

Computer / Internet

Travel & Entertainment

Repairs & Maintenance

Postage

Freight-out

Professional Fees (attorney, CPA, etc.)

Dues & Subscriptions

Donations / Contributions

Bank Charges

Taxes (other than sales)

License & Fees

Interest Expense

Other

Total Operating Expense $0

Company Operating Pro Forma

Step 11 Net Sales #DIV/0!

Step 12 less Cost of Goods Sold #DIV/0! #DIV/0!

Step 9. = Gross Profit $0 #DIV/0!

Step 10. What is your Gross Profit Rate? 0.0%

Step 8. less Operating Expenses (Overhead) $0 #DIV/0!

Step 7. = Operating Income $0

Step 6. plus "Other" Income $0

Step 5. less "Other" Expenses $0

Step 4. = Pre-tax Income $0

Step 3. less Income Tax $0

Step 2. What is your income tax rate?

Step 1. What is your goal for Net Income? #DIV/0!

Step 1. Mark-up Goal

We started with a couple of goals, a net income goal to reward company ownership and a goal

for marking-up products and services and then built a simple business plan. That’s the easy

part. The hard part is to make it work in a dynamic market place. Things will change

immediately after the plan is written. That’s okay. Keep the goals in mind and “drive your

business”. It’s difficult but sheer determination goes a long way in achieving the plan’s

“bottom line”

What Ifs: Note the changes in Net Sales as you change mark-ups, tax rates and

net income goals.

no reviews yet

Please Login to review.